As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

High Interest Costs Could Weigh On Farmland Demand

The Federal Reserve Bank of Kansas City’s Ty Kreitman reported yesterday that “higher interest rates and a moderation in agricultural commodity prices have cut potential returns and could dampen demand for farmland—and thus farmland values—going forward.”

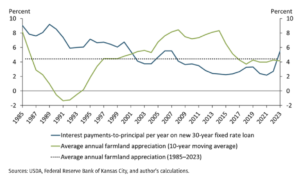

The potential for lower farmland demand is largely driven by the fact that, “In 2023, interest costs on new farmland loans (blue line) surpassed the recent average annual appreciation in land values (green line) for the first time since 2001,” Kreitman wrote.

“From 2002 to 2022, growth in agricultural real estate values was well above the cost of financing, supporting demand for farmland,” Kreitman reported. “With interest costs now above average land value appreciation, farm operating profits will determine the magnitude of returns for financed land.”

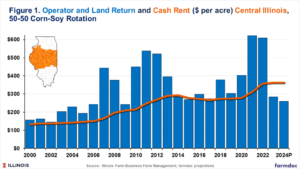

However, farm operating profits could be low in the coming year, as farmdoc daily‘s Nick Paulson and Gary Schnitkey reported last week in revised 2024 crop budgets, with “a reduction in the corn and soybean prices assumed for both 2023 and 2024 resulting in lower return and profitability projections” for farmers in Illinois.

“Current farmer return expectations are negative for both corn and soybeans across all regions for 2024 for cash rented land at average cash rent levels, suggesting cost adjustments will be needed in 2024 and beyond,” Paulson and Schnitkey wrote.

“Land costs are another potential target to attempt to reduce production costs,” Paulson and Schnitkey wrote. “Negotiating lower cash rents can be difficult but can be aided by open communication between farmer tenants and landowners. Shifting to a variable cash lease design is another option which can result in return and risk sharing between the farmer and landowner that will adjust to market conditions through time.”

In addition to interest expenses, Kreitman reported that the moderation in agricultural commodity prices that have cut potential returns could also affect the demand for farmland. Across 2023, according to Reuters reporting from Brendan O’Brien, grain futures ended 2023 significantly in the red, with the most active corn contract (Cv1) down 31% in 2023, while wheat (Wv1) was down 21% and soybeans (Sv1) were down 15%.

At the end of December, Progressive Farmer’s Elizabeth Williams reported that David Martin, managing director of USAgriculture, a farmland investment advisor based in Indianapolis said that “high interest rates — 7% for term debt and 8% to 10% for operating loans — negatively affect the farmland market.”

“‘The last time rates shot higher like this was in the 1980s when farm operations paid an average of 35 cents in interest expense for every $1 earned in farming,'” said Howard Halderman, president of Halderman Farm Management, according to Williams.

Despite the potential dampening of demand for farmland, farmland values across the U.S. are expected to remain strong in 2024, AgWeb’s Cheyenne Kramer reported last week.

“‘Even with all the pressures that we’ve seen – some declining commodity markets, interest rates being higher than what we’re used to, and the cost of inputs – we really expected more of a settling of land values,’ said Paul Schadegg, Farmers National Company senior vice president of real estate operations,” according to Kramer’s reporting. “‘And we really haven’t seen it–no decreases to speak of and still some really strong sales out there in the country.'”