As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Corn, Soybean Futures Climb on Production Cuts- Third Largest Corn Harvest Expected

Reuters writer Mark Weinraub reported yesterday that, “U.S. corn and soybean harvests will be smaller than previously forecast, with hot and dry weather during critical parts of the growing season dragging on yields, the government said on Thursday.

U.S. #Soybeans Supply and Demand pic.twitter.com/IeQSkaWuVS

— FarmPolicy (@FarmPolicy) October 12, 2023

“Corn and soybean futures markets jumped as the U.S. Department of Agriculture’s (USDA) new harvest outlooks fell below market expectations, helping prices recover from near three- and two-year lows respectively.”

U.S. #Corn Supply and Demand pic.twitter.com/ZHI0yWbkub

— FarmPolicy (@FarmPolicy) October 12, 2023

Weinraub explained that, “Chicago Board of Trade soybean futures, which hit near two-year lows overnight, surged 2.9% after the USDA’s monthly World Agricultural Supply and Demand Estimates report was released, on track for their biggest daily gain in three months.

October 2023 #Soybeans Acreage, Yield, and Production pic.twitter.com/1ijUsaaUYn

— FarmPolicy (@FarmPolicy) October 12, 2023

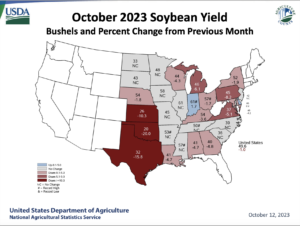

“The report pegged the corn harvest at 15.064 billion bushels and the soybean harvest at 4.104 billion bushels. It estimated average yields at 173.0 bushels per acre for corn, and 49.6 bushels per acre for soybeans.

If realized, the corn harvest would still be the third biggest on record.

The Reuters article pointed out that, “Analysts had been expecting the report to show a corn harvest of 15.101 billion bushels with an average yield of 173.5 bushels per acre, and a soybean harvest of 4.134 billion bushels based on an average yield of 49.9 bushels per acre.”

October 2023 #Corn Acreage, Yield, and Production pic.twitter.com/JetnSDgelV

— FarmPolicy (@FarmPolicy) October 12, 2023

Dow Jones writer Kirk Maltais reported yesterday that, “Trader focused more on the USDA’s lower revision of production and yield estimates for corn and soybeans than cuts to demand. The USDA reduced corn usage by 50 million bushels to 14.34 billion bushels and cut soybean usage to 4.18 billion bushels, a 23 million bushel decrease. Both declines were largely driven by cuts made to expected export volumes.”

,

Also yesterday, Wall Street Journal writer Ryan Dezember reported that, “Soybean prices are having their best day since June after the U.S. Department of Agriculture reduced its outlook for the ongoing harvest to below what traders and growers expected.”

Reuters writer Peter Hobson reported today that, “Chicago soybean futures were unchanged on Friday but set for their first weekly gain since August after the U.S. government lowered its U.S. production forecast further than analysts had expected.”

The article noted that, “In the near term, however, a record harvest in Brazil is keeping a lid on prices, with Brazilian beans trading at a discount, [Vitor Pistoia, an analyst at Rabobank in Sydney] said.”

Elsewhere, Reuters writer Mei Mei Chu reported today that, “China imported 7.15 million metric tons of soybeans in September, customs data showed on Friday, falling 7.3% from a year ago after a spike in global prices curbed recent purchases.

“China’s oilseed purchases from top producer and exporter Brazil have surged this year as buyers jumped on cheaper beans following a record harvest in the Latin American country.”

“Hog prices in China are falling, despite the start of the peak fourth quarter consumption season, weighed down by excess production and a slower than expected economic recovery,” the Reuters article said.