In a sign of growing stress for U.S. farmers, the Agriculture Department forecast on Thursday that U.S. net farm income would fall 0.7% this year, despite near-record government payments that…

FAO Food Price Index Steady in October, While Fertilizer Prices in Focus

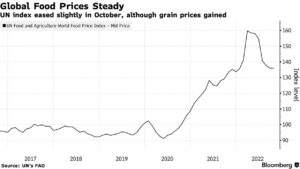

Bloomberg writer Megan Durisin reported today that, “Global food prices steadied in October, as supply disruptions wrought by the war in Ukraine were partly offset by slowing demand for staples.

“Good weather has bolstered supplies of crops like barley, and soaring inflation is curbing trade of goods from cheese to pork. That has helped buffer supply shocks from the Black Sea and brought a monthly food-cost index from the United Nations 0.1% lower in October, holding at its lowest since January.”

The Bloomberg article noted that, “Grains rose 3% during the month, the only commodity group in the index to gain. Russia resumed its part in the Ukraine crop-export pact this week, after a brief suspension that temporarily halted ships. The deal comes up for renewal in mid-November and officials have yet to verify an extension.”

Reuters News reported today that, “The United Nations food agency’s world price index edged slightly lower in October, the seventh consecutive monthly fall and some 14.9% down from its all-time high recorded in March.”

“The index has fallen from a record of 159.7 in March, but remained 2.0% higher than a year earlier.”

The Reuters article added that, “In separate cereal supply and demand estimates, FAO lowered its forecast for global cereal production in 2022 to 2.764 billion tonnes from a previous 2.768 billion tonnes.

“That is 1.8% below the estimated output for 2021.”

Also today, Dow Jones writer Yusuf Khan reported that, “Corn prices also rose 4.3%, according to the U.N. body, on lower production prospects in the U.S. and Europe as well as continued uncertainty on Ukrainian exports. Rice prices were also pushing higher, though low demand kept the increase to just 1%.”

As I have argued before, the price of rice is critical: https://t.co/oJJ8wF1eJH

— Javier Blas (@JavierBlas) November 3, 2022

Too much focus on wheat-corn and too little on rice. The 2007-08 food crisis was largely the result of a super-spike in rice prices. Today, rice prices remain well under control. That's good news pic.twitter.com/Tm2at2Sxfj

Meanwhile, Reuters writer Pavel Polityuk reported yesterday that, “Seven ships carrying agricultural products left Ukrainian Black Sea ports on Thursday, a day after the resumption of a grain deal aimed at delivering Ukrainian food to foreign markets, the infrastructure ministry said.”

And Reuters writer Michelle Nichols reported yesterday that, “Ukraine has exported 10 million tonnes of grain and other food since a U.N.-brokered deal in July restarted shipments stalled by Russia’s war, U.N. chief Antonio Guterres said on Thursday as he pushed Russia and Ukraine to extend the pact.

I am pleased to announce that, today, the Black Sea Grain Initiative has hit a new milestone.

— UN Spokesperson (@UN_Spokesperson) November 3, 2022

As of today, ten million metric tonnes of grain and other foodstuffs have been shipped through the Black Sea corridor - @antonioguterres pic.twitter.com/inFrBaQr8H

“‘I appeal to all parties to concentrate efforts in two areas. First, renewal and full implementation of the Black Sea Initiative. Second, removing the remaining obstacles to the exports of Russian food and fertilizer,’ he told reporters.”

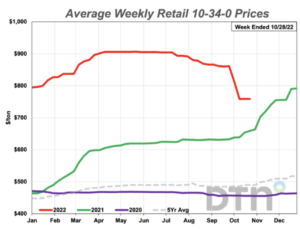

Elsewhere, DTN writer Russ Quinn reported earlier this week that, “Retail fertilizer prices continued their lower trend as five of the eight major products are cheaper compared to last month, according to locations tracked by DTN for the fourth week of October 2022.”

Also this week, Bloomberg writers Elizabeth Elkin and Jen Skerritt reported that, “Fertilizer prices are falling from the highest levels seen in years as farmers postpone purchases to await lower prices, creating gluts that are upending the market for crop inputs. It’s a reversal from earlier this year when prices surged after Russia’s invasion of Ukraine threw the world’s crop-nutrient sector into disarray.”

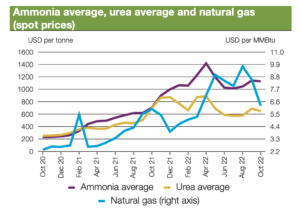

And the latest edition of the AMIS Market Monitor explained this week that, “Fertilizer prices generally declined in October following lower demand. However, prices remain high relative to historical levels, which along with lower expected farm income in view of declining grain prices is causing many farmers – particularly in Brazil and the United States – to hold off fertilizer purchases. Falling natural gas prices may further improve the fertilizer supply outlook in the near term.”

Wall Street Journal writers Yusuf Khan and Jenny Strasburg reported earlier this week that, “European fertilizer producers are restarting production across the continent, spurred on by the recent, sharp fall in natural-gas prices, though other energy-intensive industries are taking a wait-and-see approach to their own capacity cuts.

“Norway’s Yara International, one of the world’s largest fertilizer companies, said that it was now operating at 65% of its European ammonia capacity—having slashed output to just over a third of its total capacity for much of the second half of this year.”

Fertilizer maker CF Industries says the global nitrogen supply-demand balance will remain tight into 2025 and it will take at least two more seasons at trend yield to fully replenish global #grains stocks

— Tom Polansek (@tpolansek) November 2, 2022

Reuters writer Rod Nickel reported yesterday that, “Nutrien Ltd, the world’s biggest fertilizer producer, intends to follow through with plans to expand production capacity of potash and nitrogen, despite a sharp pullback in potash demand due to high prices, its chief executive said on Thursday.

“Nutrien is increasing Canadian potash production by 20% to an annual 18 million tonnes by 2025, helping to address tight global supplies related to sanctions against Russia and Belarus, the second- and third-largest producers after Canada.”

Also with respect to fertilizer, DTN Ag Policy Editor Chris Clayton reported this week that, “Asked Wednesday about the challenges of getting grain down the Mississippi River to export, Agriculture Secretary Tom Vilsack said he’s more concerned about moving fertilizer up the river to farmers than load limits on grain moving out of the river into export channels.

“‘The thing I’m most concerned about isn’t so much exports as it is the ability to get fertilizer to producers upriver,’ Vilsack said during an event at Greater Omaha Packing Co. ‘There is still barge traffic taking place on the Mississippi, but the barges may not be loaded as much as they would traditionally be.’

“On exports, ‘Any time there is a disruption, it is obviously a concern,’ he said.”