A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

COVID19 at Meat-Processing Plants Highlights Key Link, and Vulnerabilities, In Food Supply Chain

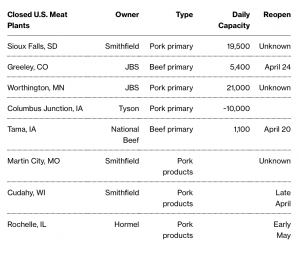

Bloomberg writers Stephen Joyce, Michael Hirtzer, and Jen Skerritt reported this week that, “Hundreds of National Guard personnel are being activated in Iowa as coronavirus sweeps through meat-processing plants in a state that accounts for about a third of U.S. pork supply.

“Iowa Governor Kim Reynolds said 250 National Guard members have been moved to full-time federal duty status and could help with testing and contact tracing for workers at plants operated by Tyson Foods Inc. and National Beef Packing Co.

Activating guard soldiers is the latest attempt to contain the disease, which has forced a growing number of slaughterhouses and meat-processing plants to slow or halt operations.

The Bloomberg writers explained that, “The disruptions are stoking concerns for eventual fresh-meat shortages in grocery stores as well leaving some farmers without a market for their animals. That’s pushing down prices for hogs and cattle, while making meat more expensive. Wholesale pork posted its biggest three-day gain in six years.”

And New York Times writers Michael Corkery and David Yaffe-Bellany reported recently that, “Yet meat plants, honed over decades for maximum efficiency and profit, have become major ‘hot spots’ for the coronavirus pandemic, with some reporting widespread illnesses among their workers. The health crisis has revealed how these plants are becoming the weakest link in the nation’s food supply chain, posing a serious challenge to meat production.

“After decades of consolidation, there are about 800 federally inspected slaughterhouses in the United States, processing billions of pounds of meat for food stores each year. But a relatively small number of them account for the vast majority of production. In the cattle industry, a little more than 50 plants are responsible for as much as 98 percent of slaughtering and processing in the United States, according to Cassandra Fish, a beef analyst.”

The Times article indicated that,

Shutting down one plant, even for a few weeks, is like closing an airport hub. It backs up hog and beef production across the country, crushes prices paid to farmers and eventually leads to months of meat shortages.

Likewise, Washington Post writer Laura Reiley pointed out last week that, “The meat supply chain is especially vulnerable to the spread of the coronavirus since processing is increasingly done at a handful of massive plants.”

Also this week, DTN Ag Policy Editor Chris Clayton reported that, “As the coronavirus pandemic has continued on, we’ve finally begun to learn just how important those tens of thousands of packing plant workers are around the country, and just what kind of risks they face to ensure there is meat in the retail cases in this chaotic moment in history.

“In rural states there are three main groups of people contracting the coronavirus: nursing home residents, health-care workers, and packing-plant workers.

“Through this weekend, packing plant workers account for at least 1,300 reported cases just in Colorado, Iowa, Nebraska and South Dakota. The numbers move significantly higher when poultry plants in the Southeast are factored in as well.”

From farms to grocery stores – food supply chain workers are on the frontlines of the #COVID19 pandemic & are risking their health to ensure Americans can put food on the table. I joined with @SenStabenow in calling on admin to do better & make these workers’ safety a priority. pic.twitter.com/hJ5e8hoGpV

— Sen. Jeanne Shaheen (@SenatorShaheen) April 20, 2020

Wall Street Journal writers Jaewon Kang and Jacob Bunge reported late last week that, “The coronavirus pandemic is cutting into supermarket meat supplies and affecting choices available in meat cases as plant workers get sick and processors struggle to meet surging demand.

“The pandemic is keeping thousands of meat-plant workers home across the U.S., according to industry officials, leaving work undone and reducing meat production as consumers turn to grocery stores for more of their food amid shutdowns of restaurants, schools and other providers. Those shifts are prompting some meat suppliers to reduce the range of cuts they sell to supermarkets. Others are repurposing meat that ordinarily would go to restaurants.”

The Journal article stated that, “The reliance of meat processors on thousands of processing-plant workers has left the industry vulnerable to disruption as the coronavirus spreads, and companies and government officials try to balance food production and public health.”

As the supply tightens and consumers buy more meat at supermarkets, grocers are making adjustments in their meat departments. They are offering fewer selections, selling new products and repackaging items they receive from restaurant distributors.

Meanwhile, Wall Street Journal writers Jesse Newman and Annie Gasparro reported earlier this week that, “The coronavirus pandemic is deepening challenges for the U.S. food system, forcing plant closures and infecting farmworkers at a time when packaged-food companies say demand for groceries has never been higher.

“Production has been curtailed at a range of facilities across the country, including a Kraft Heinz Co. macaroni-and-cheese plant and a Conagra Brands Inc. frozen-meal factory. At the same time, food companies are instituting precautions to maintain or restore production so they can to keep grocery stores stocked.”

The Journal article noted that, “[The Trump administration has] pledged $16 billion in payments to farmers and ranchers and $3 billion in mass commodity purchases to be distributed through food banks.

“Cattle ranchers, dairy and hog farmers are set to receive $9.6 billion in direct payments, while row crop farmers will receive $3.9 billion and specialty-crop producers will get $2.1 billion, according to Sen. John Hoeven (R, N.D.), chairman of the Senate Agriculture Appropriations Committee.

"What’s in @USDA’s New @Coronavirus Food Assistance Program?" -

— Farm Policy (@FarmPolicy) April 20, 2020

Of the $16 billion provided for direct payments to producers, it’s been reported that $9.6 billion is directed toward the #livestock industry; $3.9 billion is for producers of row #crops, https://t.co/pu1sz6nfp8 pic.twitter.com/RDcDaMuWi2

“Farm groups welcomed the relief program, but said it isn’t enough to offset plunging commodity prices and demand from restaurants. Hog farmers will receive $1.6 billion in direct payments, though the National Pork Producers Council estimates industrywide losses for the rest of the year will total $5 billion as farmers lose $37 per hog they market.”

More specifically with respect to hog production, Associated Press writer David Pitt reported on Tuesday that, “After enduring extended trade disputes and worker shortages, U.S. hog farmers were poised to finally hit it big this year with expectations of climbing prices amid soaring domestic and foreign demand.

“Instead, restaurant closures due to the coronavirus have contributed to an estimated $5 billion in losses for the industry, and almost overnight millions of hogs stacking up on farms now have little value. Some farmers have resorted to killing piglets because plunging sales mean there is no room to hold additional animals in increasingly cramped conditions.”

The AP article noted that, “The biggest problem could be getting worse as additional giant slaughterhouses that can process more than 20,000 hogs a day have had to close at least temporarily as the virus spreads among workers. The industry slaughters from 10 million to 12 million pigs a month.

“Whereas poultry producers can slow production by not hatching baby chicks and ranchers can keep cattle on pastures longer, pork farmers don’t have good options. Hogs are raised inside barns with limited space, and it takes time to stop the birthing cycle for pigs.”