U.S. agribusiness Cargill will permanently close its beef processing facility in Milwaukee, Wisconsin, and eliminate 221 jobs, according to a filing with the state, the latest U.S. beef plant to…

FT: Low Corn Prices “Heap Pressure on Farmers”

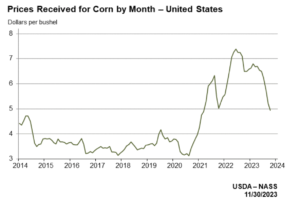

Financial Times writer Susannah Savage reported yesterday that, “The price of corn has tumbled to a three-year low as supplies from the US and Brazil surge while demand stagnates, helping to cool food price inflation but heaping pressure on farmers who had been expecting high prices to last.

Corn, which is used predominantly for animal feed and to produce ethanol, has been trading below $4.50 a bushel in Chicago in recent days, its lowest level since December 2020. It had been trading above $8 a bushel in May last year.

“The fall in prices, which has come after US farmers expanded their crop acreage last year in response to high prices, just as demand was dropping off, is proving a boon for hedge funds, who have been raising their bets on price falls.”

Savage explained that, “Russia’s invasion of Ukraine, one of the world’s largest grain exporters, sent prices of corn and other cereals soaring last year. Drought in parts of South America as a result of the La Niña weather phenomenon also hampered grain harvests, supporting the market.

“In response to rising prices, demand for corn fell last year for the first time in a decade — contracting nearly 3 per cent between 2022 and 2023.

“At the same time, farmers were trying to cash in on the high market price by planting more corn. Earlier this month a US government forecast on agricultural commodities output showed an extra 6mn acres had been planted in the Midwest’s corn belt — which includes states such as Missouri and Kentucky — while yields were higher than anticipated.”

In its monthly Agricultural Prices report yesterday, the USDA’s National Agricultural Statistics Service (NASS) indicated that, “The corn price, at $4.93 per bushel, is down 28 cents from last month and $1.56 from October 2022.”

An update yesterday from the NASS Iowa Field Office noted that, “The average price received by farmers for corn during October 2023 in Iowa was $4.96 per bushel according to the latest USDA, National Agricultural Statistics Service – Agricultural Prices report. This was 26 cents below the September price and $1.57 below October 2022.”

In Illinois, prices received for corn dropped from $6.39 in October 2022, to $4.80 in October 2023.

With respect to soybeans, the NASS Prices report stated that, “The soybean price, at $12.70 per bushel, is 50 cents lower than September and 80 cents lower than October a year earlier.”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “Export sales of U.S. corn for delivery found a marketing-year high through the week ended Nov. 23, the Department of Agriculture said.

“In its latest export sales report, the USDA said that export sales of U.S. corn for delivery in the 2023/24 marketing year totaled 1.93 million metric tons. That’s up 35% from the previous week, and the highest sales have been in the current marketing year.

“Analysts surveyed by The Wall Street Journal this week had forecast sales to land between 600,000 tons and 1.2 million tons. The better-than-expected sales were driven by strong sales to unknown destinations–which totaled 726,600 tons. Mexico, Japan, Taiwan, and China were also leading buyers.”

And Reuters writer Leah Douglas reported yesterday that, “Carbon capture and storage (CCS) at ethanol plants in the U.S. Midwest is necessary if the industry and its farmers hope to have a role in the burgeoning sustainable aviation fuel market, said Agriculture Secretary Tom Vilsack on Wednesday.

“Three CCS pipelines that would transport and store captured carbon from ethanol plants in an effort to slash that industry’s emissions have been proposed in the Midwest, though they have faced stiff resistance from landowners along the routes who fear their land will be damaged or taken through eminent domain.”

The article added that, “The ethanol industry is banking on CCS and carbon pipelines to slash their emissions, in part so the fuel can qualify as a feedstock for SAF, which the industry sees as a critical to ethanol’s growth. That effort that has been stalled by public resistance to the pipeline projects.

“To receive lucrative tax credits, SAF producers must demonstrate their fuel reduces emissions 50% over gasoline.

“Vilsack said in a conversation with Reuters reporters that using biofuels to make SAF would require the use of carbon capture and storage (CCS) technology.”