A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Mississippi River Flow a Continuing Concern, as Rising Dollar Impacts Food Importers

Cameron McWhirter reported in Saturday’s Wall Street Journal that, “Sections of the Mississippi River are approaching low water levels not seen in more than three decades, disrupting a vital supply lane for agriculture, oil and building materials and threatening businesses including barge and towboat operators, farmers and factories.

“The low water, caused by a lack of rain in the Ohio River Valley and the Upper Mississippi, has halted commercial traffic and river boat cruises at numerous spots below Illinois. Prices to ship goods have more than doubled in a matter of weeks. Barges are grounding on sandbars in unprecedented numbers and many ports and docks no longer have water deep enough for commercial boats to safely reach them.”

The Journal article noted that, “The U.S. Army Corps of Engineers has begun emergency dredging at various spots on the river to deepen it enough for commercial traffic to resume, said Lisa Parker, spokeswoman for its Mississippi Valley Division.”

“Part of the Ohio River, a tributary of the Mississippi, has experienced low water levels as well,” the Journal article said.

[10/14/22] As of 7 PM the stage on the Mississippi River at New Madrid, MO, has fallen to -5.45 ft. While these observations are still preliminary, it appears the river has fallen to a record low water level, last set in 2012. River observations at New Madrid began in 1879. #MOwx pic.twitter.com/BXRxYw59Qm

— NWS Paducah, KY (@NWSPaducah) October 16, 2022

McWhirter explained that, “Historically, shipping along the Mississippi River and its tributaries has been less expensive than other forms of transportation, but with fewer boats and barges able to transport goods, prices have skyrocketed. The cost of sending a ton of corn, soybeans or other grains southbound from St. Louis to southern Louisiana reached $105.85 on Oct. 11, according to data compiled by the U.S. Department of Agriculture. On Sept. 27, the cost was $49.88. On Oct. 5, 2021, it was $28.45.”

“Farmers and factories in the central U.S. are rushing to secure the shrinking number of spots or find alternate supply routes.”

Aerial photos of the record low Mississippi River just south of Cairo, IL #ilwx #kywx #mowx #tnwx #arwx #mswx #lawx #mississippiriver #aerial #cairoil #sandbar #drought #barge #commerce pic.twitter.com/fvt9PiAro2

— Ohio Valley Aerial (@stmchsr01) October 15, 2022

Also Saturday, Associated Press writer Michael Goldberg reported that, “Plummeting water levels in the lower Mississippi River are projected to drop even further in the weeks ahead, a projection shows, dampening the region’s economic activity and potentially threatening jobs in one of the country’s poorest states.”

“A dearth of rainfall in recent weeks has left the Mississippi River approaching record low levels in some areas across several states. Nearly all of the Mississippi River basin, from Minnesota through Louisiana, has seen below-normal rainfall since late August,” the AP article said.

A CNN article from Sunday pointed out that, “The forecast from the Climate Prediction Center is dry, with below-average rainfall in the outlook through at least October 23.”

And The Guardian reported late last week that, “The Mississippi River Basin produces nearly all – 92% – of US agricultural exports, and 78% of the global exports of feed grains and soybeans. The recent drought has dropped water levels to alarmingly low levels that are causing shipping delays, and seeing the costs of alternative transport, such as rail, rise.”

Elsewhere, Donnelle Eller reported on the front page of Sunday’s Des Moines Register that, “It’s been a year of drought in much of Iowa. The entire state is experiencing drought conditions, ranging from abnormally dry to extreme drought in northwest Iowa. Only in parts of northeast Iowa has there been adequate rain this year.”

The Register article explained that, “Even with drought cutting yields in parts of Iowa, however, farmers this year are forecast to harvest their second-largest soybean and seventh-largest corn crops. Nationally, farm receipts are expected to reach a record, thanks to higher grain and livestock prices, the USDA reported in September.

“But inflation is taking a growing toll. The crop being harvested was the second-most expensive on record to grow: The cost has risen 18% from 2021. U.S. farm income is forecast to fall 1% this year to an inflation-adjusted $147.7 billion when compared to last year, the USDA said.”

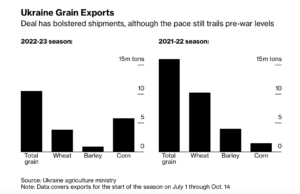

Meanwhile, Bloomberg writers Selcan Hacaoglu and Megan Durisin reported late last week that, “Russia and Ukraine are both seeking changes to their landmark grain-export deal as part of discussions to extend the initiative beyond the current deadline next month, according to the United Nations.

“Russia wants to see a pipeline that transports its ammonia to Ukraine’s Odesa port for shipment reopened as part of the new terms, Amir Abdulla, UN coordinator for the Black Sea Grain Initiative, said in an interview in Istanbul on Friday. Ukraine is seeking to extend the deal by more than year, and include Mykolayiv as a fourth exporting port, he said.”

“The initial run of the pact — which has revived seaborne grains trade from Ukraine in the midst of Russia’s invasion — is due to end Nov. 19…The fate of the agreement remains vital to tempering global food inflation,” the Bloomberg article said.

Additionally with respect to Ukraine and Russia, Financial Times writers Christopher Miller, Roman Olearchyk and Mehul Srivastava reported today that, “At least five explosions were heard in the centre of Kyiv early on Monday, as Russia conducted renewed strikes on the Ukrainian capital with kamikaze drones, one week after it hammered the country with a barrage of missile and drone attacks.”

Also today, Reuters writer Pavel Polityuk reported that, “Less than 30% of the Ukrainian winter grain crop area for the 2023 harvest was sown at optimal times because of poor weather, state weather forecasters said on Monday, adding that this was ‘significantly less‘ than in previous years.”

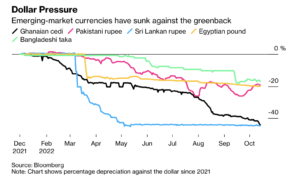

In other market news, Bloomberg writers Agnieszka de Sousa, Ekow Dontoh, and Ismail Dilawar reported on Saturday that, “Food importers from Africa to Asia are scrambling for dollars to pay their bills as a surge in the US currency drives prices even higher for countries already facing a historic global food crisis.”

The Bloomberg article stated that, “Around the world, countries that rely on food imports are grappling with a destructive combination of high interest rates, a soaring dollar and elevated commodity prices, eroding their power to pay for goods that are typically priced in the greenback. Dwindling foreign-currency reserves in many cases has reduced access to dollars, and banks are slow in releasing payments.”