A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Tariff Revenue from Ag Input Imports was Nearly $1 Billion in 2025

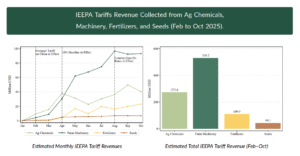

Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University’s monthly Agricultural Trade Monitor. Of that, about $530 million came from farm machinery, $273 million came from agricultural chemicals, $110 million came from fertilizers and $44 million came from seeds.

“Despite their negative effects on producers, the collected tariffs represent a relatively small share of production expenses,” NDSU reported. “…The tariff revenue collected on these three input categories represents 0.2% of seed expenditures, 1.3% of pesticide costs, and 0.3% of fertilizer costs. It is important to note that these estimates do not account for tariffs collected on other inputs in the agricultural supply chain, including steel, aluminum, and parts used in machinery and equipment, which may impose additional costs on U.S. producers.”

February–October Total (Right). Courtesy of NDSU.

For fertilizer tariffs in particular, AgWeb’s Bill Watts reported that the full cost “and then some – may have been passed through to farmers in 2025, according to data released Tuesday by North Dakota State University (NDSU).”

“The report observes that when fertilizer tariffs were imposed in April, U.S. fertilizer prices significantly rose relative to Canadian prices, which weren’t subject to the tariff,” Watts reported. “The premium for DAP, measured by the difference between prices in the U.S. Northern Plains versus Canadian prices, climbed to $343 per metric ton at its peak during the tariff period, marking an increase of $172 per metric ton from pre-tariff baseline levels. MAP and urea each saw a similar divergence.”

“So who pays the cost of tariffs? The burden can either be distributed between exporters, who eat the cost by reducing export prices, or importer and end users, who pay higher prices,” Watts reported. “The analysis of the U.S.-Canada spread ‘indicates that domestic importers and farmers bore the tariff burden substantially,’ says the report, noting price movements during the tariff period seemed to exceed the direct cost of the tariff itself.”

“The report notes the effective tariff rate on DAP imports was approximately 8% of the import value, while year-over-year spot price analysis showes the differential between U.S. and Canadian spot prices rose by $187 per metric ton in August 2025 compared with August 2024,” Watts reported. “That’s equivalent to a 342% pass-through rate when measured against the 8% tariff. At the retail level, the pass-through rate was lower at 156%, but still exceeded 100%.”

Tariffs Lawsuit Remains Unresolved

Bloomberg’s Greg Stohr reported that “the US Supreme Court is dashing any hopes of a quick rollback of President Donald Trump’s tariffs. The justices are set to start a four-week recess next week without having ruled on pending challenges to most of the duties Trump has imposed over the last year. After Wednesday’s hearing on Trump’s effort to fire Federal Reserve Governor Lisa Cook, the justices don’t have another scheduled courtroom session until Feb. 20.”

“The wait means the disputed tariffs remain in place for now, costing importers more than $16 billion every month, according to federal government data,” Stohr reported. “At that collection rate, the total collected under the law at the center of the case, the 1977 International Emergency Economic Powers Act, will surpass $170 billion by Feb. 20, according to Bloomberg Economics analyst Chris Kennedy.”

“The court heard arguments Nov. 5 on an expedited basis, setting a schedule that suggested an ultra-fast ruling might be in the offing. Some close watchers of the court predicted a decision could come in a matter of weeks, rather than the usual months,” Stohr reported. “But by not ruling on Tuesday — when the justices resolved three lower-profile cases — the court suggested a decision isn’t likely for at least another month given its normal practice of announcing all decisions in argued cases from the bench.”