President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Brazil soybean group disagrees with high production estimates

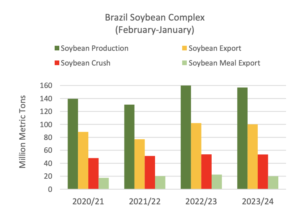

Reuters’ Ana Mano reported yesterday that Aprasoja Brasil — “an association representing thousands of grain farmers in Brazil projects production of 135 million metric tons of soybeans in the 2023/2024 cycle.”

That production estimate is significantly lower than private estimates, the United States Department of Agriculture estimate and Brazilian crop agency Conab’s estimate from earlier last week, Mano reported.

“‘The publication of data that does not match reality has caused a downward trend in prices,’ Aprosoja Brasil said,” according to Mano. “‘Farmers, in addition to having reduced yields, have to deal with prices that are incompatible with reality.'”

The primary reason for the smaller soybean production estimate, Mano reported, is because “water stress in Center-Western states such as Mato Grosso, Goias and Mato Grosso do Sul and the excess rainfall in certain areas of these same states are disrupting grain harvesting that is underway. It said this situation may lead to even greater losses for farmers this year.”

‘”There are also reports from farmers in the south of the country, mainly in the state of Parana, who suffered from excessive rainfall at the beginning of planting and are now facing a lack of rain in areas where soybeans are in the reproductive phase, which compromises crop yields,’ Aprosoja Brasil said,” according to Mano’s reporting.

Mano reported that Aprosoja said “its estimate is based on information collected from Aprosoja branches in 15 states.”

USDA and Conab Estimates

Aprosoja Brasil’s soybean production estimate is significantly lower than both the United States Department of Agriculture estimate and Brazilian crop agency Conab’s estimate released early last week. While Conab’s estimate is significantly higher — at 155.3 MMT, according to other reporting from Reuters’ Mano — it also cut its estimate from its early season forecast due to weather.

“Conab said the El Niño pattern had brought excessive heat and dryness in the center of Brazil and too much rain in the south,” Mano wrote. “It said high temperatures and water shortages, mainly in the Central-West Region, had spoiled plants on some fields.”

Conab’s estimate, however, remains at record production levels for Brazil.

The USDA also cut its estimate last week due to weather, according to its January “Oilseeds: World Markets and Trade” report, but it remains one of the higher production estimates at 157 MMT.

“Brazil soybean production is cut 4 million tons to 157 million as hot and dry weather in recent months strained the crop in key growing regions,” the report said. The production cut means the USDA estimate is now below record production levels.

“Private forecasters also said Brazil’s soy crop outlook had worsened” last week, Mano reported. “At least two lowered output expectations for the crop in January, to between 151 million tons and 153 million tons.”

While Aprosoja Brasil’s soybean production estimate is already lower than most, it hinted that it could cut its estimate even further if weather conditions require it.

“Due to climate risk, Aprosoja Brasil said its crop forecast could be revised lower if the weather does not improve,” Mano reported.