As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

“Forecasts for Crop-Boosting Rains” Pressure Grain Prices Lower

Reuters writer reported yesterday that, “U.S. corn futures fell more than 4% and soybeans more than 2% on Wednesday, pressured by forecasts for crop-boosting rains in the Midwest where dry conditions have stressed crops in many areas.”

“Wheat also declined, pressured by the expanding U.S. winter wheat harvest and a larger-than-expected Canadian acreage estimate.”

Ingwersen explained that, “Fluctuating weather forecasts for the U.S. Corn Belt have kept traders on edge for weeks. Dry conditions stressed crops and sent futures soaring to multi-month highs by mid-June, but outlooks for rain later this week and into next week bolstered production prospects and triggered a sell-off.”

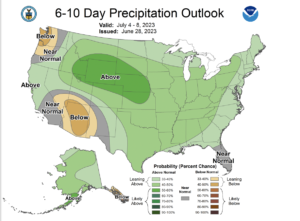

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Corn for December delivery fell 4.3% to $5.36 3/4 a bushel, on the Chicago Board of Trade on Wednesday, in response to weather forecasts calling for ample rainfall through mid-July.”

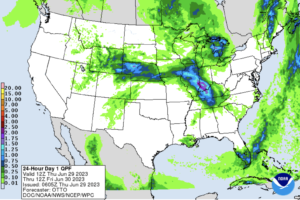

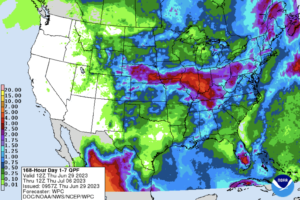

“According to data from the National Centers for Environmental Prediction, many parts of the Corn Belt that have been turning dry over the past month are expected to get more rain than usual for this time of year over the next two weeks. That’s a big change from earlier indications that El Nino would limit rainfall for thirsty crops,” the Dow Jones article said.

Maltais added that, “With sizable rainfall finally arriving to much of the U.S. Corn Belt, the question grain traders now have is whether it’s too late for distressed crops to bounce back from the punishing conditions of the past few weeks.”

Finally, FINALLY. I think it's finally happening. Tonight into the weekend we'll be entering a stretch of daily chances for showers and thunderstorms.

— Andrew Pritchard (@skydrama) June 28, 2023

The maps below show the probability of receiving 1"+ of rain in the next 10 days with Champaign County, IL highlighted in white. pic.twitter.com/bOHjMHgHGE

And Reuters writer Enrico Dela Cruz reported today that, “Chicago corn futures rebounded in Asian trading on Thursday after two sessions of sharp losses, with traders awaiting U.S. weekly export sales data later in the day and U.S. acreage and quarterly grain stocks reports on Friday for further direction.

“Gains were however capped as forecasts for beneficial rains in the U.S. Midwest eased persistent worries about dry weather hurting the crop.”

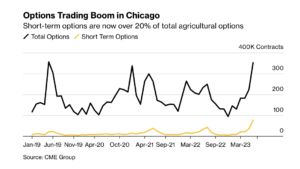

Elsewhere, Bloomberg writer Tarso Veloso Ribeiro reported yesterday that, “A drought that’s ravaging US crops is prompting agricultural commodities traders to seek protection in a new and booming corner of the options market.

“With prices moving sharply depending on the weather, traders are piling into short-term options to hedge every little bit of rain or dry forecast ahead. These products, which expire weekly or in different months than traditional contracts, accounted for a record 22% of all options transacted in June, according to CME Group Inc.

“US crops are in the worst condition since 1988, and there are concerns the dry weather will curb output in the world’s top corn grower and second-largest soybean producer. Traders are also seeking protection before the US Department of Agriculture’s acreage and grains stocks report, which could shine a light on the size of the crop and buffer supplies.”

Meanwhile, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s 2023 wheat harvest may far exceed official expectations of 17 million metric tons and reach at least 24 million metric tons, traders and analysts said on Wednesday citing farmers’ survey.

“The agriculture ministry has said the harvest could decrease sharply in 2023 due to the Russian invasion and occupation of a significant part of the country.

“Ukraine harvested around 20 million metric tons of wheat in 2022.

“But grain traders union UGA and analysts said this year’s wheat yield could be high.”