A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

More Driving Assists Ethanol Demand, While Higher Corn Prices Impact Wheat Use

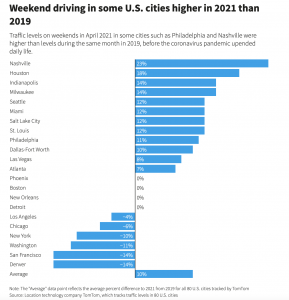

Bloomberg writer Kim Chipman reported earlier this week that, “Corn’s stunning price rally is getting an extra boost as more U.S. drivers return to the open road.

“Gasoline demand is on the rise, which means corn-based ethanol consumption is up too after a tough year in which the beleaguered industry was forced to shut down plants as pandemic restrictions slashed automobile travel.

‘As driving recovers, as the economy recovers, we’re going to use more ethanol, and so that’s been bullish,’ Scott Irwin, chair of agricultural marketing at the University of Illinois at Urbana-Champaign, told Bloomberg Television on Monday.

Ms. Chipman explained that, “Total vehicle interstate miles traveled in the week ended April 18 jumped 85% from the same period a year ago, according to the U.S. Transportation Department. Along with more car trips, Biden administration plans to fight climate change could boost usage of biofuels. It’s all good news for American corn farmers, who have seen crop prices more than double in the last 12 months.”

USDA Daily #Ethanol Report, https://t.co/vCMyEktFEc @USDA_AMS

— Farm Policy (@FarmPolicy) April 28, 2021

* Eastern Corn Belt: #Corn and ethanol average prices.

* 2021, 2020, and five-year average. pic.twitter.com/jawGPBodJV

And on Wednesday, Bloomberg writers Alex Longley, Debjit Chakraborty, and Andy Hoffman reported that, “Daimler AG, BMW AG and Toyota Motor Corp. all started the year with sales at records, and things are so hot that used car prices in the U.S. are soaring to all-time highs.

“The jump in vehicle sales is a strong sign that this is more than just a passing fad. Like the ubiquitous face mask, the car renaissance could be the latest example of how Covid-19 makes a lasting impact on our lives. The change could usher in an era of heavier traffic jams and longer commutes. All the extra driving will send gasoline consumption soaring, but with that also comes a rise in pollution.”

Also this week, Reuters writers Muyu Xu, Stephanie Kelly, and Bozorgmehr Sharafedin reported that, “In the United States, the world’s largest economy, gasoline demand is at 9.1 million barrels per day, highest since last August, according to U.S. EIA figures. The country accounts for 31% of global passenger vehicle road fuel demand, according to Rystad Energy. With more than one-quarter of the population fully vaccinated, Americans are getting out more.”

With respect to market implications of higher corn prices, Bloomberg’s Michael Hirtzer reported this week that, “China’s expanding hog herd is vacuuming up the world’s feed grains and forcing traders to dip into wheat reserves, a crop that’s normally saved for humans to eat.

According to Archer-Daniels-Midland Co., one of the biggest agricultural traders, corn arriving in China will soon be more expensive than wheat.

Mr. Hirtzer pointed out that, “Chinese hogs aren’t the only culprits behind pricey corn. The world’s cattle, hogs and chickens are all gobbling up the grain faster than farmers can grow it. Corn is so expensive that it has at times surpassed wheat, a rare occurrence.”

Pricey corn is incentivizing farmers to start feeding wheat (reserved for people) to pigs, cows, chickens instead. pic.twitter.com/pvFLf5TqKk

— David Ingles (@DavidInglesTV) April 29, 2021

The Bloomberg article noted that, “Earlier this month, a type of wheat grown in the southern U.S. Plains that’s usually used to make flour for bread traded at the biggest discount to corn since 1977.

“The disparity prompted some U.S. cattle feeders to buy wheat that will get harvested beginning around June.”

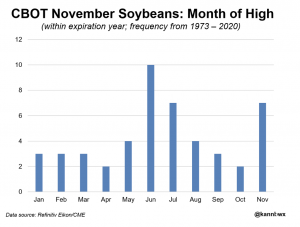

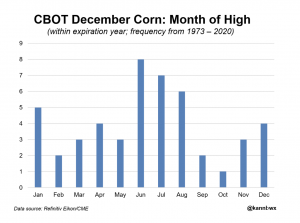

Looking ahead, Reuters columnist Karen Braun pointed out this week week that, “Price action for corn and soybeans on the Chicago Board of Trade has been nothing short of impressive this month, and more could be in store for the new-crop contracts as April is historically an uncommon time for their high-water marks.

“Since 1973, new-crop November soybeans have made their annual highs in April only twice: 1986 and 1981. Along with October, April is the least common month for the high. December is not considered here since the analysis examines the only the year of expiration.

“June is the most popular month for highs in new-crop soybeans with 10 instances in the last 48 years. July and November are tied for second with seven apiece. May and August are next at four each.”

Ms. Braun pointed out that, “June is the most common month for a December corn high with eight years and July and August follow with a respective seven and six times. An October high was seen just once, in 1974, and February follows closely with two years, the most recent being 1982.”