A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

China’s US Soy Purchases Approach 10 Million Tons

Reuters’ Naveen Thukral and Ella Cao reported that “China’s state stockpiler Sinograin bought 10 U.S. soybean cargoes this week, three traders told Reuters on Tuesday, as the world’s top buyer continues purchasing from the United States following a late October trade truce.”

“The cargoes, totalling around 600,000 metric tons, are for shipment between March and May, the traders said, which is the peak shipping season for rival supplier Brazil,” Thukral and Cao reported. “China’s total purchases from the latest U.S. crop were now estimated at 8.5 million to nearly 10 million tons, according to traders and analysts, representing up to 80% of the 12 million metric tons that U.S. Treasury Secretary Scott Bessent said China pledged to buy by the end of February.”

“‘There were more U.S. cargoes bought by Sinograin and total purchases are very close to 10 million tons,’ said one of the traders with direct knowledge of the deals. ‘We think China will buy a couple of million tons more to meet the target,'” Thukral and Cao reported. “On Tuesday morning, the U.S. Department of Agriculture reported private sales of 336,000 metric tons of soybeans to China for shipment in the 2025/26 season that ends on August 31, bringing China’s total confirmed purchases since October to nearly 6.9 million tons. In addition, a sizeable share of the roughly 3 million tons in sales confirmed by the USDA to undisclosed buyers is thought to be to China.”

US Soybeans Yet to Actually Arrive in China

Reuters’ Ella Cao and Lewis Jackson reported that “China imported no soybeans from the United States for a third straight month in November, as buyers turned to South American supplies amid fears of a shortfall if the trade war with Washington dragged on.”

“Following a trade truce in late October, China has stepped up purchases of U.S. cargoes, with traders saying that more than 7 million metric tons have been purchased since then,” Cao and Jackson reported. “In late November, Reuters reported, citing a shipping schedule, that two cargo vessels would carry the first U.S. soybean shipments to China since May. As these cargoes have not yet arrived, they do not appear on the customs website.”

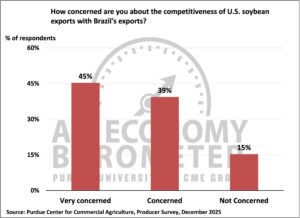

US Producers Concerned About Soybean Competitiveness with Brazil

Purdue University’s Michael Langemeier and James Mintert reported in the December Ag Economy Barometer that “farmers’ perspectives on U.S. agricultural exports were mixed in December. Responding to a generic question about the future of agricultural exports, producers provided one of their most optimistic outlooks of the year, with just 5% of producers looking for exports to decline over the next five years.”

“However, when asked to focus more specifically on soybeans, a key agricultural export, their outlook was notably less sanguine,” Langemeier and Mintert reported. “In December, 13% of corn and soybean growers said they expect soybean exports to decline over the upcoming five years, up from 8% of growers who felt that way in November. Similarly, the percentage of growers who expect soybean exports to increase in the next five years fell from 47% in November to 39% in December.”

“Increasing competition from Brazil is weighing on producers’ minds,” Langemeier and Mintert reported. “Eighty-four percent of corn and soybean producers said they were concerned or very concerned about the competitiveness of U.S. soybean exports versus Brazil’s, with 45% indicating they were very concerned.“