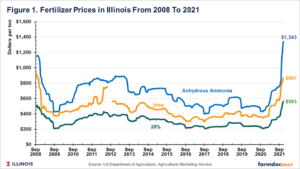

As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve: Observations on the Ag Economy- November 2021

On Wednesday, the Federal Reserve Board released its November 2021 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Sixth District- Atlanta– “Agricultural conditions remained mixed. Most of the District remained drought free.

Agriculture producers indicated supply chain issues and labor scarcity are putting pressure on margins.

“On a year-over-year basis, production forecasts for the District’s corn and soybean crops were up while rice, peanuts, cotton, and sugar-cane forecasts were down. The USDA reported year- over-year prices paid to farmers in September were up for corn, cotton, rice, soybeans, cattle, broilers, eggs, and milk. On a month-over-month basis, prices were up for cotton, cattle, broilers, and eggs but down for corn, rice, and soybeans while milk prices were unchanged.”

* Seventh District- Chicago– “Expectations for farm incomes in 2021 moved up, driven by stronger than anticipated corn and soybean yields. Contacts said the soybean harvest would likely set a District record, and the corn harvest would likely be the third largest ever. Despite a sizeable harvest, corn prices moved higher during the reporting period. Soybean prices languished but were still above year-ago levels.

Farmers were reportedly purchasing inputs for 2022 ahead of their normal schedules because of concerns about future prices and availability of fuels, chemicals, fertilizers, and seeds.

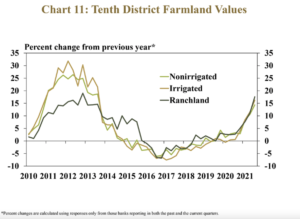

“Prices for hogs and eggs edged lower. Cattle and dairy price movements were mixed. Agricultural land values moved sharply higher.”

* Eighth District- St. Louis– “District agriculture conditions have remained stable compared to the previous reporting period. Production forecasts for corn and soybeans have declined slightly, while forecasts for cotton remained unchanged and rice increased. On a year-over-year basis, however, production levels for corn and soybeans are expected to be moderately higher, while cotton and rice production is expected to moderately decline.

While production has remained relatively steady, contacts in the District have expressed concern over rising input prices, specifically nitrogen and other fertilizers, and labor shortages, which they fear may cause production shortfalls next year.

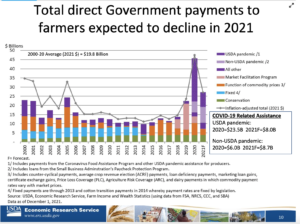

* Ninth District- Minneapolis– “District agricultural conditions improved overall, though drought took a heavy toll on certain areas and commodities. Responses to a survey of agricultural lenders indicated increased farm income, as producers continued to benefit from strong commodity prices and government payments.

“Drought damage was not as bad as expected in general, though ranchers saw heavy losses, and damage to crops was much more severe in the western Dakotas and Montana’s wheat-producing region. In other areas, though crop yields will decrease, timely rains for many were helpful, and higher crop prices appear to have more than offset the financial loss.”

* Tenth District- Kansas City– “Economic conditions in the Tenth District’s agricultural sector remained strong amid continued strength in commodity prices. The price of all major crops remained elevated and harvest estimates in November indicated that both corn and soybean production are expected to be at high levels across the District. Cattle prices increased modestly to above pre-pandemic levels in early November. With healthy conditions across the sector, farm real estate values increased sharply from a year ago.

“District contacts continued to express concerns about high input prices, yet farm income and credit conditions continued to improve and were expected to remain strong in the coming months.”

* Eleventh District- Dallas– “Overall, the agricultural sector was doing quite well. Soil moisture remained mostly favorable, though some areas have begun getting dry over the past six weeks. Harvesting continued and production was strong, particularly for cotton and soybeans, far outstripping last year’s numbers. Solid agricultural prices combined with high yields have boosted many farmers’ financial positions this year.

Contacts voiced concern going forward over higher input costs—fuel, fertilizer, machinery, etc.—and there were scattered reports of difficulty sourcing herbicides.

“On the livestock side, cattle prices rose, bolstered by solid beef demand.”

* Twelfth District- San Francisco– “Conditions in the agriculture and resource-related sectors strengthened over the reporting period. Demand remained strong domestically and, partly due to a more favorable foreign exchange environment, internationally, for the region’s meats, produce, seafood, and lumber. Inventories were at satisfactory levels for most crops, although crop yields for tree fruit and wheat were relatively lower due to warmer temperatures and water shortages. Contacts highlighted underground water availability as being of particular concern. However, recent rains in Northern California eased drought conditions a bit in some regions. Contacts also noted that a general lack of readily available labor, continued logistical delays, interruptions related to the Delta variant, and difficulties concerning equipment maintenance further restrained production.”