Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Global Food Prices Climb, as “U.S. Corn Export Sales Hit Record Low”

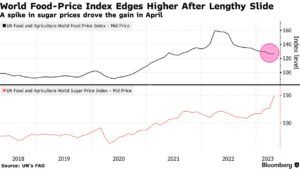

Bloomberg writers Megan Durisin and Mumbi Gitau reported today that, “Global food prices rose for the first time in a year, just as the rampant run-up in grocery costs begins to cool in some countries.

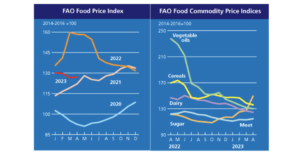

“A United Nations index of food-commodity prices gained 0.6% in April, with pricier sugar offsetting losses for grains and dairy products. The sweetener has rallied as bad weather and lower fertilizer use hurts crops and limits field work in parts of Asia and South America. A looming El Nino also threatens to further tighten supply.

“The UN’s gauge is down about 20% from a record set a year ago, when Russia’s invasion of Ukraine disrupted grain exports. But last month’s rebound could again stoke concerns over food inflation, which recently slowed in places from Kenya to Germany and Australia. Grocery prices still remain historically high in many regions, straining consumer budgets and worsening a hunger crisis.”

“Growing conditions for Northern Hemisphere crops and talks over extending a crucial Black Sea crop corridor will be key to where prices head,” the Bloomberg article said.

Reuters News reported today that, “In a separate report on cereals supply and demand, the FAO forecast world wheat production in 2023 of 785 million tonnes, slightly below 2022 levels but nonetheless the second largest outturn on record.”

And Dow Jones writer Yusuf Khan reported today that, “In April, the FAO’s cereal price index fell 1.7% from March to 136.1 points which is also 19.8% below its April 2022 value. High exports of Russian and Australian wheat pressured prices, the UN body said, while strong harvests in parts in South America pushed corn prices down 3.2%.”

Meanwhile, Bloomberg writers Tarso Veloso Ribeiro and Megan Durisin reported yesterday that, “Wheat futures in Chicago were on track for the biggest two-day advance in more than a month on concern Russia may interrupt Ukrainian grain exports in retaliation for a recent attack on the Kremlin.”

Ribeiro and Durisin explained that, “Wheat rose as much as 1.2% on Thursday after jumping 5% a day earlier. Still, traders also are contending with bearish supply prospects in key growing regions, including Brazil, where farmers are preparing to harvest what’s expected to be a record corn crop.”

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Grain traders are increasingly concerned that attacks in Russian-occupied territory will translate to the Black Sea Grain Initiative not being renewed this month, which has traders adding risk premium to the most-active futures contract.”

With respect to the Black Sea Grain Deal, Reuters writers Huseyin Hayatsever and Ezgi Erkoyun reported yesterday that, “Technical personnel from Turkey, Russia, Ukraine, and the United Nations will meet on Friday to discuss a deal that allows the exports of Ukrainian grains on the Black Sea, Turkish Defence Minister Hulusi Akar said.”

The article added that, “Ankara is working to extend the deal that will expire on May 18. Friday’s meeting would be technical and it would be followed up by a deputy ministers’ meeting next week, a Turkish defence ministry statement cited Akar as saying.”

Elsewhere, Reuters writer Mark Weinraub reported yesterday that,

U.S. export sales of corn fell to their lowest weekly total on record, government data showed on Thursday, as overseas buyers canceled purchases made earlier in the year.

“Concerns about export demand for U.S. corn have weighed on prices for months and the futures market sank to a nine-month low earlier this week, as a massive crop in Brazil was expected to provide a glut of cheaper supplies.

“The U.S. Agriculture Department forecasts Brazil will overtake the United States as the top global supplier of corn this year, and Chinese buyers have turned to that market as a reliable supplier of the grain.”

Weinraub pointed out that, “Combined corn export sales for both the 2022/23 and 2023/24 marketing years totaled -194,682 tonnes in the week ended April 27, according to U.S. Agriculture Department data released on Thursday morning. The weekly total was the lowest since at least 1999, the earliest that records are available for export sales.

“USDA said the total included cancellations of deals totaling 562,800 tonnes by China as well as 168,800 tonnes from unknown buyers.”

And Dow Jones writer Kirk Maltais reported yesterday that, “Export sales of U.S. corn were net negative for the week, with sales of new crop being outweighed by large cancellations of old crop, the U.S. Department of Agriculture reported Thursday.

“The USDA reported that for the week ended April 27, export sales of corn for the 2022/23 marketing year were a reduction of 315,600 metric tons. Fueling the decrease in previously announced sales was a reduction of 562,800 tons by China, with cancellations also announced for unknown destinations, Panama, South Korea, and Hong Kong.”