A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Thirty-Three Grain Cargo Ships Have Left Ukraine, While Dry Weather Weighs on U.S., China and European Production Prospects

Reuters writers Pavel Polityuk and Jonathan Spicer reported today that, “A total of 33 cargo ships carrying around 719,549 tonnes of foodstuffs have left Ukraine under a deal brokered by the United Nations and Turkey to unblock Ukrainian sea ports, the Ukrainian agriculture ministry said on Tuesday.”

“In addition to the vessels that have already left Ukraine, the agriculture ministry said a further 18 were now loading or waiting for permission to leave Ukrainian ports,” the Reuters article said.

Polityuk and Spicer explained that, “The ministry said Ukrainian grain exports could reach 4 million tonnes in August, compared with 3 million tonnes in July.

“In a separate statement, the ministry said exports of key Ukrainian agricultural commodities had fallen by almost half since the start of the Russian invasion compared to the same period in 2021.”

And yesterday, Reuters writer David Ljunggren reported that, “Ukraine has restored a rail link to neighbouring Moldova after a 23-year hiatus and the connection could carry 10 million tonnes of freight a year, President Volodymyr Zelenskiy said in a video address on Monday.

“Although he did not specify what kinds of goods, Ukraine is keen to find new ways to export millions of tonnes of grain that have been stranded by Russia’s invasion. Moldova borders Romania, a member of the European Union.”

Also yesterday, Reuters writer Noor Zainab Hussain reported that, “Broker Marsh and Lloyd’s of London insurer Ascot said on Tuesday they have provided coverage for a vessel carrying grain and food products from Ukraine’s Black Sea ports under its new marine cargo and war insurance facility.

“Launched last month, it provides coverage up to $50 million for Ukrainian vital food supplies being shipped through safe corridors established by the newly signed Black Sea Treaty.”

With respect to agricultural production in Ukraine, Reuters writer Naveen Thukral reported yesterday that, “Grain traders union UGA on Monday cut Ukraine’s 2022 combined grain and oilseeds crop forecast to 64.5 million tonnes from the previous outlook of 69.4 million due to a smaller than expected harvested area caused by the Russian invasion.”

The Reuters article added that, “In its weekly crop progress report, the USDA rated 55% of the U.S. corn crop in good-to-excellent condition, down from 57% the previous week. For soybeans, the government rated 57% of the crop as good-to-excellent, down from 58% previously.”

Elsewhere, Bloomberg writers Kim Chipman, Tarso Veloso Ribeiro, and Michael Hirtzer reported yesterday that, “Scouts traveled through parts of Nebraska, South Dakota, Ohio and Indiana on the first day of the [Pro Farmer Midwest Crop Tour] on Monday, carefully measuring fields to determine the outlook for this season’s harvest. They found that corn yields in South Dakota averaged 118.45 bu/acre, down 22% and from the state’s 2021 tour average of 151.45 bu/acre. In Ohio, yields were estimated to average 174.2 bu/acre based on 130 fields sampled, down from 185.1 bu/acre seen last year.”

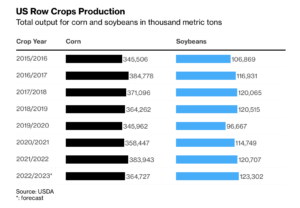

Bloomberg writer Tarso Veloso Ribeiro reported yesterday that, “Eyes around the world are watching to see if the US can produce enough corn and soybeans to revive supplies diminished by war, heat and drought.”

Also yesterday, Bloomberg writers Elizabeth Elkin and Dominic Carey reported that, “Acres that US farmers were unable to plant have more than tripled from the same period last year as extreme weather wreaks havoc on fields.

“Prevented planting acres — or insured crop that can’t be planted because of disasters including flooding and drought — were at 6.4 million, according to the USDA Farm Service Agency’s August report. That’s up from 2.1 million in 2021.”

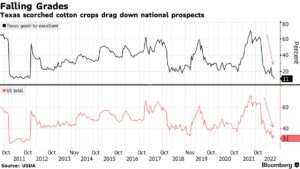

And regarding U.S. cotton prospects, Bloomberg writer Marvin G Perez reported yesterday that, “The outlook for cotton production in Texas, the nation’s largest producer, took a turn for the worse in a fresh blow to global supplies of the fiber.

“Only 11% of Texas crops were rated good-to-excellent in the week to Aug. 21, down from 14% a week earlier, matching the lowest since 2011, Department of Agriculture data showed. The portion of plants in poor-to-very poor conditions increased to 59% from 50% a week earlier.”

In a broader look at global agricultural production issues, Reuters writer David Stanway reported today that, “China’s long heatwave and drought is posing a ‘serious threat’ to the country’s autumn crops and everything possible should be done to try to expand water availability, the agriculture ministry said in a notice posted on Tuesday.”

Brian Spegele and Yang Jie reported in today’s Wall Street Journal that, “Tang Renjian, China’s minister of agriculture and rural affairs, said in certain drought-stricken areas the government should seek to artificially increase rainfall while also spraying crops with a water-retaining agent to help prevent evaporation, according to a ministry press release over the weekend.

“‘While we believe most weather-related disruption should be short-lived, higher risk persists on grain supply, in our view, followed by aluminum given its highest energy intensity, should the drought and weaker hydropower extend,” Goldman Sachs analysts said in a note Sunday.”

With respect to Europe, Bloomberg writer Megan Durisin reported yesterday that, “The drought and heat waves marring Europe’s summer will pare the corn crop at double the rate predicted just last month.

“Yields of the staple grain will fall 16% below the five-year average, the bloc’s Monitoring Agricultural Resources unit said in a report Monday. That compares with a July forecast for a 7.8% decline.”