U.S. fuel ethanol production expanded by 9%, reaching a record high 1.196 million barrels per day the week ending Jan. 9. The week ending Jan. 9 marks the fourth time…

Lack of 45Z Guidance Could Cause Biofuel Production Shutdowns

Bloomberg’s Tarso Veloso and Kim Chipman reported Monday that “agriculture giants including Cargill Inc. and Bunge Global SA are slowing their buying of soybeans due to uncertainty over US biofuels policy.”

“The lack of guidance for a new clean-fuel tax credit is causing biofuels producers to put off some purchases of soyoil for early next year. That’s damping demand for soybeans, causing the giant crop traders to also rein in their buying, according to people familiar with the matter, who asked not to be identified discussing private information,” Veloso and Chipman reported. “…By mid-October, most fuel retailers had procured only about 10% of their biodiesel feedstocks for the coming first quarter, said David Fialkov, executive vice president of government affairs for NATSO, a trade group for truck stops and transportation energy centers. That compares with more than 80% by that time over the past decade.”

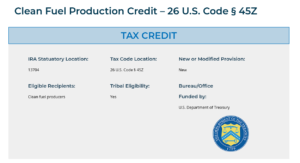

“The industry is waiting for the Treasury Department to issue guidance for the clean fuel production credit set to start in January. Thorny issues dividing the industry include whether the tax incentive, known as 45Z, will be available for low-carbon fuels made from foreign-sourced biofuel ingredients, like waste animal fat and used cooking oil that compete with soybeans and other US-grown crops,” Veloso and Chipman reported. “Another big uncertainty around the tax credit is the outcome of US presidential and congressional elections taking place next week. It’s not clear if the Biden administration will issue proposed guidance before a new US leader is sworn in. And a major question is whether the 45Z credit will be extended beyond its current expiration at the end of 2027.”

“Producers aren’t eager to book a lot of soybean oil until the guidance is released, said No Bull Inc. grain analyst Susan Stroud,” Veloso and Chipman reported. “With such uncertainty over when and how the new subsidy will take place, crushers have been diverting a larger share of soybean supplies to food export markets, said Kent Woods, chief executive officer of CrushTraders.”

Producers Considering Shutting Down Biofuels Operations

Successful Farming’s Cassidy Walter reported that “Brad Wilson said if the U.S. Department of the Treasury doesn’t issue regulations on the 45Z Clean Fuel Production Credit soon, the 45-million-gallon-a-year biodiesel plant he manages in northwest Iowa may have to idle.”

“‘We anticipate somewhere between 25% to 75% of the industry idling by the end of this year or into January if there is no guidance,’ said Kurt Kovarik, vice president of federal affairs for Clean Fuels,” Walter reported. “The organization estimates a 25% industry shutdown would correlate to 250 million pounds of unprocessed soybean oil.”

Why Shutdowns May Occur

Walter reported that “the biomass-based diesel industry has enjoyed a tax credit on and off for several years. Today biodiesel and renewable diesel in this category can claim a $1-per-gallon credit. The credit is factored into purchasing and sales decisions and can mean the difference between operating at a loss or profit. Starting in January this credit expires and the industry will qualify for the 45Z Clean Fuel Production Credit, created by the Inflation Reduction Act.”

“How much a biofuel plant will be eligible to claim under the 45Z credit is tied to the company’s ability to reduce carbon emissions. Until Treasury finalizes how carbon intensity (CI) scores can be measured, no company knows for sure how much they will be able to claim. Rumors abound on when Treasury will release guidance, including that it may be after 2025 has already begun,” Walter reported. “This makes it impossible for biodiesel and renewable diesel producers to know whether they are purchasing feedstocks like soybean oil at a profitable price. The same is true for booking fuel sales.”

“Kovarik said Clean Fuels is continuing to communicate to leaders in Washington about the urgency of the situation but is up against a fatigue at Treasury from fielding requests related to the Inflation Reduction Act,” Walter reported. “‘I’m not going to tell you that we’re making enormous headway, but the folks that need to hear our story and hear the narrative about what’s happening are listening,’ Kovarik said. ‘And we’re hopeful that the political pressure from both the leadership at the White House and perhaps from a handful of Members of Congress who represent rural areas will get Treasury to understand that something needs to be done in the interim.'”