As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

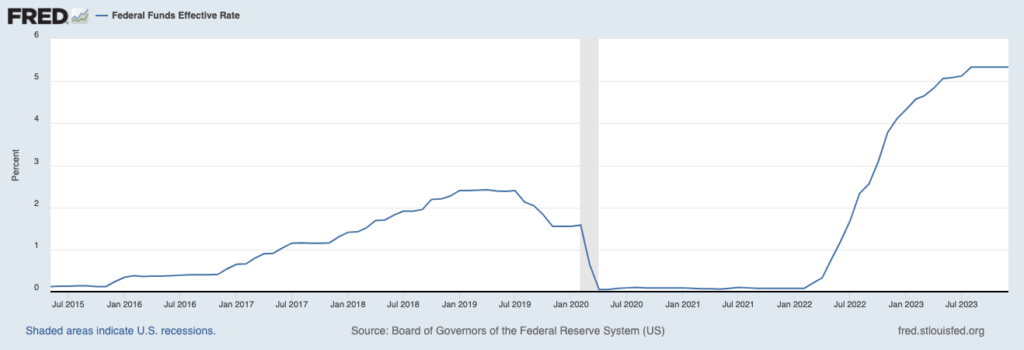

Fed Rates Unchanged in January

CNBC’s Jeff Cox reported that “the Federal Reserve on Wednesday sent a tepid signal that it is done raising interest rates but made it clear that it is not ready to start cutting, with a March move lower increasingly unlikely.”

“Policy makers have kept their benchmark interest rate between 5.25% and 5.5% — the highest in over two decades — since July,” according to NPR’s Scott Horsley.

Cuts Not Likely Soon

CNBC’s Jesse Pound reported that “Fed Chairman Jerome Powell said Wednesday that the central bank would likely not be comfortable enough with the path of inflation by its next meeting in March to cut interest rates.”

“In a statement, the Fed said it won’t consider rate cuts until it ‘has gained greater confidence that inflation is moving sustainably toward’ its 2% target,” according to Forbes’ Derek Saul.

But Powell “told reporters Wednesday that interest rates are unlikely to go any higher, and that he and his colleagues are beginning to contemplate cutting rates,” Horsley reported. “‘If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year,’ Powell said. He cautioned, however, that the economy remains unpredictable and said the central bank would proceed cautiously.”

Effects on Agriculture

The rates hikes beginning in 2022 have had an effect on farmers around the United States “who may have to borrow a lot of money, whether it’s to buy land, equipment or other inputs, OpenMarkets’ Debbie Carlson reported in June 2023. That’s because “loans will be much more costly than a year ago when the Federal Reserve started to raise interest rates.”

For example, in the Federal Reserve’s Tenth District (Kansas City), interest rates for farm loans have skyrocketed since 2022 to their highest levels since the mid-2000s. The fourth quarter of 2023 was the first in which “the sharp climb in farm loan interest rates abated during the quarter as average rates increased modestly for some types of loans and dropped slightly for others.”

“The average rate charged on feeder livestock and operating loans dropped about 50 basis points from the previous quarter as benchmark rates remained steady in recent months,” the Federal Reserve Bank of Kansas City reported. “The average rate on loans for other livestock and machinery edged slightly higher.”

FarmProgress’ Betty Haynes reported Thursday that “overhead costs are projected to increase (in 2024) as higher interest rates and labor challenges continue.”

“Rising interest rates to battle inflation from the COVID-19 pandemic will continue to impact borrowing for the 2024 crop, with possible rate reductions expected in the last half of the year that could provide more relief in 2025,” she wrote.