Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Fed Reports Show Declining Farmland Values, Tighter Credit Conditions

On Thursday, the Federal Reserve Banks of Chicago, St. Louis and Kansas City each released updates regarding farmland values and agricultural credit conditions from the fourth quarter of last year. The Fed reports, which contained concerning news for farmers, came on the heels of USDA’s forecast that U.S. farm incomes will drop 8.7% in 2017, and on the same day that The Wall Street Journal ran a front page story titled, “The Next Farm Bust is Coming.”

Federal Reserve Bank of Chicago Fourth Quarter Report

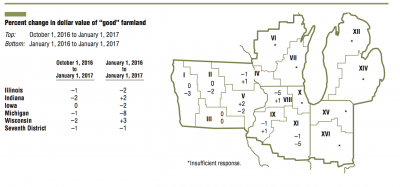

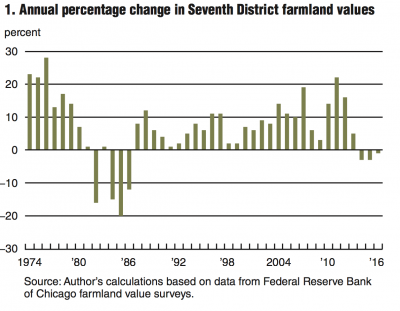

David Oppedahl, Senior Business Economist at the Chicago Fed, explained last week in The AgLetter that, “Agricultural land values in the Seventh Federal Reserve District suffered a third consecutive annual decrease, yet the 1 percent decrease for 2016 was smaller than the 3 percent declines for the previous two years. ‘Good’ farmland values in the fourth quarter of 2016 were down 1 percent from the third quarter, according to 192 survey respondents from District banks.”

“However, this stretch of decreases has been much more moderate than the previous such stretch during the 1980s,” the AgLetter said.

Mr. Oppedahl pointed out that, “Since their 2013 peaks, Illinois, Indiana, and Michigan farmland values have experienced real declines of 11 percent, 7 percent, and 12 percent, respectively. Additionally, since their 2012 peak, Iowa farmland values have experienced a real decline of 15 percent. In contrast, Wisconsin agricultural land values have risen 4 percent in real terms since 2013.”

More specifically on credit conditions, the AgLetter stated that, “Non-real-estate farm loan renewals and extensions in the fourth quarter of 2016 were higher than in the fourth quarter of 2015, as 39 percent of respondents reported increases in them while only 3 percent reported decreases.

Moreover, the volume of the farm loan portfolio deemed to have ‘major’ or ‘severe’ repayment problems grew to 5.9 percent in the fourth quarter of 2016, matching the share in 2002 and the highest such proportion in 15 years.

“[S]urvey respondents forecasted the downward trends for farmland values and agricultural credit conditions to continue into 2017,” the report added.

Recall that last month, in the Fed’s Beige Book, the Chicago District pointed out that, “Farmland rents were also somewhat lower, but had not fallen as much as land values.”

Federal Reserve Bank of St. Louis Fourth Quarter Report

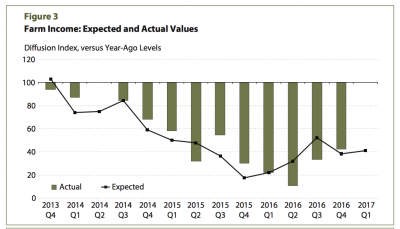

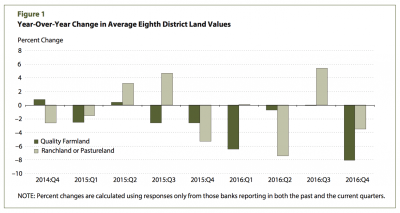

The Agricultural Finance Monitor from the St. Louis Fed noted on Thursday that, “According to the latest survey of agricultural bankers in the Eighth Federal Reserve District, fourth-quarter farm income declined from the previous year, continuing the downward trend reported in the past several surveys. Lower incomes continue to push down farmers’ household and capital spending.”

“Bankers also reported that agricultural land values and cash rents moved in tandem with farm income in the fourth quarter, with values and rents falling from the previous year for quality farmland and ranch or pastureland.”

Federal Reserve Bank of Kansas City Fourth Quarter Report

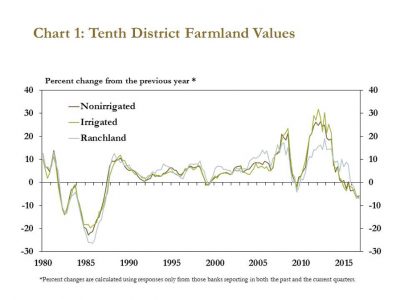

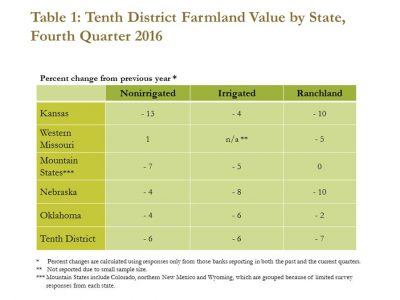

Cortney Cowley and Matt Clark, writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Farmland values continued to wane in the fourth quarter, according to the Tenth District Survey of Agricultural Credit Conditions. On average, nonirrigated and irrigated farmland values dropped 6 percent, and ranchland values fell 7 percent from the same period last year.

These downgrades were the largest since the Great Recession of 2007-09 but were relatively small compared to declines in the 1980s.

“The largest changes in District states occurred in Kansas and Nebraska. The value of nonirrigated farmland fell 13 percent in Kansas, and irrigated farmland in Nebraska was 8 percent lower. Decreases in ranchland values in Kansas, Nebraska and Missouri were the largest since 2002.”

Cowley and Clark stated that, “Amid the slump in farmland values, cash rents also edged down. Cash rents for nonirrigated and irrigated cropland each fell 8 percent while ranchland cash rents fell 12 percent from the fourth quarter of 2015…[A]ll District bankers surveyed in the fourth quarter expected cash rents to remain unchanged or decline in the first quarter of 2017.”

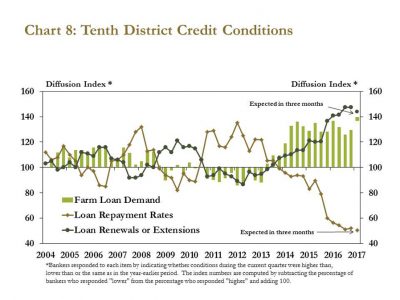

The Kansas City Fed added that, “Farm income also weakened in the fourth quarter. In fact, farm income fell for the fifteenth consecutive quarter, the longest such streak in survey history. Moreover, 70 percent of bankers expected the downward trend to continue in the first quarter of 2017.”

When addressing credit conditions, last week’s report indicated that, “Credit conditions also weakened alongside lower farm income. Bankers again reported the growing divergence of increasing loan demand and declining repayment rates. In the fourth quarter, half of respondents recorded lower repayment rates and elevated demand for renewals and extensions.”

Wall Street Journal Article

Meanwhile, Jesse Newman and Patrick McGroarty reported on the front page of Thursday’s Wall Street Journal that, “Across the heartland, a multiyear slump in prices for corn, wheat and other farm commodities brought on by a glut of grain world-wide is pushing many farmers further into debt. Some are shutting down, raising concerns that the next few years could bring the biggest wave of farm closures since the 1980s.”

Front Page today's @wsj: "The Next Farm Bust is Coming" https://t.co/a9wps5adfg @jessenewman13, @patmcgroarty pic.twitter.com/rrfnEK2TSG

— Farm Policy (@FarmPolicy) February 9, 2017

Pointing to the importance of off-farm income and the broader rural economy, the Journal article stated that, “‘No one just grain farms anymore,’ said Deb Stout, whose sons Mason and Spencer farm the family’s 2,000 acres in Sterling, Kan., 120 miles east of Ransom. Spencer also works as a mechanic, and Mason is a substitute mailman.

‘Having a side job seems like the only way to make it work,’ she said.

Neman and McGroarty explained that, “Corn prices once varied year-to-year by less than $1 a bushel. Since 2006 they have shot up and dropped more than $4 a bushel.”

On the more positive side, last week’s Journal article stated that, “Costs for farm supplies like fertilizer have fallen, and economists foresee increasing pressure on seed prices and land rental rates. The crunch could ease if bad weather curbs harvests, lifting demand for America’s excess grain. Fewer rural communities rely economically on agriculture today, which could help insulate them from the downturn.”

On Wednesday, the House Agriculture Committee is scheduled to hold a hearing titled, “Rural Economic Outlook: Setting the Stage for the Next Farm Bill,” and the meeting “will feature a panel of distinguished economists who will discuss the challenges faced by farmers and ranchers.”