A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

China Corn Purchases Continue, as Inflation Garners Attention and Mississippi Barge Traffic is Disrupted

Earlier this week, Bloomberg writers Kim Chipman and Isis Almeida reported that, “A drought in Brazil is changing up trade flows, and sending China on a U.S. grain-buying binge that’s causing global prices to surge.

“Brazil is typically the top market for corn this time of year, but planting delays and drought hurt the current crop, known as safrinha. As a result, China has been regularly scooping up American corn over the past two weeks, people familiar with the matter said.

The purchases by China are squeezing global supplies and have already sent prices to the highest in eight years. That’s boosting the cost of feeding chickens, pigs and cows and stoking concerns about food inflation.

The Bloomberg writers pointed out that, “American exporters sold 680,000 metric tons of corn to China for delivery in the marketing year starting starting Sept. 1, the U.S. Department of Agriculture said Tuesday. That’s on the heels of hefty purchases Monday and last week. Many of the sales are for the U.S. crop that’s currently being planted.”

On Thursday, USDA indicated that an additional 680,000 metric tons of U.S. corn was sold to China.

And on Friday, USDA announced corn export sales of 1,360,000 to China.

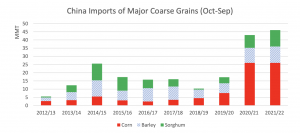

In its monthly Grain: World Markets and Trade report on Wednesday, USDA’s Foreign Agricultural Service stated that, “China imports of combined coarse grains are projected to rise from the revised 2020/21 estimate on expectations of strong feed demand from its swine sector. Increased commercialization of the swine heard has ostensibly improved demand for manufactured feeds. Domestic corn prices remain at record levels, despite substantial release of years-old wheat and rice stocks from reserves.

“Moreover, to alleviate the use of corn and to help cool down prices, the Ministry of Agriculture and Rural Affairs issued new guidelines in April suggesting lower inclusion rates for corn in swine and poultry feeds and recommending sorghum and barley for corn substitutes among other feed ingredients. Corn imports are projected at the same as the 2020/21 level, while barley and sorghum imports rise with greater availability in the world market. With combined coarse grain imports nearing 50 million tons, China’s demand is expected to drive global trade dynamics for 2021/22.”

Also this week, Reuters writer Mark Weinraub reported that, “Strong domestic demand will keep U.S. stockpiles of corn and soybeans near seven-year lows even after farmers harvest the crops they are currently seeding, the government said on Wednesday.

“The stocks estimates were in line with market expectations but the report showed that the recent gains in ag commodities, highlighted by soybean futures’ rally to a nearly nine-year high this week, are likely to continue.”

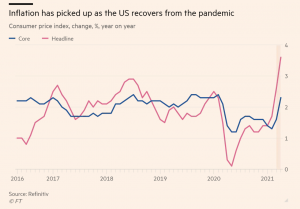

With this background in mind, Financial Times writers James Politi and Andrew Edgecliffe-Johnson reported this week that, “The rate of consumer price inflation was 4.2 per cent in the 12 months to April, a bigger jump than economists had expected, fuelling concerns that the world’s largest economy is overheating.

“The higher inflation reading reflects a combination of hefty fiscal support, supply bottlenecks and increased spending as economic activity picks up following the rollout of coronavirus vaccinations.”

The Wall Street Journal editorial board pointed out in Thursday’s paper that, “Commodities have also been surging and are feeding into consumer prices. Corn prices are up 50% this year and some 125% year-over-year. Overall food prices climbed 0.4% from March and 2.4% over the past 12 months. Fresh produce and meat prices rose even more.”

And Paul Davidson reported on the front page of Friday’s USA Today that, “Consumer prices jumped 4.2% annually in April, the most in 13 years, sparking this question: Is it a blip or a harrowing return to the 1970s?”

Meanwhile, Bloomberg writer Reade Pickert reported this week that, “Prices paid to U.S. producers rose in April by more than forecast, adding to signs of a growing wave of inflationary pressure that’s extending to American consumers.

“The producer price index [PPI] for final demand increased 0.6% from the prior month after a 1% gain in March, according to data from the Labor Department Thursday.”

The Bloomberg article added that, “The PPI tracks changes in production costs, and supply bottlenecks and shortages tied to the pandemic recovery have caused commodity prices to soar. At the same time, labor costs have begun picking up. Together, the increases represent a threat to profit margins unless companies pass along the higher costs and boost productivity.”

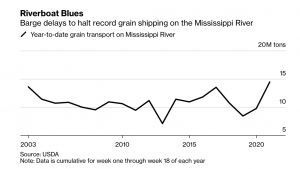

In other developments regarding commodity flows, Reuters writer Tom Polansek reported this week that, “More than 400 barges were delayed on the lower Mississippi River on Wednesday after a bridge crack prompted the U.S. Coast Guard to halt vessel traffic on a portion of the waterway crucial for shipping crops to export markets.

“The disruption hit as strong demand for U.S. corn and soybeans has tightened inventories and pushed crop prices to their highest in more than eight years. Also, U.S. President Joe Biden is seeking to have Congress approve a $2.25 trillion infrastructure bill.”

From "The Bloomberg Open" morning Email -

— Farm Policy (@FarmPolicy) May 13, 2021

* Traffic Jam ⬇️ pic.twitter.com/LEa8nO4gnI

And on Thursday, Mr. Polansek reported that, “A traffic jam on the lower Mississippi River swelled to 771 barges on Thursday as a fractured bridge near Memphis closed the waterway that is crucial for U.S. crop exports.”

Today I discussed the I-40 bridge with @USDOT and the need to cooperate with all local & state entities to help safely reopen it. This is a real-world example of the need for targeted investment in our core infrastructure, including roads & bridges, which @SenateGOP has offered. pic.twitter.com/x7N9LDDn1e

— Senator John Boozman (@JohnBoozman) May 13, 2021

However, Bloomberg writers Isis Almeida and Michael Hirtzer reported on Thursday that, “The Mississippi River may reopen to barge traffic in 24 to 48 hours after a second engineering review of the highway bridge that developed a crack is completed, according to people who have been briefed on the situation.

“A group including the U.S. Coast Guard, Army Corps of Engineers and barge companies met Thursday to discuss the matter, said two of the people, who asked not to be named because the information isn’t public.

“A plan is being put together to restore traffic once the river is reopened, prioritizing certain vessels, the people said. The highest priority is a Department of Defense shipment, followed by fuel barges going to replenish areas hit by the Colonial Pipeline disruption, one of the people said.”

The Bloomberg writers added that, “The crack in the truss of the Interstate 40 Hernando DeSoto Bridge, which was found during a routine inspection, has stranded more than 900 barges, cutting off the biggest route for U.S. agricultural exports at a time when the critical waterway is at its busiest.”

The Associated Press reported Friday morning that, “The U.S. Coast Guard said Friday that river traffic has reopened on the Mississippi River near Memphis, Tennessee, three days after it was closed when a crack was discovered in the Interstate 40 bridge that connects Tennessee and Arkansas.

“Boats and barges can now cross under the Hernando De Soto Bridge, Petty Officer Carlos Galarza told The Associated Press. River traffic under the bridge was shut down Tuesday after inspectors found a fracture in a steel beam on the span.”