The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

NAFTA Negotiations Set to Begin: Background– Pork, Corn Issues Noted

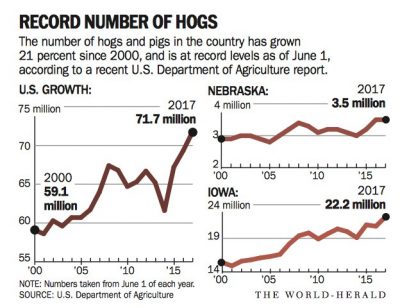

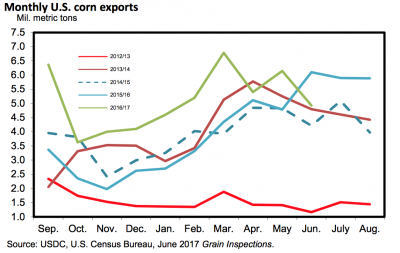

Today’s update looks at recent news items that focus on the first round of NAFTA trade negotiations that are scheduled to start this week. Along with some general background, the articles also highlight perspective from both Canada and Mexico, and explore agricultural concerns associated with the NAFTA discussions, particularly with respect to pork and corn.

Background

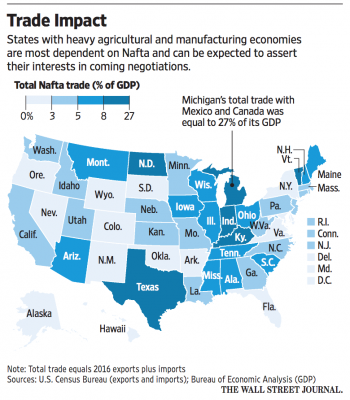

William Mauldin and Jacob M. Schlesinger reported earlier this week at The Wall Street Journal Online that, “The first round of negotiations over the North American Free Trade Agreement is scheduled to start Wednesday in Washington, D.C. President Donald Trump has called the pact, which took effect in 1994, a disaster for U.S. workers, a message that resonated in manufacturing states during his campaign. But businesses that have benefited from open trade with Canada and Mexico are urging the administration not to jeopardize the complex system of commerce among the three countries that has taken root under the agreement.”

With respect to timing, an issue that lawmakers emphasized at a House Ag Committee hearing on NAFTA late last month, Mauldin and Schlesinger explained that, “Trump aides say the president wants to move quickly, aiming to wrap up negotiations by early next year, to avoid having the talks getting caught up in the 2018 election campaigns in Mexico and the U.S. But that is an unusually rapid timetable, as major trade negotiations are usually measured in years, not months. Trade experts say the quick deadline might be feasible if the countries were only looking at minor tweaks, but Mr. Trump’s desire for a major overhaul makes it particularly challenging.”

While addressing farm interests, the Journal article indicated that:

The big U.S. agricultural industries—corn, beef, pork—are happy with the current version of Nafta and are focused mainly on preserving their duty-free, quota-free access to Mexico and Canada.

“But disagreements over agriculture can quickly turn bitter in trade talks. When Mr. Trump threatened to pull out of Nafta in April, some Mexican politicians warned that their nation could import more food from other Latin American nations instead of the U.S. Meanwhile, U.S. dairy farmers want Canada, which tightly controls dairy prices and imports, to open up its market.”

More from @SecretarySonny & @ILFBPres on this week’s NAFTA negotiations. pic.twitter.com/5kO61tu0fD

— Todd E. Gleason (@commodityweek) August 14, 2017

In a separate Wall Street Journal article posted on Sunday, Jacob M. Schlesinger, Robbie Whelan, Paul Vieira and Jacob Bunge explained that, “The question is whether U.S. negotiators can extract enough concessions from Mexico and Canada so that Mr. Trump can declare victory to his factory-worker base without upsetting his business backers, who have lobbied intensively to preserve the agreement.

“Few think that will be an easy needle to thread.”

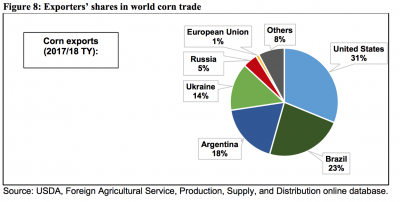

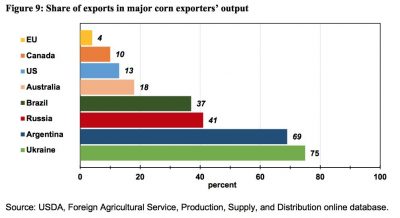

The Feed Outlook report also explained that, “The United States is also the largest corn exporter, even though it is projected to export only 13 percent of its produced corn. However, some major exporters produce much less corn than the United States but export a much larger share of their corn output because of low domestic use. Brazil, Argentina, and Ukraine are projected to account for 9, 4, and 3 percent of world corn output in 2017/18, while their world corn export shares are much higher at 22, 18, and 14 percent, making them the largest corn exporters after the United States. These three countries are projected to collectively account for more than half (55 percent) of world corn exports, supplanting the United States, which used to have more than a 50 percent share in world corn trade [see ERS graphs below].”

Floyd Gaibler, the Director, Trade Policy & Biotechnology at the U.S. Grains Council, noted the concern about market changes in a comment to Rep. Frank Lucas (R., Okla.) at the Ag Committee’s NAFTA hearing last month: “And all of us who are in the international export business know that once you lose market share, even with your best customers, it is very difficult to recover it.”