Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Wall Street Journal: China Prepares Tariffs Targeting Agricultural Exports

The Wall Street Journal reported on Wednesday that, “China is preparing to hit back at trade offensives from Washington with tariffs aimed at President Donald Trump’s support base, including levies targeting U.S. agricultural exports from Farm Belt states, according to people familiar with the matter.”

Background: White House Crack Down on China

Wall Street Journal writer Bob Davis reported on Tuesday that, “The White House is preparing to crack down on what it says are improper Chinese trade practices by making it significantly more difficult for Chinese firms to acquire advanced U.S. technology or invest in American companies, individuals involved in the planning said.

The administration plans to release on Thursday a package of proposed punitive measures aimed at China that include tariffs on imports worth at least $30 billion.

Mr. Davis pointed out, “But the tariffs won’t be imposed immediately. Rather, U.S. industry will be given an opportunity to comment on which products should be subject to the duties. As part of the package, the White House will announce possible investment restrictions by Chinese firms in the U.S. and will direct the Treasury Department to outline rules governing investment from China.

“Final details of the plan, including the amount of imports to be hit by tariffs, remain in flux, those involved with the discussions said. While the rough amount and rationale for the tariffs are expected to be disclosed on Thursday, the final decisions will come once U.S. industry has had its say, they said.”

The Journal article added that, “The effort stems from a monthslong investigation by the administration into Chinese intellectual property practices that found the damage to U.S. companies from forced technology transfer is $30 billion annually.”

On Wednesday, Bloomberg writers Andrew Mayeda and Jennifer Jacobs reported that, “President Donald Trump plans to announce trade sanctions on China as soon as Thursday over intellectual property violations, two people familiar with the matter said.

“The president is weighing tariffs of as much as $60 billion worth on Chinese goods though the package could still be altered, according to the people familiar with the matter.”

Potential Retaliation- Agriculture Highlighted

Also on Wednesday, Bloomberg writer David Tweed reported that, “A newspaper affiliated with China’s ruling Communist Party urged ‘strong restrictive measures’ against alleged U.S. soybean dumping, underscoring concern that trade disputes pressed by President Donald Trump could extend into other sectors.

“The Global Times published an editorial late Tuesday accusing the U.S. of decimating Chinese growers and breaching of World Trade Organization rules with soybean subsidies. China is the world’s biggest importer of soybeans — consuming about one-third of the U.S. crop — which it uses largely to feed 400 million or so pigs.”

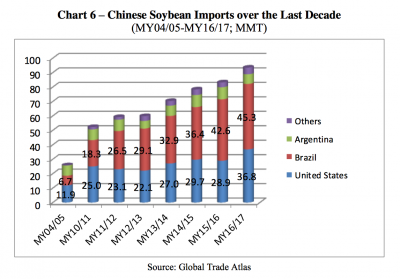

Meanwhile, a report this month from USDA’s Foreign Agricultural Service (FAS) stated that, “China is the largest oilseed importer in the world with total oilseed imports at 98.42 million tons (MMT) in MY16/17. Chinese total soybean imports hit another record at 93.5 MMT, absorbing 62.6 percent of total world exports, and 61.2 percent of total U.S. soybean exports.”

The FAS report noted that,

The United States soybean exports to China are expected to face fierce competition from South American countries in MY17/18 and beyond. Despite a change in China’s government policy in MY16/17 encouraging farmers to plant more soybeans, growth in China’s oilseed production remains constrained by limited arable land and stagnant yield.

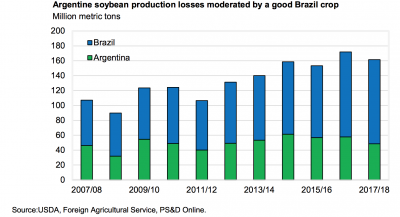

In addition, USDA’s Economic Research Service (ERS) pointed out this month that, “Production losses in Argentina are steering more of the world’s soybean demand to Brazil. The country is well situated for the challenge, though. Except for its very southern tip, Brazil has been untouched by drought. Based on a higher yield (now only 4 percent lower than last year’s record), Brazil’s 2017/18 soybean harvest is now expected at 113 million tons. That is a production gain of 1 million tons from last month’s forecast and nearly matches the record 2016/17 crop of 114.1 million. By early March, soybean harvesting in the country was about 35 percent complete.

“The broadening new-crop harvest is accelerating the pace of shipments from Brazil, which climbed to 2.86 million tons in February from 1.56 million in January. For all of 2017/18, soybean exports are forecast to expand by 1.5 million tons to 70.5 million, up from 63.1 million for 2016/17. The export gap with the second-ranked United States—at 56.2 million tons in 2017/18—will grow even wider.”

And Reuters writer Karl Plume reported earlier this week that, “U.S. agricultural exports could be at risk in any retaliation over tariffs implemented by the White House, U.S. Secretary of Agriculture Sonny Perdue said on Monday.

“Tension over trade has been simmering in agribusiness circles for months, after the White House slapped duties on imported washing machines and solar panels – and, more recently, President Donald Trump’s plan to impose sweeping tariffs on steel and aluminum.”

The Reuters article stated, “China has opened an antidumping investigation into U.S. sorghum, seen by some as a response to White House actions on washing machines and solar panels. Beijing also began enforcing stricter quality standards as of Jan. 1 on U.S. soybeans, the top agricultural export from the United States in terms of value.

Projected 2017/18 #sorghum exports are lowered 15 million bushels based on expectations of reduced shipments to #China; China has initiated a Countervailing Duty Investigation alleging U.S. sorghum is being sold at below cost to China https://t.co/KkLNHi63Fa @USDA_ERS pic.twitter.com/dlGWiD8bIb

— Farm Policy (@FarmPolicy) March 12, 2018

“Farm groups fear that China, which imports more than third of all U.S. soybeans, could slow their purchases of agricultural products, heaping more pain on the struggling U.S. farm sector.”

Wall Street Journal- Ag Exports From Farm Belt Targeted

Wall Street Journal writers Lingling Wei, Yoko Kubota and Liza Lin reported on Wednesday that,

China is preparing to hit back at trade offensives from Washington with tariffs aimed at President Donald Trump’s support base, including levies targeting U.S. agricultural exports from Farm Belt states, according to people familiar with the matter.

“The plans are part of a strategy that has taken shape in recent weeks as China seeks to avert tariffs by warning of possible repercussions and offering incentives to the U.S., including better access to China’s markets, especially in the financial sector.”

The Journal writers explained that, “The White House plans to announce punitive measures against China on Thursday, including tariffs on at least $30 billion in imports. Those are in addition to the steel and aluminum tariffs taking effect Friday.

“In response, China is likely to target U.S. exports of soybeans, sorghum and live hogs, according to the people with knowledge of the matter. The U.S. is among the top suppliers of these products to China, which imports around a third of soybeans that the U.S. produces, data from the two countries show.

“Any duties to be levied by China on those products would depend on how broad-based the U.S. tariffs are on Chinese imports, and plans could change based on what the Trump administration proposes, these people said.”

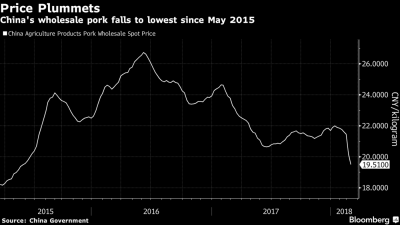

In addition, Bloomberg writer Megan Durisin reported earlier this week that, “A boost in China’s sow herd means pork from the U.S. is an ‘easy target’ amid escalating trade tensions between the nations.

“Pork prices in China have dropped after hogs tumbled as much as 30 percent in the past three months, analysts at Vertical Group, a New York-based investment bank, said in a report. For the Asian nation, ‘the timing would be opportune for a ban on pork exports in more ways than one,’ the report said.”

Jacob Bunge and Benjamin Parkin reporter on Wednesday evening that, “Shares in grain trading firms fell Wednesday amid growing concern the Trump administration’s tougher trade policies will provoke China to punish U.S. farmers.

“Shares of Bunge Ltd., the world’s largest soybean processor, declined 1.3%, while Archer Daniels Midland Co. fell 0.8% after The Wall Street Journal reported Chinese officials are considering tariffs on soybeans, sorghum and hogs imported from the U.S. ADM and Bunge are two of the world’s largest soybean shippers, and China is far and away the world’s biggest buyer.

China may not be able to slow purchases of U.S. soybeans for long, according to analysts at Vertical Group, a banking and research firm. The country is by far the world’s biggest soybean importer, and its need for soybeans to feed expanding livestock operations is likely too insatiable to be met exclusively by farmers in South America, a top U.S. rival.

The Journal writers explained that, “Shane Hanna, who farms 1,400 acres in Delphi, Ind., fears his profit margins could be squeezed further if export disruptions push soybean prices down more. ‘It will be insult to injury,’ he said.”

And Doug Palmer reported on Wednesday at Politico that, “President Donald Trump’s ‘America First’ trade policies took a bashing Wednesday from free-trade House Republicans, angry and fearful about the prospect of global retaliation and how the policies are playing back home.”

“‘I think we’re on pins and needles,’ Rep. Erik Philip Paulsen (R-Minn.) told U.S. Trade Representative Robert Lighthizer at a House Ways and Means Committee hearing on Trump’s trade agenda. ‘I hope we won’t be seeing tariffs imposed on products that a lot of American families and consumers and small business purchase every day.'”

The Politico article indicated that, “Rep. Jackie Walorski (R-Ind.) told Lighthizer she was concerned not only about the impact of the steel and aluminum tariffs, but also how China might retaliate against farmers and businesses in her district if Trump imposes tariffs to punish Beijing over its poor protection of U.S intellectual property rights.

“‘In my district in northern Indiana, with the second largest concentration of manufacturing jobs in the country, there’s a whole host of ag that I’m concerned about — corn, soybeans, dairy, pork, beef, poultry, tomatoes and the list goes on,’ Walorkski said. ‘Half the soybeans grown in Indiana are exported to China. Honeywell makes brakes and avionics in South Bend that go into Boeing airplanes. China is threatening retaliation against both.'”

“Rep. Kristi Noem (R-S.D.) told the story of a farmer in her district who asked if she knew what the Trump administration was thinking on trade ”because it seems like every time they take a position, soybeans drop 40 cents a bushel and we can’t hardly pay our bills today.'”