President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Edible Oil Prices Surge, While Producers Contend with Production Input Variables

Saabira Chaudhuri reported in today’s Wall Street Journal that, “Russia’s invasion of Ukraine has sparked a global shortage of sunflower oil that has in turn pushed prices of other edible oils to record highs, hitting food makers and consumers already grappling with inflation.

“Ukraine is a major producer of sunflower oil, making up over 47% of the world’s exports, according to research firm Mintec. But shipments of sunflower oil—and seeds used by crushers elsewhere—have ground to a halt amid the war, disrupting supplies of a commodity widely used for cooking and as an ingredient in everyday products like margarine, mayonnaise and bread.

The shortage of Ukrainian sunflower oil has triggered a domino effect that underscores how interconnected global commodity markets are pushing up the price of other oils produced elsewhere, including those not ordinarily considered substitutes for sunflower oil.

Today’s article noted that, “Much of Ukraine’s sunflower oil exports—like its sizable grain shipments—are sent to developing countries, where higher food prices will have an outsize impact on poorer consumers.”

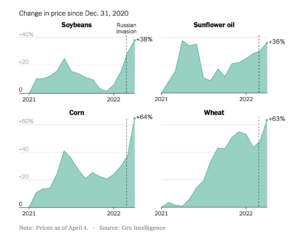

Sara Menker and As Ukraine’s farms have turned into battlefields, uncertainty around the country’s agricultural exports, as well as Russia’s, has created a global food emergency by driving up the prices of wheat, corn, soybeans, fertilizers and sunflower oil.

“The prices of commodities like wheat and corn are global, but their shocks are inequitable. Wealthier countries and people can absorb sharp price increases. Meanwhile, people in poorer countries, like Sudan and Afghanistan, are finding it far more expensive to eat. In Sudan, rising wheat prices have caused the price of bread to roughly double. Because Ukraine and Russia exported livestock feed and fertilizer before the war, the cost and difficulty of producing food will increase in the months and years ahead.”

Ukraine war has created a huge global supply gap in grain and sunflower seeds. High energy prices have jacked up food production & input costs, limiting other countries' capacity to boost production and fill the gap. It could further raise global food and feed prices up to 22%.

— Maximo Torero (@MaximoTorero) April 5, 2022

Wall Street Journal writer Michael M. Phillips reported earlier this week that, “A quarter of Africa’s population is facing a food-security crisis driven by severe drought, raging wars and a rise in world food prices caused by Russia’s invasion of Ukraine, the International Committee of the Red Cross warned Tuesday.”

Market signals are triggering responses to the evolving supply situation.

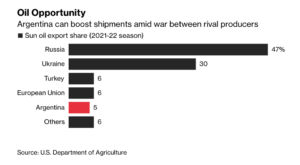

Bloomberg writers Maria Cervantes and James Attwood reported this week that, “Ever since Russia invaded Ukraine, farmers in one small town after another on Argentina’s Pampas plains have been recalibrating plans to account for rocketing prices of both crops and inputs like fertilizers. Six weeks later, a trend is emerging: the South American nation is poised for a sunflower boom.

“Russia and Ukraine normally account for nearly 80% of sun oil exports. With shipments plunging amid the upheaval of war, a door has swung open for Argentina, the biggest soy oil supplier, to rekindle its sunflower industry.

“Planting in 2022-2023 could spread as wide as 2 million hectares (4.9 million acres), Guillermo Pozzi Jauregui, head of the Argentine Sunflower Association, said in an interview. That’d be a fifth more than the previous season and the most for 14 years, according to Buenos Aires Grain Exchange data.”

And Reuters writers Michael Hogan and Gus Trompiz reported yesterday that, “Russia’s wheat exports are picking up pace after an initial slowdown following the country’s invasion of Ukraine, with lower prices than many of its rivals helping secure sales.”

“‘Russian wheat is looking cheap and some importers face huge increases in their costs if they turn to alternatives like the EU, the U.S., Canada, Argentina and Australia, all of whom are more expensive than Russian wheat,’ [one European trader said.]”

Availability and rising costs of production inputs continue to be an issue that producers are contending with.

Bloomberg’s Jonathan Gilbert reported yesterday that, “Argentina is grappling with shortages of diesel fuel that powers tractors and trucks just as the soybean and corn harvests pick up in the powerhouse crop exporter.

“Farmers ready for fieldwork and truckers who drive the crops to port are reporting rationing and soaring prices across the Pampas growing belt, with protests this week along key trucking routes. Argentina is the world’s biggest exporter of soy meal and soy oil and the third-biggest corn supplier.

“If the soy harvest gets delayed, plants would start to shed beans and lose yield, according to Esteban Copati, head of crop estimates at the Buenos Aires Grain Exchange. High diesel prices, he said, also risk squeezing profit margins that are closely watched by traders because they impact farmers’ planting and selling strategies.”

And Reuters writers P.j. Huffstutter, Tom Polansek and Bianca Flowers reported yesterday that, “Some livestock and dairy farmers, including those who previously paid to have their animals’ waste removed, have found a fertile side business selling it to grain growers. Equipment firms that make manure spreading equipment known as ‘honeywagons’ are also benefiting.

“Not only are more U.S. farmers hunting manure supplies for this spring planting season, some cattle feeders that sell waste are sold out through the end of the year, according to industry consultant Allen Kampschnieder.

“‘Manure is absolutely a hot commodity,’ said Kampschnieder, who works for Nebraska-based Nutrient Advisors. ‘We’ve got waiting lists.'”

The Reuters article noted that, “Prices for good-quality solid manure in Nebraska alone have reached $11 to $14 per ton, up from a typical price of $5 to $8 per ton, consultant Kampschnieder said.”