Reuters reported Wednesday that "production capacity of sustainable aviation fuel in the United States could jump by 1400% in 2024 if all announced capacity additions come on line, the U.S.…

Decrease in Energy Demand Due to COVID-19 “Crushes Ethanol Market”

Wall Street Journal writer Kirk Maltais reported this week that, “Plummeting energy demand during the coronavirus pandemic has decimated the ethanol industry. The timing for U.S. farmers couldn’t be worse.

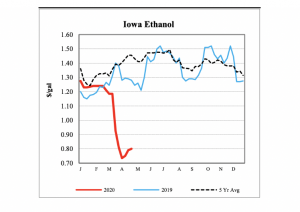

Ethanol production has dropped to a record-low 563,000 barrels a day, the U.S. Energy Information Administration said Wednesday, and domestic inventories have reached a record 27.7 million barrels as of April 17.

“The falloff mirrors the collapse of the wider energy industry as stay-at-home orders in response to the coronavirus pandemic have clobbered air travel, driving and public transportation. The U.S. benchmark crude-oil price has dropped nearly 70% since March 1. Ethanol companies are losing nearly 20 cents on each gallon they refine, price-assessment firm S&P Global Platts said Friday.”

The Journal article explained that, “Ethanol producers such as POET LLC, Valero Energy Corp. and Archer Daniels Midland Co. have responded by cutting production or closing plants.”

Mr. Maltais added that, “For farmers who sold corn to these ethanol plants, the closures come at a bad time. Many corn farmers struggled to stay solvent in 2019 after record rainfall delayed planting and the U.S.-China trade war weighed on commodities prices.

“Ethanol demand was also hurt last year after the Environmental Protection Agency granted waivers to 31 small refineries, eliminating a requirement that they blend the corn-based fuel into gasoline.”

The Journal article also noted that, “Ethanol plant closures are expected to reduce domestic corn consumption by 375 million bushels, the U.S. Department of Agriculture said in a report earlier this month. That is one reason the Food & Agricultural Policy Research Institute at the University of Missouri estimates that farm income could be reduced by as much as $20 billion, or 19%, in 2020.”

#COVID2019 Impacts on 2020 net #farm income (@FAPRI_MU webinar) pic.twitter.com/tLriObm1VG

— Farm Policy (@FarmPolicy) April 13, 2020

Meanwhile, DTN writer Todd Neeley reported last week that, “When it’s all said and done, the ethanol industry could see about $10 billion in losses as a result of the COVID-19 economic stall this year, according to a new analysis released [April 20th] by a leading ethanol advocacy group.

U.S corn futures hit multi-year lows as ethanol production plunges. Insights via @CMEGroup pic.twitter.com/NjNapikpQi

— QuickTake by Bloomberg (@QuickTake) April 27, 2020

“[On April 17th], USDA announced some $19 billion in relief funds directed to a number of agriculture sectors — ethanol was not on that list.”

On Monday @USDA announced $19B in Coronavirus aid — but not a penny for biofuels. Now CR is losing an ethanol plant, furloughing 90 workers & cutting off an essential market for farmers. We must support producers & keep the Midwestern economy strong. #IA01 https://t.co/V7DILySpdd

— Abby Finkenauer (@RepFinkenauer) April 23, 2020

And in a separate DTN article last week, Mr. Neeley reported that, “The American Petroleum Institute asked the EPA to reconsider the 2020 volume obligations in the Renewable Fuel Standard after a federal court ruled the agency mishandled small-refinery exemptions.

“The ethanol and refining industries are waiting for the agency to decide whether it will apply nationally a ruling from the U.S. Court of Appeals for the 10th Circuit in Denver, that the agency inappropriately approved many SREs without merit.

The Administration has demonstrated a pattern of prioritizing padding the pockets of their friends at big oil over standing with our family farmers. We must do more to sustain our biofuel producers. I’ll keep fighting to ensure no farmer is left behind.https://t.co/f1iNtKAzPa

— Rep. Cheri Bustos (@RepCheri) April 22, 2020

“In an April 6 petition letter to EPA Administrator Andrew Wheeler, API attorney Maryam Hatcher said the court’s ruling means the agency has to redo 2020 volumes.”

The DTN article noted that, “Geoff Cooper, president and chief executive officer of the Renewable Fuels Association, said in a statement to DTN the court’s decision shouldn’t be a reason to complete an RFS rewrite.”

Our ethanol plants, farmers & producers were operating on the thinnest margins even before the #COVID19 outbreak began.

— Rep. Cindy Axne (@RepCindyAxne) April 25, 2020

Now, we're demanding @USDA to expand its aid programs to support this critical industry that is vital to our rural communities. #IA03https://t.co/p2B66mqCvW

“Cooper said EPA should ‘immediately adopt the 10th Circuit decision nationwide and leave the 2020 RVO as is.'”