Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Fertilizer and Food Prices Climb, While Egypt Pays High Price for Wheat; Corn Extends Gains

DTN writer Russ Quinn reported yesterday that, “Retail fertilizer prices continue to march higher and higher, according to locations tracked by DTN for the first week of April 2022. All fertilizers were higher once again compared to last month.

“Leading the way higher was urea. The nitrogen fertilizer was 14% more expensive compared to last month and had an average price of $1,031/ton, which is an all-time high price in the DTN data set.

“DAP was 13% higher compared the prior month with an average price of $1,040/ton, an all-time high price. MAP was 11% more expensive looking back a month with an average price of $1,056/ton.”

Quinn noted that, “Potash was also up a considerable amount. DTN designates a significant move as anything 5% or more. Potash was 6% more expensive compared to last month and had an average price of $875/ton.

“The remaining four fertilizers were slightly higher compared to the previous month. 10-34-0 had an average price of $901/ton, anhydrous $1,534/ton (all-time high), UAN28 $629/ton (all-time high) and UAN32 $729/ton (all-time high).”

Earlier this week, Associated Press writers Geoffrey Kaviti, Chinedu Asadu and Paul Wiseman reported that, “Higher fertilizer prices are making the world’s food supply more expensive and less abundant, as farmers skimp on nutrients for their crops and get lower yields. While the ripples will be felt by grocery shoppers in wealthy countries, the squeeze on food supplies will land hardest on families in poorer countries. It could hardly come at a worse time: The U.N. Food and Agriculture Organization said last week that its world food-price index in March reached the highest level since it started in 1990.”

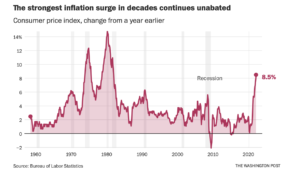

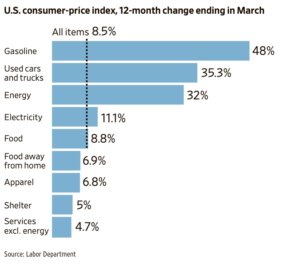

Meanwhile, Rachel Siegel reported on the front page of Wednesday’s Washington Post that, “The inflation surge in the United States picked up speed in March, as prices rose 8.5 percent compared with a year ago. It was the largest annual increase since December 1981, with energy prices spiking because of Russia’s war in Ukraine.”

“The inflation data, released Tuesday by the Bureau of Labor Statistics, showed prices rose 1.2 percent in March compared with February. Price increases for gas, shelter and food were the largest contributors to inflation, underscoring how inescapable these cost increases have become,” the Post article said.

Siegel explained that, “The food index rose 1 percent in March compared to February. It is up 8.8 percent compared to the prior 12 months, the largest increase since May 1981. Few categories have been left untouched. Breakfast cereal was up 2.4 percent from February to March. Rice prices rose 3.2 percent, ground beef grew 2.1 percent and eggs were up 1.9 percent. Milk was up 1.3 percent, potatoes 3.2 percent, and canned fruits and vegetables tacked on 3.8 percent.”

Wall Street Journal writer Gwynn Guilford reported on the front page of Wednesday’s paper that, “Food inflation is also raising consumers’ grocery bills.

Meat prices were up 14.8% in March from a year ago, with hot dogs and lunch meats rising at the fastest clip since 1979. Breakfast cereal prices climbed 9.2% in the past year, the sharpest increase since 1989. The Ukraine crisis is likely to add more pressure in coming months because of disruptions to global wheat and fertilizer production.

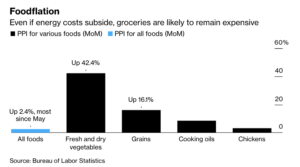

And Bloomberg writer Olivia Rockeman reported yesterday that, “The cost of foods for final demand rose in March by the most in 10 months, indicating mounting grocery store bills for Americans in the coming months even as gasoline prices cool.

“The producer price index report on Wednesday showed food costs climbed 2.4% from a month earlier, the largest increase since May. The jump was driven by bigger increases in prices for grains, vegetables, cooking oils and pork — suggesting the closely watched consumer price index will soon reflect such advances.”

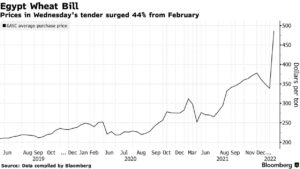

More broadly on food prices, Bloomberg writers Megan Durisin, Abdel Latif Wahba, and Salma El Wardany reported yesterday that, “Top wheat buyer Egypt’s latest purchase laid bare the eye-watering costs importers face as the Ukraine war upends the global grains trade.

“The country is boosting efforts to ensure it has enough to feed its citizens, many of whom rely on a bread-subsidy program. In a tender on Wednesday, it drew offers from six companies, about half the normal number, traders who asked not to be identified said. The state-run buyer ultimately scooped up 350,000 tons, including French wheat, a rare Bulgarian cargo and one from Russia.

“That came at a high price: The amount booked averaged almost $490 a ton after factoring in freight. That’s up a whopping 44% from the rate paid in mid-February, just before the war erupted, and the most in at least six years. The large volume purchased, even at high prices, highlights Egypt’s urgency to build reserves, said Matt Ammermann, a commodity risk manager at StoneX.”

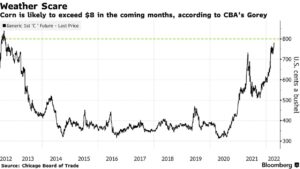

And today, Bloomberg writers Jasmine Ng and Megan Durisin reported that, “Corn extended gains toward $8 a bushel as the war in Ukraine threatens the country’s ability to ship and sow crops, while chilly weather slows early U.S. planting.

“Futures in Chicago are up for a third straight session, heading for the longest rally since Russia’s invasion began. The country is repositioning forces for renewed attacks in the east and south of Ukraine. The conflict has snarled grains trade out of the Black Sea region and could prevent Ukraine from shipping about half the corn it was expected to sell this season, before the war erupted.”