As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Minneapolis Fed: Farm Income, Land Values, and Cash Rents Climb in Third-Quarter

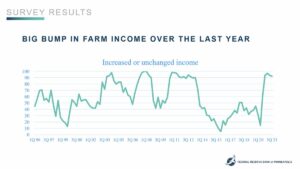

In an article last week from the Federal Reserve Bank of Minneapolis, “Even with severe drought and supply chain woes, farms remain in good financial shape,” Joe Mahon pointed out that, “A year into a tenuous recovery in agriculture driven as much by government support as by market conditions, widespread and severe drought could be expected to be a major setback. And while that drought was indeed a harsh blow to producers in the worst-hit regions, continued strong commodity prices along with timely rains in other areas softened the impact, according to the Federal Reserve Bank of Minneapolis’ third-quarter agricultural credit conditions survey conducted in October.

Joe Mahon (November 19, 2021).

“Farm incomes across the Ninth District continued to increase from July through September 2021 relative to the same period a year earlier, according to most lenders surveyed. Spending on capital equipment and farm household purchases also increased on balance. Loan demand decreased, while incomes supported a higher rate of loan repayment, and renewals and extensions largely held steady.

Joe Mahon (November 19, 2021).

“Land values and cash rents jumped across district states, and interest rates on loans generally ticked down slightly further from the previous quarter. Despite drought impacts, the outlook for the fourth quarter is moderately optimistic, with lenders in the district generally expecting farm incomes to increase.”

Joe Mahon (November 19, 2021).

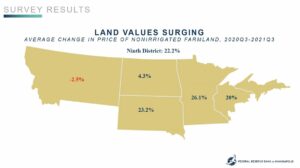

Mr. Mahon explained that, “Land values and cash rents jumped again in the third quarter after growing strongly in the previous survey.

Ninth District nonirrigated cropland values increased by 22 percent on average from the third quarter of 2021. Values for nonirrigated land increased by nearly 14 percent, while ranch- and pastureland values increased about 6 percent.

“Land rents followed suit, as the district average cash rent for nonirrigated land increased by 12 percent from a year ago. Rents for irrigated land grew by 8 percent, while ranchland rents jumped 13 percent. Changes in land values and rents were generally consistent across district states.”

Joe Mahon (November 19, 2021).

The Federal Reserve Banks of Chicago and Kansas City also released third-quarter agricultural credit survey results last week, a summary of those findings can be found here.