A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

“World Fertilizer Prices Continue to Soar,” as 2022 U.S. Acreage Considerations Underway

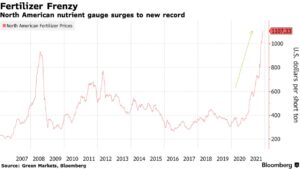

Bloomberg writer Elizabeth Elkin reported on Friday that, “World fertilizer prices continue to soar as tightening supplies send costs up for farmers and consumers across the globe.

“In India, contract pricing for the nutrient potash skyrocketed 59% to $445 per metric ton, according to Bloomberg’s Green Markets. In Northwest Europe, potash prices rose 1.7%, the most since 2015. And in the U.S., the Green Markets North American Fertilizer Price Index climbed to the highest price ever for a third week in a row. [Recent records recap: Oct. 8th, Nov. 5th, and Nov. 12th].”

The Bloomberg article noted that, “These surging costs for farmers are stoking concerns about already high food prices at a time when U.S. consumers are seeing the steepest inflation since 1990 and people around the world continue to struggle with the impacts of the pandemic.”

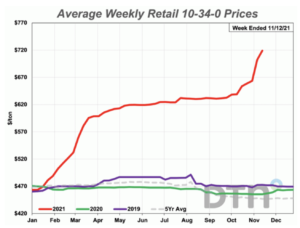

Also last week, DTN writer Katie Micik Dehlinger reported that,

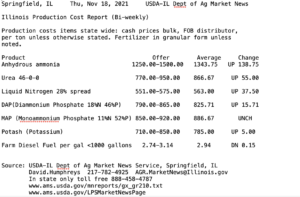

Anhydrous, urea, UAN28 and UAN32 set new all-time highs this week, according to prices tracked by DTN for the second week of November.

“The average price of 10-34-0, a starter fertilizer for corn, jumped 10% from last month, which is notable because it hasn’t seen many double-digit percentage gains during this fall rally in retail prices.”

The DTN article pointed out that, “Anhydrous led the way with an average price of $1,162 per ton, up 33% from last month.

“UAN28 was 28% higher at $566/ton, while UAN32 was 26% higher at $614/ton.

“Urea, up 16% compared to last month, cost an average of $832/ton.”

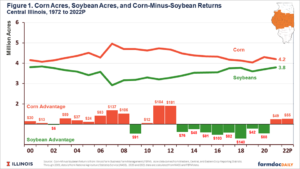

And with respect to crop acreage allocations for 2022, Daniel Grant reported last week at FarmWeekNow Online that, “The 2021 crops aren’t completely out of the fields yet, but farmers are already wrestling with annual production and acreage decisions for next year.

“The main issue, of course, revolves around skyrocketing input costs with fertilizer prices at or near record levels in some markets. Glyphosate prices also jumped from around $14 to $50 per gallon in the past year, according to Kevin McNew, chief economist for the Farmers Business Network.

‘We’re seeing massive price increases for fertilizer and chemicals,’ McNew said during a webinar hosted by the U.S. Soybean Export Council (USSEC) and American Soybean Association. ‘There’s going to be some really tough decisions for farmers in 2022. Brazilian farmers are facing those decisions now.’

Mr. Grant added that, “Kevin Mainord, a farmer who serves on the Missouri Soybean Merchandising Council, believes many will look to precision ag to help squeeze input costs along with possibly adjusting their planting mix.”