President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Black Sea Grain Initiative Deadline Looms, Ukrainian Farmers Still “Risk Deadly Harvest”

Michael Schwirtz and Stanislav Kozliuk reported in Sunday’s New York Times that, “Oleksandr Hordienko stepped gingerly into a wheat field that had recently served as a Russian tank position, following closely behind an assistant with a metal detector. He stopped when he came to a row of metal disks glinting in the late-winter sun.

They were tank mines, hundreds of them, laid out in a checkerboard pattern across his field and presenting a deadly conundrum before the spring planting season.

“Farmers who choose to climb into their tractors and work their land risk death or dismemberment by the mines, shells and other ordnance that litter the fields. Those who do not risk an economic crisis: The fighting has already cost the southern Kherson region three harvests, and there is no sign that farming will resume its role as an engine of Ukraine’s economy anytime soon.”

Schwirtz and Kozliuk explained that, “Producing watermelons, barley, sunflower oil and corn, Ukraine’s fertile lands have sustained generations, delivered huge amounts of food to the world and could now provide a desperately needed lifeline to the country. But although the Russian troops who once occupied many of the fields of southern Ukraine are long gone, they left a colossal array of explosives behind, some abandoned and others rigged as traps.”

Sunday’s article pointed out that, “Clearing the immense, rolling farm fields of the region poses a particular challenge. [Oleksandr Dvoretskyi, the head of demining in the region for Ukraine’s state emergency service] estimates that some 300,000 hectares will have to be demined before they will again be suitable for agriculture. (A hectare is 10,000 square meters, or about two and a half acres.).”

“A sea corridor, negotiated by the United Nations last year to allow already harvested Ukrainian grain to bypass a Russian blockade and for shipment abroad, has partly alleviated the global food crisis set off by the war. The deal is due to expire on March 18, but even if it is extended, Ukrainian farmers have to be able to plant and harvest grain again for the shipments to continue,” The Times article said.

#Ukraine Is Relying On Numerous Crop-Export Routes, https://t.co/2cxxgfvGVX pic.twitter.com/66zZDNXnc1

— FarmPolicy (@FarmPolicy) March 11, 2023

Reuters writer Ali Kucukgocmen reported this week that, “Turkish Defence Minister Hulusi Akar said on Sunday that he believes that a deal allowing Ukrainian grain to be exported via the Black Sea will be extended from its current March 18 deadline.”

#BlackSeaGrainInitiative vs Solidarity lanes.

— FarmPolicy (@FarmPolicy) March 9, 2023

Nicholay Gorbachev, President, Ukrainian Grain Association, @IFPRI, @AMISoutlook webinar, "Ukraine One Year Later: the impact of the war on agricultural markets & food security," (March 8) https://t.co/xLfS1H4DMl pic.twitter.com/lylQlzhBR7

Nonetheless, a separate Reuters article this week pointed out that, “Russia’s foreign ministry said on Sunday that Russian representatives had not yet taken part in negotiations on extending the Black Sea grain deal.”

But Reuters writers Gabrielle Tétrault-Farber and Emma Farge reported Monday that, “Negotiations began on Monday between U.N. officials and Russian Deputy Foreign Minister Sergei Vershinin on a possible extension to a deal allowing the safe export of grain from Ukraine’s Black Sea ports, the Russian diplomatic mission in Geneva said.”

The article added that, “United Nations trade official Rebeca Grynspan and aid chief Martin Griffiths arrived at the U.N. European headquarters in Geneva on Monday morning, without making a comment.

“Two sources involved with the talks said they were initially scheduled to last just one day but could be extended as needed.”

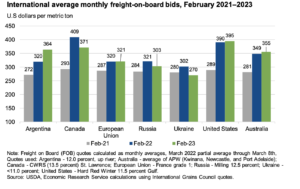

More broadly on the ramifications of the Grain Initiative, the USDA’s Economic Research Service (ERS) indicated in its monthly Wheat Outlook report last week that, “Following the start of the Russia-Ukraine war on February 24, 2022, global wheat prices spiked and then peaked in May 2022. A year later and prices have mostly recovered to pre-war levels.”

ERS stated that, “In 2021/22, the United States and Canada were coming off drought-stricken wheat crops in 2021/22 and prices for both wheat-exporting countries were elevated above other major competitors. More recently, Canada’s prices have returned to values lower than last February based on its bumper crop in 2022/23, enhancing the countries competitiveness in global export markets.

In contract, U.S. prices are slightly higher than a year ago as drought conditions continue to persist across the winter wheat belt, inhibiting competitiveness.

“Three consecutive record wheat crops have supported Australia’s strong and growing position in global wheat export markets [more on this in the USDA Radio segment below].

“A severe drought in Argentina has kept local wheat prices above most of the other major exporters at $364 per metric ton, up 44 per metric ton from 2022. Russia’s prices are slightly lower than a year ago due to a record crop. While Ukraine is able to export through the Black Sea Grain Initiative, large stocks and logistical challenges have continued to put downward pressure on prices resulting in its freight-on-board bids being $10 per metric ton lower than February 2021.”