Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Kansas City Fed: U.S. Ag Economy Softened in Third Quarter; While Soybean Futures Climb “10% From a 22-Month Low in October”

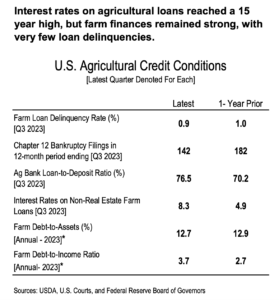

Last week, in its Third Quarter 2023 Ag Bulletin, the Federal Reserve Bank of Kansas City indicated that, “The U.S. agricultural economy softened in the third quarter alongside a drop in commodity prices. Agricultural prices remained above historical averages, but decreased by about 5% from the previous quarter.

“As harvest went into full swing across many regions, crop production was expected to rebound from a year ago. Corn production was anticipated to be particularly strong and put downward pressure on prices.

“In livestock markets, profit margins for dairy and hog producers remained suppressed alongside relatively low prices while a small cow herd continued to support higher cattle prices.

“Profit opportunities have thinned for many agricultural producers relative to a year ago, but agricultural credit conditions and farm real estate values have held firm with ongoing support from a strong agricultural economy in recent years.”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “A new flash sale of U.S. soybeans to China was confirmed by the USDA on Monday morning, bringing last week’s streak of sales into a new week. The USDA confirmed that China has purchased 204,000 metric tons of soybeans for delivery in the 2023-24 marketing year.”

The article pointed out that, “Last week, the USDA announced several flash sales of U.S. soybeans to China, totaling nearly 2 million tons, not counting sales made to ‘unknown destinations,’ which is a separate designator often used for sales to China.”

In a separate Dow Jones article yesterday, Maltais reported that, “Inspections of U.S. soybean shipments through the week ended Nov. 9 fell 24% from the previous week, according to the Department of Agriculture.

“In its latest weekly grain export inspections report, the USDA said that soybean export inspections totaled 1.67 million metric tons. This is down from 2.18 million tons reported last week, as well as 2.03 million tons at this time last year. Total soybean shipments are behind where they were at this time last year, totaling 14.03 million tons in the 2023/24 marketing year – a 5.6% decline from last year.”

And Reuters writer Peter Hobson reported today that, “Chicago soybean futures dipped on Tuesday after large U.S. bean sales to China and fears that hot and dry conditions in top producer Brazil may be damaging crops pushed prices to their highest since August in the previous session.”

The article added that, “U.S. exporters sold 204,000 tonnes of soybeans to China for 2023/2024 delivery, the U.S. Department of Agriculture said – the latest in a string of sales ahead of a meeting between Joe Biden and Xi Jinping in San Francisco on Wednesday.

Higher demand for U.S. beans has helped push Chicago prices up 10% from a 22-month low in October.

“CBOT December soymeal futures have also surged, hitting a contract high on Monday.”