As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

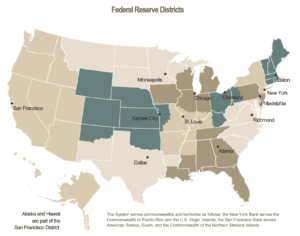

Federal Reserve: Observations on the Ag Economy- August 2022

On Wednesday, the Federal Reserve Board released its August 2022 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

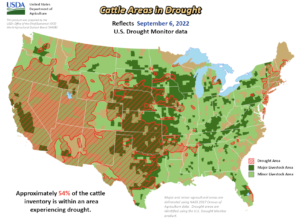

* Sixth District- Atlanta– “Demand for agricultural products remained strong. Hot weather and dry spells damaged crop yields, particularly corn, in many areas of the District. Prices paid to farmers were elevated overall but fell somewhat for corn and milk. Restrictions on imports from China led to higher demand for domestic cotton. Demand for poultry exceeded supply, while the beef market held steady. Long lead times for machinery and parts forced many farmers to use decommissioned machinery and some small farms suffered crop losses due to inoperable equipment.”

* Seventh District- Chicago– “Agricultural income prospects for 2022 were little changed, with contacts continuing to expect that most producers would turn a profit this year.

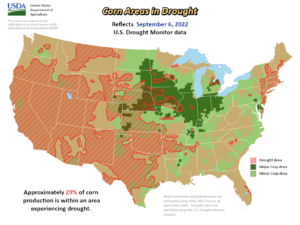

Although portions of the District were in drought, farms were generally expected to have at least average yields for corn and soybeans.

“Crop progress was behind the typical pace due to late plantings but was catching up. Corn, soybean, and wheat prices were down from the previous reporting period, as were prices for milk and eggs. Hog prices declined slightly from a high level, while cattle prices edged up. Strong demand for agricultural equipment continued, with long lead times for delivery.”

* Eighth District- St. Louis– “District agriculture conditions have moderately worsened since our previous report. Compared with the previous reporting period, crop conditions in the District have either slightly declined or remained relatively unchanged. Relative to the previous year, the percentage of corn, cotton, and soybeans rated fair or better sharply declined, while the same measure for rice slightly increased.

Worsened conditions may be partially attributable to the droughts and severe flooding that have affected the District, especially Missouri and Kentucky.

“Additionally, District contacts indicated that farming conditions remained strained due to input prices and labor shortages, with the ability to hire quality labor being their biggest concern.”

* Ninth District- Minneapolis– “District agricultural conditions strengthened modestly since the previous report, with notable exceptions. A survey of agricultural credit conditions pointed to continued growth in farm incomes; 80 percent of farm lenders said incomes in their area increased in the second quarter from a year earlier. While lenders reported continued concerns about rising production costs, commodity prices were strong enough to offset them. However, wheat and small grains production in Montana will be severely impacted by drought for the second year in a row.”

* Tenth District- Kansas City– “Conditions for the Tenth District’s farm economy remained favorable, supported by the overall strength in commodity prices, despite elevated volatility in certain markets in recent months. Crop prices remained generally higher than a year ago, but were lower in August compared to earlier in the summer. Specifically, corn and wheat prices declined moderately, and soybean prices also dropped slightly during the past month. Heightened production costs and adverse growing conditions were worse than the national average in some District states over the past month. Several farmers noted that, even with elevated levels of revenue expected this year, net income levels would likely be more subdued. In the livestock sector, profit opportunities remained sound as cattle prices were slightly higher than the previous reporting period and hog prices increased notably.”

* Eleventh District- Dallas– “Overall drought conditions improved slightly over the past six weeks, as some areas received significant rainfall in late August.

Many row crops were experiencing high abandonment and low yields resulting in significantly lowered production this year, particularly for cotton.

“High input costs and low production will financially strain many producers. Severe drought and higher feed costs have prompted significant culling of cattle herds.”

* Twelfth District- San Francisco– “Conditions in the agriculture and resource-related sectors were mixed. Drought conditions in many areas continued to impact the growing season, with some producers letting portions of their farms go fallow to prioritize water usage. Farmers throughout the District reported strong international demand for both fresh and processed foods. Shipping bottlenecks eased slightly in recent weeks, but overall supply chain disruptions persisted. Utilities reported continued challenges meeting demand as labor and materials shortages delayed maintenance and expansion projects. Input costs, despite some relief in fuel prices, remained elevated.”