As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Fertilizer Prices Mixed, While Brazilian Soybean Production Estimates Adjusted

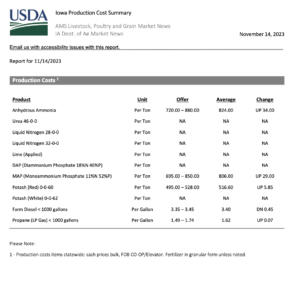

DTN writer Russ Quinn reported last week that, “Retail fertilizer prices saw mixed moves again during the second week of November 2023, according to sellers surveyed by DTN.

“Average retail prices for five of the eight major fertilizers were higher compared to last month while prices for the remaining three were lower. None of the moves were significant, which DTN designates as anything 5% or more.

“The five fertilizers with slightly higher prices than last month were DAP with an average price of $717 per ton, MAP $811/ton, potash $511/ton, anhydrous $843/ton and UAN28 $361/ton.”

Quinn noted that, “The three fertilizers with just slightly lower prices were urea with an average price of $574/ton, 10-34-0 $613/ton and UAN32 $415/ton.”

The DTN article added that, “All fertilizers are now lower by double digits compared to one year ago. MAP is 18% lower, 10-34-0 is 19% less expensive, DAP is 23% lower, urea is 29% less expensive, UAN28 is 38% lower, UAN32 is 39% less expensive, potash is 40% lower and anhydrous is 42% less expensive compared to a year prior.”

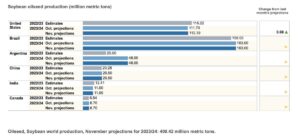

Meanwhile, Reuters writer Naveen Thukral reported today that, “Chicago soybeans fell to more than three-week lows on Monday as rain in parts of Brazil’s oilseed producing areas eased crop concerns, even as leading consultants reduced their output forecasts.”

The article pointed out that, “Rains in Brazil’s key soybean growing areas have reduced early crop damage risks.

“However, agribusiness consultancies Safras & Mercado and hEDGEpoint on Friday reduced their estimates for Brazil’s 2023/24 soybean crop, as consensus grew that bad weather will hamper output in the world’s largest producer and exporter.

Safras said it now forecasts production this season to total 161.38 million metric tons, down from the 163.25 million tons it estimated before, while hEDGEpoint cut its projection to 160.1 million tons from 162.3 million tons.

Elsewhere, Bloomberg writer Sophie Caronello reported yesterday that, “Conditions on the Mississippi are once again a cause for concern. Despite water levels rebounding in October after an extended decline since June, the river is poised to shrink through early December amid below-average rains, according to the National Oceanic and Atmospheric Administration.

“The situation is the latest example of how extreme weather brought on by climate change is plaguing trade and threatening to further increase the cost of moving corn and soybeans from the Midwest to Gulf Coast terminals as barges face delays and are forced to carry reduced loads.”

Barge movements on the #Mississippi River (Locks 27-Granite City, IL), https://t.co/b5pBFdEjsV

— FarmPolicy (@FarmPolicy) November 24, 2023

For the week ending November 18:

22 percent lower than last year and

21 percent lower than the 3-year average. pic.twitter.com/3R217fhxGl

In other news, Reuters writers Dominique Patton and Mei Mei Chu reported yesterday that, “China’s most active hog futures DLHCV1 fell more than 5% on Monday, after farmers ramped up selling of pigs after several months of weak prices.”

The Reuters article explained that, “China’s cash hog prices have been falling since August, amid large oversupply and weak demand.

“Yet the country’s sow herd at the end of October was still larger than needed at 42.1 million pigs, state media reported last week.

“Farmers have begun to accelerate destocking of herds in recent weeks however, hitting market confidence, say analysts.”

Lower pork prices in China are considered to be “bad news” for soybean and corn exporters, as feed demand could be negatively impacted.