President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Supply Chain Bottlenecks Add to Inflation Concerns, as Chinese Demand for Corn Garners Attention

Bloomberg writers Brendan Murray, Enda Curran, and Kim Chipman reported this week that, “A year ago, as the pandemic ravaged country after country and economies shuddered, consumers were the ones panic-buying. Today, on the rebound, it’s companies furiously trying to stock up.

“Mattress producers to car manufacturers to aluminum foil makers are buying more material than they need to survive the breakneck speed at which demand for goods is recovering and assuage that primal fear of running out. The frenzy is pushing supply chains to the brink of seizing up.

Shortages, transportation bottlenecks and price spikes are nearing the highest levels in recent memory, raising concern that a supercharged global economy will stoke inflation.

The Bloomberg writers stated that, “Copper, iron ore and steel. Corn, coffee, wheat and soybeans. Lumber, semiconductors, plastic and cardboard for packaging. The world is seemingly low on all of it.”

This week’s Bloomberg article added that, “A United Nations gauge of world food costs climbed for an 11th month in April, extending its gain to the highest in seven years. Prices are in their longest advance in more than a decade amid weather worries and a crop-buying spree in China that’s tightening supplies, threatening faster inflation.”

Meanwhile, on Monday, the USDA’s Foreign Agricultural Service (FAS) reported export sales of 1,700,000 metric tons of corn for delivery to China.

This follows on the heels of large corn purchases by China over the past couple of weeks, and ranked in the top ten daily export sales records for U.S corn.

Today's #corn sale to #China tied for number seven on the top ten list of Daily Export Sales, https://t.co/ROZagfaKfN @USDAForeignAg pic.twitter.com/LBjIfBt5pN

— Farm Policy (@FarmPolicy) May 17, 2021

Additionally, on Tuesday, FAS reported export sales of 1,360,000 metric tons of corn for delivery to China.

Putting this year's U.S. corn sales to China in context with last year's: stronger & earlier.

— Karen Braun (@kannbwx) May 18, 2021

Total new-crop U.S. #corn sales might look roughly like this (at minimum) as of today after a flurry of sales to #China. China has secured 8+ million tonnes in the last 8 business days. pic.twitter.com/Tw3lMvKxr2

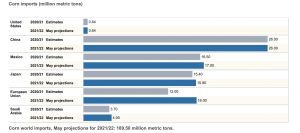

Reuters columnist Karen Braun indicated last week that, “China’s corn stocks and import demand is likely to remain a wild card. USDA pegs Chinese corn imports at 26 million tonnes in 2021-22, equal to 2020-21 after this month’s 2 million-tonne rise. That compares with 7.6 million last year and 4.5 million in the prior year.”

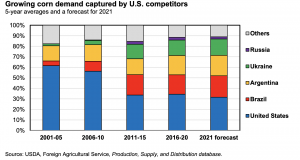

In its monthly Feed Outlook report last week, USDA’s Economic Research Service (ERS) pointed out that, “U.S. 2021/22 corn export prospects face tough competition. Competition from Argentina, Brazil, and Ukraine—whose combined exports are to increase by 19.5 million tons—is expected to weigh down on U.S exports.

“On the other hand, U.S. corn export prospects for both 2020/21 and 2021/22 are starting to get support from the current poor conditions in Brazil, as dryness in major producing areas cuts the country’s second-crop corn yields.”

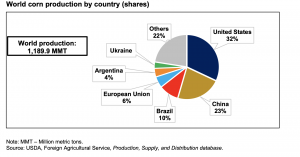

The ERS update noted that, “China, the world’s largest foreign producer of coarse grains, is expected to continue to be a leading factor in global coarse grain demand.”

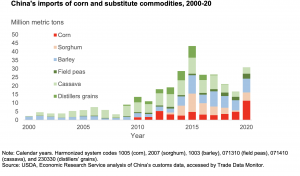

The Feed Outlook indicated that, “Growth in animal feed production—the chief use of corn in China—has been instrumental in driving China’s demand for imported commodities.”

“In April 2021 Chinese agricultural officials issued recommendations urging livestock producers to replace corn and soybean meal with other feedstuffs to indigenize feed ingredients (National Animal Nutrition Guidance Committee, 2021).”

ERS also pointed out that, “China’s progress in restoring swine production is an uncertain influence on feed use. China’s Ministry of Agriculture and Rural Affairs (2021) predicted that swine inventories would return to ‘normal’ levels by June-July 2021. However, reports of speedy recovery are inconsistent with persistently high feeder pig prices, record meat imports in the first quarter of 2021, and reports of disrupted breeding systems and resurgence of disease.”

The USDA’s Foreign Agricultural Service noted last week that, “On May 12, 2021, China’s Ministry of Agriculture and Rural Affairs (MARA) notified the U.S. Embassy in Beijing that on April 28, 2021, China detected African Swine Fever (ASF) in Inner Mongolia Autonomous Region. China is continuing to monitor the situation.”

Meanwhile, Reuters writer Dominique Patton reported on Monday that, “China’s leading pig producer Muyuan Foods Co Ltd 002714.SZ used only 9.8% soymeal in its feed last year, cutting costs as feed prices soared, Chairman Qin Yinglin said on Monday.

“Qin’s comments follow guidelines from Beijing to its huge livestock sector last month to lower the soymeal and corn content in feed after record imports of both during 2020.

“Beijing’s guidelines were voluntary. Muyuan, though, known for its low-cost hog production, could influence others to follow its lead, threatening China’s annual $40 billion in soybean imports.”

And a Bloomberg News article from Monday noted in part that, “Purchases of corn, wheat and sorghum are likely to stay elevated, as China’s buying binge continues to help fuel a global grains rally.”