A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Impact of Summer Heat on U.S. Crops Debated, as Black Sea Export Issues Persist

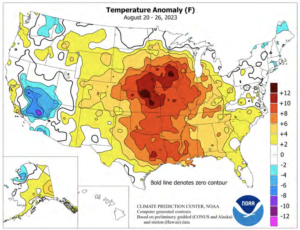

Dow Jones writer Kirk Maltais reported on Friday that, “The effect of scorching heat on maturing U.S. crops is driving the price debate in grain markets, with trading volume of grain futures muted as observers are split over the extent of crop damage.

“Some clarity is expected next week from the U.S. Department of Agriculture’s world supply and demand report, due on Tuesday. The monthly report will update the agency’s projections on the expected output for crops being harvested this fall.”

Maltais noted that, “Grain prices have been choppy, with futures catching support in late August on indications that corn and soybean crops will likely be hurt by unseasonably hot and dry conditions. Most-active corn futures were down 0.1%, to $4.86 a bushel, on Friday, while soybeans were up 0.3%, to $13.63 a bushel, and wheat down 0.1%, to $5.99 a bushel.

“Analysts across the board agree that the tough weather seen in the latter half of August, as well as other bursts of hot and dry conditions seen this summer, will decrease the USDA’s outlook this month. Where they differ is by how much.

“In August, the USDA forecast that U.S. corn production would total a near-record of 15.11 billion bushels, with an estimated yield of 175.1 bushels an acre. Soybean production was pegged at 4.21 billion bushels, with a yield of 50.9 bushels an acre.”

The Dow Jones article added that, “Weather impact on corn and soybean crops are tied to the timing of when these crops are typically planted. Corn is often planted in April through May, with soybean planting extending from May until late June. As a result, the younger soybean crops is more susceptible to late summer weather volatility, while the more-mature corn crop is mostly grown and ready to be harvested.”

Timely July rains in some parts of the Corn Belt also served to have an impact on crops, particularly with respect to corn that was in the pollination stage.

#Drought Monitor- Corn Belt

— FarmPolicy (@FarmPolicy) September 7, 2023

* One-Month Change pic.twitter.com/C5II6kKyyW

Meanwhile, Reuters writer Michelle Nichols reported late last week that, “A Russian Agricultural Bank subsidiary in Luxembourg could immediately apply to SWIFT to ‘effectively enable access’ for the bank to the international payments system within 30 days, the United Nations told Russia in a letter, seen by Reuters on Friday.

“‘SWIFT has confirmed that RSHB Capital S.A. would be eligible to apply for membership and access to SWIFT for food and fertilizer transactions, based on its current status as an issuer of debt securities,’ U.N. Secretary-General Antonio Guterres told Russian Foreign Minister Sergei Lavrov on Aug. 28.”

The article explained that, “Russia’s grain and fertilizer exports are not subject to Western sanctions but Moscow said restrictions on payments, logistics and insurance have been a barrier to shipments.

“A key Russian demand has been the reconnection of the Russian Agricultural Bank, Rosselkhozbank, to the SWIFT international payments system. It was cut off by the European Union in June 2022 after Russia’s February invasion of Ukraine.”

Russia continues its attacks on Ukraine's vital Danube ports, systematically destroying civilian infrastructure to prevent Ukrainian grain from feeding the world. This is Russia's playbook: strangle Ukrainian grain exports, weaponize food, and make hungry people pay the price.

— Secretary Antony Blinken (@SecBlinken) September 8, 2023

On Saturday, Reuters News reported that, “Russia said on Saturday it was sticking to its conditions for a return to the Black Sea grain deal which it quit in July.

“In particular, Kremlin spokesman Dmitry Peskov said Russia needed its state agricultural bank – and not a subsidiary of the bank, as proposed by the United Nations – to be reconnected to the international SWIFT bank payments system.”

And on Sunday, Reuters reported that, “Any initiative to revive the Black Sea grain deal that isolates Russia is not likely to be sustainable, Turkish President Tayyip Erdogan said in a press briefing after the conclusion of the G20 summit in New Delhi on Sunday.”

Reuters reported today that, “The United Nations rights chief on Monday blamed Russia’s exit from the Black Sea grain deal as well as its attacks on agricultural facilities for higher food prices that have been particularly damaging in the Horn of Africa.”

Also today, Reuters writer Naveen Thukral reported that, “Work is ongoing to diversify Ukraine’s export routes and Romania was set on Friday to approve a plan to upgrade road infrastructure in the Black Sea port of Constanta, helping more Ukrainian grain to transit.”