As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Fertilizer Prices Continue “Shift Lower”

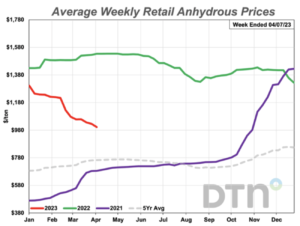

DTN writer Russ Quinn reported last week that, “Retail fertilizer continues to shift lower, according to prices tracked by DTN for the first full week of April 2023. The trend has been in place since the beginning of the year.

“Seven of the eight major fertilizer prices are lower compared to last month. DTN designates a significant move as anything 5% or more.

“Anhydrous leads the way lower once again. The nitrogen fertilizer was 5% less expensive compared to last month and had an average price of $1,002/ton.”

“Six fertilizers were all just slightly lower compared to last month. DAP had an average price of $818/ton, MAP $809/ton, potash $642/ton, urea $625/ton, UAN28 $423/ton and UAN32 $507/ton,” the DTN article said.

Quinn added that, “All fertilizers are now double digits lower compared to one year ago. 10-34-0 is 18% less expensive, DAP is 21% lower, MAP is 23% less expensive, potash is 27% lower, UAN32 is 31% less expensive, UAN28 is 33% lower, anhydrous is 35% less expensive and urea is 39% lower compared to a year prior.”

Elsewhere, Jinjoo Lee reported in Saturday’s Wall Street Journal that, “Potash, a potassium-based fertilizer mined from the ground, came into sharp focus last year when prices reached record highs following supply disruptions from Belarus and Russia. Some see it as a key commodity not just for agricultural production but also combating global warming.

“Now potash producers elsewhere—most notably in Canada—are seeing an opportunity to grab market share. BHP, the world’s largest miner, sees the fertilizer as one of the keys to its future. Will their potash bets pay off?”

The Journal article explained that, “Potash prices in Brazil, the world’s largest importer of the fertilizer, spiked to a record high of $1,180 a ton in April 2022, 250% above the trailing-five-year average. That was quite the reversal for potash prices, which had been stuck in a rut for at least a decade because of a capacity glut. The supply disruptions from Belarus and Russia, which together typically produce 40% of the world’s potash, were to blame. Both the U.S. and the European Union started imposing sanctions on Belarus’ state-run potash producer in 2021 following a disputed presidential election, and they tightened those restrictions in 2022 in response to Belarus’ involvement in Russia’s invasion of Ukraine. On top of that, Lithuania started banning the transport of Belarusian potash last year, eliminating a key export route. Belarusian exports were down by about 70% last year, according to an estimate from analyst Allan Pickett of S&P Global Commodity Insights. And while there were no direct sanctions imposed on Russian potash, restrictions on export-enabling activities such as banking and shipping have affected supply from there.”

Lee pointed out that, “Potash prices have moderated considerably since then, partly because some potash buyers stockpiled it last year when it wasn’t clear how disrupted Russian potash supply would be, according to analyst Humphrey Knight at CRU Group. Still, prices today are about 28% above the 10-year average preceding Russia’s invasion of Ukraine.

“That’s what’s driving miners elsewhere to increase production, including in Canada, which typically accounts for about 30% of potash production. Nutrien, the world’s largest producer of potash, has said it plans to ramp up its operating production capacity in Saskatchewan to 18 million tons a year by 2026 from 15 million tons today. In a typical year, the world uses about 70 million tons of potash. Mining giant BHP plans to spend $5.7 billion on its inaugural potash mine in Saskatchewan, which has an initial capacity target of 4.35 million tons a year and a startup date of 2026.”

Saturday’s article added that, “It is tough to predict how potash demand will actually play out this year. Crop prices are elevated, with corn and soybean prices roughly 46% and 33% above their respective 10-year averages, which should encourage farmers to maximize yield and drive up fertilizer demand.”

Weekly #diesel fuel⛽️ prices, U.S. average, https://t.co/ydkZmSKDT5 pic.twitter.com/4dQuqP0Kai

— FarmPolicy (@FarmPolicy) April 13, 2023

Meanwhile, in its weekly Grain Transportation Report last week, the USDA’s Agricultural Marketing Service indicated that, “For the week ending April 10, the U.S. average diesel fuel price decreased 0.7 cents from the previous week to $4.098 per gallon, 97.5 cents below the same week last year.”