A package of funding bills assembled by House and Senate appropriators that needs to pass before the end of January does not contain any more aid for farmers. It's also…

Gasoline Sales Provide Lift for Ethanol- Corn; While Higher Prices are Impacting Farmland Values

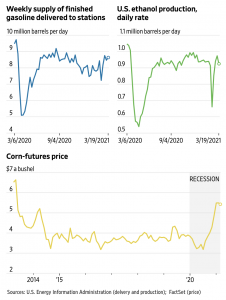

Reuters writer Stephanie Kelly reported this week that, “U.S. gasoline sales for 2021 have exceeded prior-year levels for the first time since last March, when officials first started to widely impose coronavirus lockdowns, according to a report on Tuesday from the Oil Price Information Service by IHS Markit.

“However, demand still trails pre-pandemic levels, and the year-on-year increase is a bigger reflection on last year’s demand destruction rather than strong economic recovery this year, the report said.”

The Reuters article stated that, “U.S. oil consumption crashed by 27% in April last year from the year prior, the Energy Information Administration said, as aircraft were grounded and people were forced to remain at home to curb the spread of the coronavirus.

“Gasoline same-store sales for the week ended March 20 were 10.1% higher than 2020, said the report, which surveyed 25,000 fuel stations nationwide. Sales were still 16% below pre-pandemic levels.”

And Wall Street Journal writer Kirk Maltais reported in Wednesday’s paper that,

Corn prices have hit their highest levels in almost eight years. Analysts say they are likely to get a further boost from motorists.

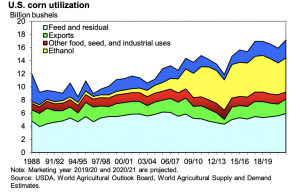

“Drivers returning to the road are expected to lift demand for ethanol. About 40% of the U.S. corn crop goes to producing the gasoline additive, and consumption has plunged amid the pandemic. Now ethanol producers envision a rebound powered by economic reopenings and a potential wave of bioenergy-friendly regulations from the Biden administration.

“Corn prices have already climbed about 50% over the past six months, lifted by increased demand from China. That country is buying more row crops in an attempt to bounce back from the African swine fever’s destruction of its hog herds and meet targets set in its recent trade agreement with the U.S. Chinese corn imports in the first two months of 2021 were more than five times higher than a year earlier, German bank Commerzbank AG said in a note last week.”

The Journal article stated that, “‘We expect gasoline and ethanol consumption to move steadily closer to pre-pandemic levels over the next few months as vaccinations expand and people are increasingly able to return to normal activities, barring any unforeseen developments,’ said Scott Richman, chief economist with the Renewable Fuels Association.”

Mr. Maltais added that, “Others expect a boost from potential Biden administration policies encouraging the use of renewable fuels. The Environmental Protection Agency indicated last month it would step back from Trump administration policies enabling some gasoline producers to sidestep regulations requiring them to blend ethanol into their fuel.”

More broadly, the increase in corn prices, along with a recent infusion of ad hoc federal farm payments, have contributed to an improving agricultural economy and farm credit conditions. This improved outlook is impacting farmland values.

Wall Street Journal writer Jesse Newman reported in Monday’s paper that,

In a resurgent American Farm Belt, the hottest commodity around is dirt.

“Across the Midwest, prices to buy and rent farmland are climbing as demand is driven by rallying grain markets, historic government payments and low interest rates, according to economists, agricultural lenders and land managers.

“The battle for farmland is playing out in small town community centers, online portals and parking lots, where bids in Covid-19-era auctions are placed with a wave from the window of a pickup truck or a quick flashing of headlights.”

Ms. Newman pointed out that, “Now, a sharp turnaround in the farm economy is breathing new life into the land market. Farmland values rose during 2020 as soaring grain prices last fall revived farmers’ fortunes, according to February reports from three regional Federal Reserve Banks. Land prices in the Chicago Fed region, which covers parts of Illinois, Indiana, Iowa, Michigan and Wisconsin, climbed 6% last year, the largest such increase since 2012, the bank said.

“Many agricultural lenders surveyed by the banks expected farmland values to rise this year as well. A March survey of Iowa farmland specialists showed a statewide average of farmland values was up nearly 8% since September, according to Iowa’s chapter of the Realtors Land Institute.”