As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Soybeans Climb on “Shockingly Tight Supplies” – Looming Railroad Strike Could Impact Shipping

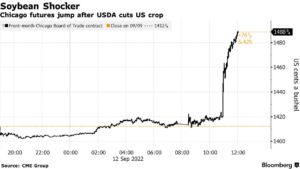

Bloomberg writers Kim Chipman, Michael Hirtzer, and Tarso Veloso Ribeiro reported yesterday that, “Soybean futures climbed 5.4%, the most in more than a year, after a closely watched crop report signaled shockingly tight supplies.”

The Bloomberg writers indicated that, “Soy and grains are being scrutinized because of their role in the price of food. Inflation has ripped across the globe as Russia’s war with Ukraine strains the supply of key farm commodities and adds pressure on the other major shippers to produce big harvests. Other potential threats loom, including a possible US freight-rail strike later this week.

Soybean Prices Surge on Supply Squeeze https://t.co/qgsTEvGp4X

— FarmPolicy (@FarmPolicy) September 13, 2022

Soybean futures climbed 5.4%, the most in more than a year, after a closely watched crop report signaled shockingly tight supplies. USDA Chief Economist @SethMeyerMU talks about the report on "Bloomberg Triple Take."

“‘It’s obviously a concern, especially in North America at a time when we are beginning to harvest our crops and it’s a very intense shipping period,’ USDA chief economist Seth Meyer said in a Bloomberg Television interview on Monday about the labor woes.”

“Chicago soybeans for November settled the trading day on Monday up 5.4% at $14.8825 a bushel, the biggest increase since late June 2021 and highest price in about 11 weeks,” the Bloomberg article said.

#Soybean Yield, U.S. pic.twitter.com/3ZSAdFozSY

— FarmPolicy (@FarmPolicy) September 12, 2022

Wall Street Journal writer Ryan Dezember reported yesterday that, “Soybean prices are having one of the best days of the past decade after U.S. agricultural forecasters trimmed their harvest estimate for the country’s top cash crop.

“Most actively traded futures shot up 5.4%, to $14.88 a bushel. Soybean futures have only risen by more than that in a session three times over the past decade.

“The main culprit behind forecasts for a weaker harvest is the drought that has desiccated the Southern Plains and is expected to offset record yields in Indiana and three Southern states. The U.S. Department of Agriculture predicted that dry conditions will reduce yields in Oklahoma by nearly a third from last year and by more than one-fourth in Texas.”

September 2022 #Soybeans pic.twitter.com/2kzAPYqAPH

— FarmPolicy (@FarmPolicy) September 12, 2022

And Reuters writer Enrico Dela Cruz reported today that, “Condition ratings for the U.S. corn and soybean crops declined in the last week while the corn harvest began in southern reaches of the Midwest, the [USDA’s weekly Crop Progress report showed on Monday].

September 2022 #Corn pic.twitter.com/EqIi9TKZJD

— FarmPolicy (@FarmPolicy) September 12, 2022

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “The back-and-forth over the continued viability of the deal allowing grain exports to leave from Ukrainian ports looks to be an ongoing source of volatility for grain futures.”

With respect to Ukraine, Reuters writer Sybille de La Hamaide reported yesterday that, “Ukraine’s grain maize (corn) harvest is expected to fall 24% below last year and 5% below the five-year average to 32.0 million tonnes, the European Union’s crop monitoring unit MARS said on Monday in updated estimates for the war-torn country.”

Also yesterday, Reuters writer Pavel Polityuk reported that, “Ukrainian farmers are likely to cut the winter grain sowing area by at least 30% because of a jump in prices for seeds and fuel combined with a low selling prices of their grain, the Ukrainian Agrarian Council (UAC) said on Monday.”

And in more detail regarding a possible US freight-rail strike, Tyler Pager, Lauren Kaori Gurley and Jeff Stein reported on the front page of today’s Washington Post that, “President Biden made calls to union leaders and rail companies Monday, pressing for a deal to avert a national railroad strike that is days away from shutting down much of the country’s transportation infrastructure, according to a White House official.

“Biden administration officials have also started preparing for a potential shutdown, warning a strike could seriously damage the U.S. economy, as well as hurt Democrats in the upcoming midterm elections, according to two people familiar with the matter.

“Biden’s calls follow unsuccessful emergency meetings at the White House last week, which have been led by the White House National Economic Council and included Labor Secretary Marty Walsh. Transportation Secretary Pete Buttigieg is also involved in trying to broker the impasse, said the two people, who spoke on the condition of anonymity to speak freely about internal deliberations.”

The Post article stated that, “A strike could also have a significant impact on a variety of industries — energy, automobiles, agriculture and retail — which all depend on freight rails to transport inventory from the ports to warehouses and distribution centers. And the shutdowns would cause a domino effect, paralyzing multiple sectors.”