President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

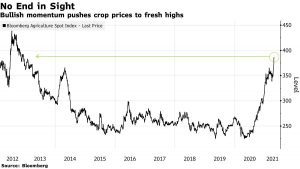

Wheat, Corn, Soybeans: Highest Since 2013

Bloomberg writers Kim Chipman and Megan Durisin reported this week that, “A crop rally in the U.S. is making essential food commodities dramatically more expensive, and the costs could soon spill over onto grocery store shelves.

“Wheat, corn and soybeans, the backbone of much of the world’s diet, are all surging to highs not seen since 2013 after gains last week had some analysts warning that a speculative bubble was forming.”

The Bloomberg article noted that, “Bad crop weather in key-producing countries is a major culprit. Dryness in the U.S., Canada and France is hurting wheat plants, as well as corn in Brazil. Rain in Argentina is derailing the soy harvest. Adding to that, there are fears of drought coming to the American Farm Belt this summer.

“Meanwhile, China is gobbling up the world’s grain supplies and is set to import the most corn ever as it expands its massive hog herd. Rumors are swirling that the Asian nation is working on 1 million metric tons of new corn purchases, according to Arlan Suderman, chief commodities economist at StoneX.”

“Wheat climbed to the priciest since February 2013 before closing 3.8% higher at $7.395 a bushel,” the Bloomberg article said; adding that, “Corn settled up by the 25-cent exchange limit at $6.575 a bushel, the highest since May 2013. Soybeans were the most expensive since June 2013 before closing up 1.5% to $15.3925.”

Weekly Livestock, Poultry & #Grain Market Highlights, https://t.co/wnR9OVBc0a @USDA_AMS

— Farm Policy (@FarmPolicy) April 26, 2021

* Central #Illinois Avg #Corn Price, $6.58 (Change From Past Year, ⬆️119.3%).

* Central Illinois Avg #Soybean Price, $15.52 (Change From Past Year, ⬆️89.1%). pic.twitter.com/9jZr4Mrwcu

Bloomberg writers Michael Hirtzer and Isis Almeida reported on Monday that, “The backdrop of tighter crop supplies is the opposite of the glut that capped trading margins in recent years. China’s expanding hog herd has the U.S. shipping record amounts of corn to the Asian country. More cars and trucks on roads has lifted demand of corn-based ethanol and biodiesel made from soybeans.”

Meanwhile, Reuters writers Naveen Thukral and Gavin Maguire reported this week that, “Asian feed manufacturers are switching to wheat in animal rations as multi-year high corn prices constrict demand for the yellow grain widely used to fatten hogs and chickens.

Some of the world’s top corn buyers such as China, South Korea and Vietnam are buying more wheat from Australia and the Black Sea region in the months ahead as the landed cost of corn has climbed to a rare premium to wheat, said two Singapore-based grains traders.

“Combined, those three countries are forecast to buy 26.4% of global corn imports this year, according to the U.S. Department of Agriculture, so any substitution for wheat could have a large impact on global grain trade flows.”

The Reuters article noted that, “A combination of strong global demand, adverse weather in the United States and expectations of lower output in Brazil have raised concerns over global corn supplies.”

Also this week, farmdoc’s Scott Irwin spoke with Bloomberg’s Caroline Hyde, Romaine Bostick and Joe Weisenthal on ‘What’d You Miss?’ about the reasons behind the rise in soft commodity prices.

Looking forward to having @ScottIrwinUI on WDYM today to talk about the incredible surge we're seeing in grains and beans https://t.co/q9V6VLxOMb pic.twitter.com/xU1D9UERRy

— Joe Weisenthal (@TheStalwart) April 26, 2021

A replay of that discussion is available here.

And Reuters columnist Karen Braun stated this week that, “Words like ‘unprecedented’ have sometimes been used within the last year to describe price action for Chicago-traded corn futures, but now that term almost underrepresents the situation given the scope of the rally over the last several weeks.

“Spring rallies hardly ever cause American farmers to significantly increase their corn acreage plans between March and June, but this year could be different given both how early it is and how much prices have surged.”

Ms. Braun added that, “An unprecedented gain in corn acres in the June survey would be fitting given recent market themes, though input costs have also risen along with prices. That could keep expectations in check since it is part of the reason that super high acres were not reported in the first place.”