Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

U.S. Ag Economy: Kansas City Fed Reports; and, Ag Export Competitiveness

The Federal Reserve Bank of Kansas City released two interesting reports this month that provide timely insights into the U.S. agricultural economy. The first report took a closer look at crop inventories and agricultural finance, while the second update included recent analysis on farm lending. Meanwhile, a front page article in Friday’s Wall Street Journal highlighted issues associated with America’s agricultural export competitiveness in the global market.

Kansas City Fed- Crop Inventories and Agricultural Finance

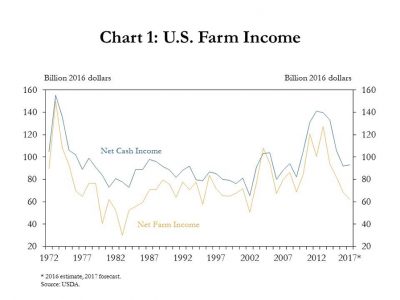

Cortney Cowley, an economist at the Federal Reserve Bank of Kansas City, indicated in a report from earlier this month (“Persistent Large Inventories, Low Prices“) that, “Income forecasts in 2017 have provided somewhat differing views of the agricultural outlook. The U.S. Department of Agriculture (USDA), for example, expected farm income to decline by about 8 percent from 2016, continuing declines from previous years. Cash income, however, was forecast to increase slightly. The two measures differ in that the calculation for farm income includes an adjustment for changes in farmers’ inventories, which is difficult to predict. Therefore, the slightly higher expectation for cash income has generated some optimism nationally because it breaks the trend of steep declines that has persisted since 2013.”

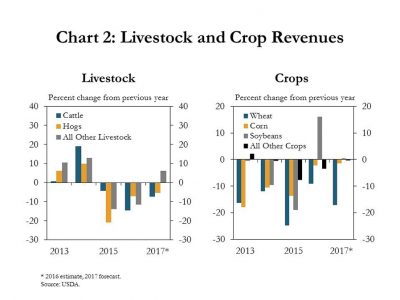

The Fed update stated that, “Although cash income was forecast to increase slightly, the outlook for some commodities was more pessimistic…In the crop sector, only soybean revenues were expected to remain relatively flat, following large gains in 2016.”

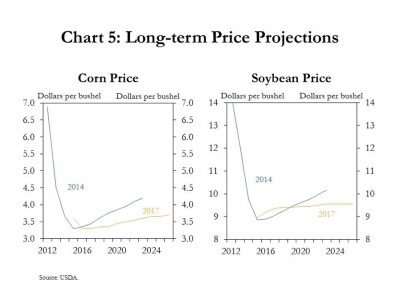

Dr. Cowley added that, “Expanded production has put downward pressure on longer-term price projections. Prices for both corn and soybeans have fallen significantly since 2012.”

The Fed update pointed out that, “Elevated inventories also were correlated with lower repayment rates at agricultural banks. Specifically, producers seemed to be selling commodities to make loan payments but otherwise storing commodities and hoping for better prices later.

Accordingly, a high, positive correlation has developed between corn stocks in the Tenth District and the percent of bankers who reported lower repayment rates.

“On a positive note, despite the correlation between elevated corn stocks and lower repayment rates, producers still have grain to sell. Additionally, the significant volume of stored commodities may explain why farm loan delinquencies have not risen substantially, even as loan repayment rates have fallen sharply.”

Dr. Cowley added that, “Another factor helping keep delinquency rates low is relative stability in farmland values despite expectations of further declines. Recent declines in farmland values have not been as sharp as expected, giving bankers more options for restructuring and/or extending loans. However, if the agricultural economy continues to slip, the persistent expectation of lower farmland values, which carried into the fourth quarter of 2016, becomes a larger concern.”

The report concluded by pointing out that,

If large supplies of agricultural products remain the recurring theme across all industries in 2017, prices likely will stay below more profitable levels, adding additional pressure to agricultural finance and credit conditions.

Kansas City Fed- Farm Lending Update

Barbara Soderlin reported in Saturday’s Omaha World-Herald that, “Farm lending declined for the sixth consecutive quarter, evidence of how farmers and their bankers are adjusting in the face of persistent weakness in the agriculture economy, the Kansas City Fed said in a Friday report.

“Farmers are cutting back on spending, facing another year of falling income projections. Meanwhile, bankers are extending loan payoff windows and raising rates, according to the report, from Omaha Branch executive Nathan Kauffman and assistant economist Matt Clark.

“The dollar volume of farm loans nationally fell 16 percent in the first quarter of 2017, to $82.5 billion, compared to the first quarter a year ago. Farmers use these loans to cover non-real estate expenses like seed, fertilizer, livestock and machinery. First-quarter lending is down a total of 28 percent from its high in 2015.”

Saturday’s article noted that, “The first-quarter drop followed a 40 percent year-over-year plunge in dollar volume of loans in the fourth quarter of 2016.”

With respect to farmland values, the Kansas City Fed update noted that, “A gradual, but steady softening in the farm economy has continued to push down the value of farmland throughout agricultural-production regions. Farmland values in most states in the Chicago, Kansas City and Minneapolis districts declined at a moderate pace from the previous year.

Most bankers generally indicated they expect farmland values to continue to moderate in the coming months, which could intensify financial stress in the farm sector, particularly in regions that have experienced significant declines in farm income and farmland values.

The report concluded by explaining that, “Farm lending at commercial banks has declined significantly for two consecutive quarters, indicating that some adjustments are being made in an environment of persistent weakness in the farm economy. In the 1980s, the accumulation of debt during the early years of the downturn in the farm economy contributed significantly to the crisis that developed later. Although the current downturn has persisted for several years and could still intensify, the adjustments being made could also place the farm sector in a more stable longer-term position.”

U.S. Agricultural Export Competitiveness- Wall Street Journal

Jesse Newman and Jacob Bunge reported on the front page of Friday’s Wall Street Journal that, “Brazil overtook the U.S. as the world’s biggest soybean exporter in 2012-13, according to the U.S. Department of Agriculture. It’s projected to be the second-largest corn exporter, on the heels of the U.S., this season. As of the last crop year, Russia now beats America in shipments of wheat.”

Front Page today's @WSJ "U.S. Farmers Fall Behind New Powers," by @jessenewman13, @jacobbunge #Brazil, #Russia https://t.co/RbqYgpdZG3 pic.twitter.com/Q0m6aVSGqT

— Farm Policy (@FarmPolicy) April 21, 2017

“It’s a reversal for a country that has long identified as the world’s bread basket. America’s share of global corn, soybean and wheat exports has shrunk by more than half since the mid-1970s, the USDA says. In soybeans, the most exported U.S. crop, U.S. supplies make up about 40% of world exports, down from more than 70% three decades ago.”

Graphic from today's FrtPg @wsj article, https://t.co/NEnIudZrIC 1985 vs. 2016 U.S. export share, #soybeans #corn #wheat pic.twitter.com/9UcP5WoUFb

— Farm Policy (@FarmPolicy) April 21, 2017

“Other countries’ rising share of global trade and their bin-busting harvests have helped fuel a multiyear downturn in crop prices that is pushing some U.S. farmers out of business.

Soybeans: Brazil vs. U.S. - production and harvested area--- graphic from today's FrtPg @wsj article, https://t.co/NEnIudZrIC pic.twitter.com/xLJKczqWpt

— Farm Policy (@FarmPolicy) April 21, 2017

The Journal writers reminded readers that, “Agriculture is among the few U.S. industries that exports more goods than it imports, helping to narrow the nation’s overall trade deficit, which last year hit its largest point since 2012, the Commerce Department says.”

Ag trade has grown significantly since 2000; Free trade agreements like #NAFTA have contributed to the growth in trade, @USDA_ERS pic.twitter.com/n5yLdB2pKQ

— Farm Policy (@FarmPolicy) April 21, 2017

Friday’s article added that, “Russia over the past decade boosted its wheat harvests by 61%, the USDA forecasts. Corn acreage has nearly tripled in Russia, and more than doubled in Ukraine. Brazil and Argentina have also ramped up output of the grain.”

Newman and Bunge also indicated that, “Income in the U.S. farm sector will decline for a fourth year this year, falling to $62.3 billion, half of the record $123 billion farmers earned in 2013, the USDA projects. The last time income fell four years in a row was in the mid-1970s.

“U.S. growers are adding soybean acres, wagering that robust demand from China and other importers will make soybeans more profitable than corn. The USDA projects a record 89.5 million U.S. acres will be planted with soybeans and that U.S. exports will expand modestly over the next decade.”