A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Some Eastern European Countries Worry About Local Grain Glut From Ukrainian Imports

Late last week, Bloomberg writers Piotr Skolimowski, Irina Vilcu and Megan Durisin reported that, “Blocked border crossings, a minister pelted with eggs and overflowing silos — anger is mounting among farmers in eastern Europe who say a rush of grain from Ukraine threatens their businesses, and it’s steadily eroding political goodwill.

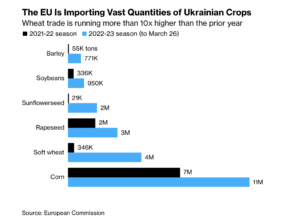

“Poland and other neighboring states agreed to help get grain out of Ukraine and on to global markets after the Russian invasion blocked exports last year. Part of that supply is now piling up in eastern Europe, and it’s threatening local livelihoods.

“The surplus has been created by infrastructure bottlenecks as well as farmers delaying selling last year’s produce. The hoard of grain is becoming a political issue as protests spill into the streets.”

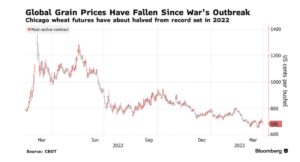

The Bloomberg article explained that, “Local growers held on to their crop in anticipation of higher prices following the war. A broader global downturn has instead pushed prices down, leaving farmers in Poland, Romania, Slovakia, Hungary and Bulgaria facing lower revenue and struggling to empty their stockpiles before the new harvest starts in the summer.”

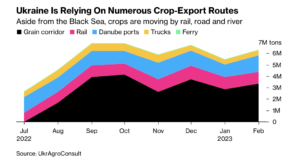

Skolimowski, Vilcu and Durisin pointed out that, “The glut is very much a local one. Ukraine’s exports to global markets are still well below pre-war levels as a deal to get grain out of Black Sea ports remains tenuous.”

Also last week, Reuters writers Alan Charlish and Anna Wlodarczak-Semczuk reported that,

Tariffs on Ukrainian agricultural imports may need to be reintroduced if an influx of products that is pushing down prices in European Union markets cannot be stopped by other means, the prime ministers of five eastern states said on Friday.

“In a letter to European Commission President Ursula von der Leyen published on a Polish government website, the prime ministers of Poland, Hungary, Romania, Bulgaria and Slovakia said that the scale of the increase of products including grains oilseeds, eggs, poultry and sugar had been ‘unprecedented.'”

“Logistical bottlenecks mean large quantities of Ukrainian grains, which are cheaper than those produced in the EU, have ended up in central European states, hitting prices and sales of local farmers,” the Reuters article said.

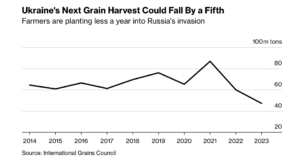

Recall that Ukraine grain output could fall by a fifth compared to last year.

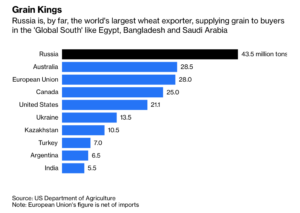

Elsewhere, Bloomberg writers Aine Quinn and Megan Durisin reported on Saturday that, “Russia’s grip on global food supply is tightening after two of the biggest international traders said they would halt grain purchases for export from the country.

“The exit of Cargill Inc. and Viterra means Russia, the world’s largest wheat exporter, will have more control over its food shipments and reap more of the revenues. Russia’s dominance in the global grain market was laid bare by the war in Ukraine, with prices surging last year amid supply disruptions.”

Quinn and Durisin pointed out that, “Archer-Daniels-Midland Co. is also weighing options to quit its main Russian operations, according to people familiar with the matter. Louis Dreyfus is considering reducing its presence in the country, the Kommersant newspaper reported.

“For Russia, ‘we can assume that it will be easier to control the export flows if authorities want to do that, as it’s easier to deal with local players,’ said Andrey Sizov, managing director of researcher SovEcon.”