Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China Makes Large U.S. Soy Purchase, While Granting Domestic Subsidies to Its Grain Farmers

Late last week, Reuters writer Karl Plume reported that, “Chinese state-owned importers bought at least eight cargo shipments of U.S. soybeans on Friday, or at least 480,000 tonnes, the country’s largest U.S. soybean purchases in 4-1/2 months, two U.S. traders familiar with the deals said.

“The deals, which were for shipment from U.S. Pacific Northwest ports mostly in October, came after new-crop November soybean futures on the Chicago Board of Trade tumbled nearly 7% on Thursday to the lowest point since March.

“China had slowed its U.S. soybean purchases in recent months as cheaper shipments of newly harvested Brazilian soybeans came available and as U.S. soybean prices soared to the highest in about 8-1/2 years.”

Private exporters report the following sales for MY 2020/21: 336,000 MT of soybeans for delivery to China and 120,000 MT of soybeans for delivery to unknown destinations. https://t.co/0kE52krME9

— Foreign Ag Service (@USDAForeignAg) June 21, 2021

Mr. Plume explained that, “But this week’s price plunge gave the world’s largest soybean importer a chance to secure purchases needed for later in the year to feed its hog herd, the world’s largest.

Concerns are also growing that drought could reduce the U.S. harvest and further raise prices.

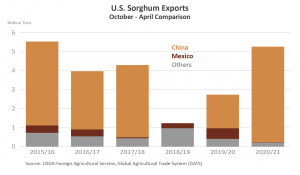

“China has largely focused on feed grain purchases from the United States this spring, booking record volumes of U.S. corn and sorghum as China’s domestic corn prices soared to historic highs.”

Also late last week, Reuters writers Judy Hua and Kevin Yao reported that, “China will grant 20 billion yuan ($3.1 billion) in subsidies to grain farmers this year to offset soaring fertiliser and diesel costs, the country’s cabinet said on Friday, in the government’s latest attempt to manage the impact of rising commodity prices.

“The one-time subsidies will help stabilise incomes, the cabinet was cited as saying by state broadcaster CCTV after a regular meeting, as China looks to ensure its farmers are incentivised to keep producing food for the world’s most populous nation.

“‘Subsidies should be paid out as soon as possible, so as not to miss the farming season,’ the cabinet added after the meeting led by Premier Li Keqiang, pledging to keep farmers keen on growing crops for the summer harvest by calling for increased supply of agricultural raw materials.”

In a related article, Reuters writer Dominique Patton reported late last week that, “China’s central government urged its regions on Friday to ‘strengthen’ supplies of fertiliser during the summer amid record prices and tight stocks of the chemicals.

“The appeal comes as the government battles soaring prices of a host of raw materials, and after Premier Li Keqiang called for curbing prices of key farm inputs like fertiliser and diesel to guarantee stable grain prices.

The government has stepped up its focus on food security since the global coronavirus pandemic and is targeting a bigger corn crop this year after prices hit record levels in 2020, roiling global markets.

More broadly with respect to agricultural markets, Bloomberg writers Nicholas Larkin and Mark Burton reported on Friday that, “The commodities boom has taken a knock this month, and while there are many reasons to still bet on a so-called supercycle, it’s unlikely to be plain sailing.

“Vast amounts of stimulus, economies reopening from the pandemic and strong Chinese demand have driven a surge in raw-material prices this year, some to record highs. Yet they’ve slumped in the past two weeks — with some wiping out gains for the year — on a more hawkish U.S. monetary policy tone, China’s bid to cool inflation pressures and better weather for crops.”

The Bloomberg writers pointed out that, “Showers across the U.S. corn belt and uncertainty over biofuel policy have helped send crop markets tumbling lately, but much more rain will be needed to ensure bumper harvests in one of the world’s top suppliers. More than a third of America’s corn and soybean area is suffering from drought, after record-breaking heatwaves.”

Approximately 36% of #soybean production is within an area experiencing #drought, @usda_oce pic.twitter.com/U2GsMe5kha

— Farm Policy (@FarmPolicy) June 17, 2021

Meanwhile, Dow Jones writer Kirk Maltais reported late last week that, “Soybeans for July delivery rose 5% to $13.96 a bushel on the Chicago Board of Trade Friday, with traders taking Thursday’s steep drop as an opportunity to buy back into futures.

After a historic drop near $1.20 per bushel Thursday, front-month CBOT #soybeans jumped 5% (66.25 cents) on Friday, breaking the $14 mark before settling just below. November beans rose 4.8% and moved back into the teens, finishing at $13.13 per bushel. pic.twitter.com/EB6Vfm4YP6

— Karen Braun (@kannbwx) June 18, 2021

“Wheat for July delivery rose 3.7% to 6.62 3/4 a bushel.

“Corn for July delivery rose 3.5% to $6.55 1/4 a bushel.”

June 18: CBOT December #corn surges 6.3% (33.75 cents) after falling the daily 40-cent limit Thursday. Limits were expanded to 60 cents Friday but the contract rose at most 42.5 cents during the session. Friday's settle of $5.66-1/4 per bushel was just 1% off Wednesday's finish. pic.twitter.com/fW9jfvJrUZ

— Karen Braun (@kannbwx) June 18, 2021

“Selling seen in grains Thursday appears to have been overdone, with wet weather seen as not being enough to alleviate dryness issues in certain growing areas,” the Dow Jones article said.

And Reuters writer Julie Ingwersen reported Friday that, “U.S. corn, soybean and wheat futures rose sharply on Friday, rebounding from steep declines a day earlier on bargain-buying ahead of the weekend and uncertainty about weather in the Midwest crop belt, analysts said.

“Fresh export interest lent support as this week’s break in futures appeared to stimulate demand. Chinese state-owned importers bought at least eight cargo shipments of U.S. soybeans on Friday, the country’s largest U.S. soybean purchases in 4-1/2 months, two U.S. traders familiar with the deals said.”

Compare the performance of selected #commodities, year-to-date, https://t.co/Uzf2OAPYcY @WSJ

— Farm Policy (@FarmPolicy) June 19, 2021

* #hogs, #corn, #cattle, #cotton, #soybeans, #wheat. pic.twitter.com/7NFY48BHL5

“Weather remains in the spotlight, given continuing risks of drought stress to Midwest crops at a time when markets are looking to large U.S. corn and soybean harvests to ease supply tensions,” the Reuters article said.