Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

“Fertilizer Prices Are Falling,” Black Sea Export Deal in Focus, While Mississippi River Flow Draws Attention

Bloomberg writers Elizabeth Elkin and Tarso Veloso Ribeiro reported yesterday that, “Fertilizer prices are falling as farmers balking at the high costs of nutrients hold off on purchases, driving down demand and causing gluts that are upending the market for crop inputs.

“Fertilizer prices soared to record highs earlier in the year after sanctions against Belarus, a major producer, and Russia’s war in Ukraine fueled soaring prices for crop nutrients. That prompted global fertilizer firms to boost purchases and transport massive amounts of product to avoid supply chain issues and trade restrictions in export markets such as Russia.

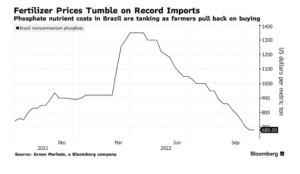

“Such moves have led to bloating fertilizer inventories in some key regions and farmers just aren’t buying — a situation that’s now weighing on the market. The turnabout is playing out in both the US, a major fertilizer-buying nation and the world’s top corn exporter, as well as agricultural powerhouse Brazil, the No. 1 soybean supplier.”

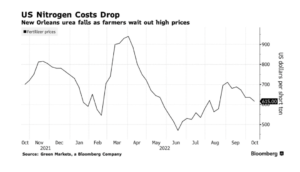

Elkin and Ribeiro pointed out that, “A weekly index for the common nitrogen fertilizer urea in New Orleans fell 3.2% Friday, extending a monthlong downward trend as US farmers wait to see how low prices might go. Brazilian farmers are also halting purchases, driving prices down as fertilizer piles up.”

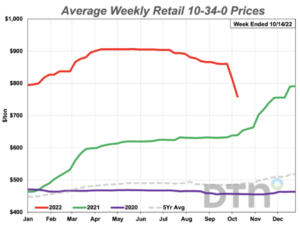

Also yesterday, DTN writer Todd Neeley reported that, “Five of eight fertilizer prices tracked by DTN are on the downward slide in the second week of October compared to one month ago, with the starter fertilizer 10-34-0 continuing a significant drop for the second straight week…The average price of 10-34-0 was $759 per ton for the second week of October, falling a whopping 12% from one month ago.”

Neeley explained that, “DAP’s average price was $925/ton, down about 3% from one month ago. MAP’s average price dropped to $986 a ton from $1,009 one month ago, or about 2%. The average price of potash dropped by about 2% to $863/ton. The average price of UAN28 fell fractionally from $578/ton to $576 in this update.”

“The average price of anhydrous spiked by about 4% to $1,417/ton since last month. Urea jumped in price by about 2% from $808/ton to $824. UAN 32′s average price saw a 1% bump from $665/ton to $670,” the DTN article said.

Meanwhile, New York Times writer Carly Olson reported earlier this week that, “Russia is threatening to refuse to extend the United Nations-brokered deal that resumed Ukrainian agricultural exports by sea if Moscow’s demands over its food and fertilizer exports are not met, a Russian official told a top U.N. official in a meeting on Monday.”

The Times article noted that, “Before the war, Ukraine supplied about 50 million tons of grain a year to the world market, according to the United Nations. Ukrainian officials have estimated that the blockade trapped about 22 million tons of grain in silos.

“Since the deal was struck nearly three months ago, Ukraine has exported about 8.6 million tons of grain and other agricultural products, according to the United Nations.

“Although exports have yet to reach their prewar levels, they have picked up in recent months. This is partly a capacity issue, with only three of Ukraine’s 17 ports in use.”

Bloomberg writer Aine Quinn reported yesterday that, “A logjam of vessels shipping Ukrainian crops eased as inspections sped up over the weekend, but the backlog remains high with just over a month of the grain-export deal left.

“Outbound ships need to be inspected in Istanbul under the deal, and at least 12 were checked each day from Friday through Sunday. That’s up from seven to nine a day earlier in the week. The number of inspection teams edged up to five on Friday, said Amir Abdulla, United Nations coordinator for the Black Sea Grain Initiative.”

“Shippers are rushing to export as much as possible through the Black Sea corridor before the current deal expires, with negotiations on extending it continuing.”

And Reuters writers Krisztina Fenyo and Krisztina Than reported yesterday that, “Europe’s largest land-based container terminal started operating near Hungary’s border with Ukraine on Tuesday, aiming to increase shipments of Ukrainian grains via Hungary to Adriatic ports.”

Also with respect to Ukraine, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s agriculture ministry revised up its forecast of the area to be sown for the 2023 winter wheat harvest to around 4 million hectares from the previous outlook of 3.8 million hectares, ministry data showed on Tuesday.

“The ministry said farmers had sown 2.5 million hectares of winter wheat as of Oct. 18, or 61% of the expected area.”

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Wheat for December delivery fell 1.3% to $8.49 1/2 a bushel on the Chicago Board of Trade on Tuesday, with grain traders continuing to price in the possibility that the Black Sea grain export corridor deal is renewed.”

“Weakness in wheat weighed on row crop futures, with the U.N. this week calling talks between it and Russia ‘constructive‘ and leaving open the possibility of a renewed Black Sea grain export corridor agreement.”

Maltais added that, “While dry weather causing low water levels is the main concern for grain traders regarding barge traffic, labor issues are also playing a role in slowing traffic [on the Mississippi River].”

Reuters writer Mark Weinraub reported yesterday that, “A U.S. Department of Agriculture (USDA) report on Monday showed the corn harvest was 45% complete by mid-October, slightly below market forecasts but ahead of the five-year average.

“The U.S. soybean harvest was 63% complete, above the five-year average of 52%.

“Traders are also assessing U.S. export prospects, which have been complicated by a strong dollar and low water levels on the Mississippi river, a major route for transporting grain to U.S. Gulf export terminals.”

Recent Twitter updates have also provided insight into the drought’s continuing impact on Mississippi River transportation flows:

Low water conditions continue on the lower #OhioRiver and lower #MississippiRiver with a few locations preliminarily breaking modern day low water records from Cairo, IL to Memphis, TN. pic.twitter.com/d2rqludy77

— NWS LMRFC (@NWSLMRFC) October 18, 2022

We put together a webpage summarizing the historically low river stages along the Lower Ohio and Mississippi Rivers. If you have pictures of low water levels (either on the ground or from drones) that you'd like to share, we'll add them to the webpage. https://t.co/itkcceUofo pic.twitter.com/j1RcSpBHte

— NWS Paducah, KY (@NWSPaducah) October 19, 2022

The #Mississippi River at record low levels in many areas. Here near #Tiptonville, TN people are walking and vehicles have been driving on dry river bed that would be totally under water in normal conditions. #MOwx #TNwx #ARwx #MSwx pic.twitter.com/u4UKW7jXf4

— Charles Peek (@CharlesPeekWX) October 19, 2022