China has bought about 12 million metric tons of U.S. soybeans, fulfilling a U.S.-stated pledge to purchase that volume by the end of February, three traders told Reuters on Tuesday,…

U.S., China Trade Spat Persists

Keith Bradsher and Cao Li reported in Saturday’s New York Times that, “China threatened on Friday to tax an additional $60 billion a year worth of imports from the United States if the Trump administration imposes its own new levies on Chinese goods.

“The threat comes just two days after President Trump ordered his administration to consider increasing the rate of tariffs it has already proposed on $200 billion a year of Chinese goods — everything from chemicals to handbags — to 25 percent from 10 percent.”

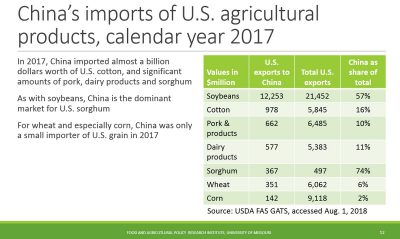

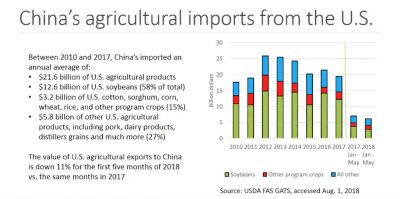

Although news reports indicate that the new Chinese duties “is leaving the farm largely unscathed,” ongoing concerns about the trade war persist, particularly as it relates to U.S. soybean exports.

Background

Financial Times writers Demetri Sevastopulo and Shawn Donnan reported late last week that, “Barely a week after Donald Trump agreed to a ceasefire in his trade war with Europe, the US president has dramatically upped the ante in his battle with China by proposing even higher tariffs on Chinese imports.

“The threat to raise duties on some $200bn of Chinese goods from 10 to 25 per cent took some by surprise since it came just after Mr Trump had eased concerns in the US about trade friction with Europe.

“But the escalation — which Beijing described as ‘blackmail’ — suggests that Mr Trump has decided to focus his firepower on China as he gears up for the critical midterm elections in November.”

.@larry_kudlow: "We are coming together with the European Union to make a deal with them... and I think most of our trade team will tell you we're moving close on Mexico. So this unifies NAFTA and US, Europe, Australia, Japan. China is increasingly isolated with a weak economy." pic.twitter.com/cF8bv52uXx

— FOX Business (@FoxBusiness) August 3, 2018

Reuters writer Christian Shepherd reminded readers Friday that, “[The U.S.] wants China to stop stealing U.S. corporate secrets, abandon plans to boost its high-tech industries at America’s expense and stop subsidizing Chinese companies with cheap loans that enable them to compete unfairly.

“China says the United States is trying to stop the rise of a competitor and it has imposed its own tariffs on U.S. goods. The rising tensions have weighed on stock and currency markets, with the Chinese yuan falling against the dollar.

The two countries have not had formal talks on their trade dispute since early June.

Also Friday, Wall Street Journal writers Lingling Wei and Bob Davis reported that, “China is planning to impose tariffs on a majority of its U.S. imports, a move designed to match the Trump administration’s tariff threats blow-for-blow that is bound to further intensify trade tensions between the world’s two largest economies.”

The Journal article noted that, “Among the additional $60 billion U.S. goods that could be subject to tariffs: some 662 kinds of products including small and medium-size airplanes and computers that could be hit with a 5% duty; nearly 1,000 products including coffee beans and textiles that could be slapped with a 10% duty; another more than 1,000 products such as chemicals and deodorant that could be levied at 20%; some 2,493 products such as meat, wine and liquefied natural gas that could be levied at 25%.”

.@larry_kudlow: "The Chinese had better not underestimate the determination of President Trump to follow through and seek zero tariffs and non-tariff barriers." pic.twitter.com/QZmAOYvU58

— FOX Business (@FoxBusiness) August 3, 2018

However, Megan Durisin reported at Bloomberg on Friday,

China has targeted U.S. agriculture in a big way as the nations exchange fire in an escalating trade war. But luckily for American farmers, they seem to have escaped the latest blow.

“Most major U.S. crops were already hit by previously announced Chinese duties, so the fresh duties announced Friday on about $60 billion worth of American goods is leaving the farm largely unscathed. Products that were included in the latest list like soybean oil aren’t heavily shipped to the Asian nation. Fines were also slapped on turkey and chicken breasts, but China has maintained a ban on American poultry imports since 2015,” the Bloomberg article said.

Also Friday, Bloomberg writers Andrew Mayeda, Reade Pickert, and Justin Sink reported that, “President Donald Trump will keep pressing China for trade concessions, a top White House economic adviser said, as the Asian nation continued the tariff escalation by announcing further retaliatory actions against U.S. goods.

Larry Kudlow says targeted tariffs are going to be part of the China negotiation strategy until China agrees to come to the table https://t.co/2m6Q99T1wR pic.twitter.com/p62Mga7b7V

— Bloomberg TV (@BloombergTV) August 3, 2018

“‘We’ve said many times: no tariffs, no tariff barriers, no subsidies. We want to see trade reforms. China is not delivering, OK?,’ National Economic Council Director Larry Kudlow said in a Bloomberg Television interview on Friday. ‘Their economy’s weak, their currency is weak, people are leaving the country. Don’t underestimate President Trump’s determination to follow through.'”

Soybeans

Financial Times writer Gregory Meyer reported last week that, “China’s high tariffs on US soybeans, if maintained, will weigh on the market for the rest of the year, according to the head of the world’s largest oilseed processor.

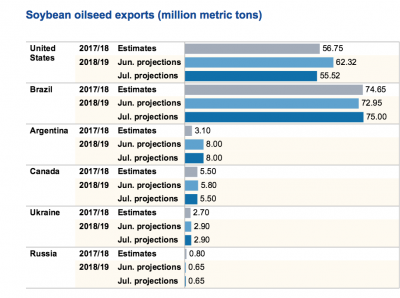

“Soren Schroder, chief executive of Bunge, said China had built up a glut of soybeans for use over the summer. But when the country’s crushing plants return to the market in August and September they will try to purchase supplies from Brazil, even though US farmers will be on the cusp of harvesting what is forecast to be a bumper crop.

‘They’ll do whatever else they have to do not to buy US soybeans,’ Mr Schroder said. ‘The export hole that the Chinese leave in the US will be bigger than anyone else can really replenish. The net impact is negative.’

The FT article pointed out that, “The US government last month reduced its outlook for US soybean exports by nearly 11 per cent.”

And Reuters writer Marcelo Teixeira reported late last week that, “Brazilian soybean growers have sped up sales for both the current season and the next crop, signs of strong demand and attractive prices, according to data from consultancy Safras & Mercado released on Friday.

“Safras said sales of soy from the 2017/18 campaign, which is nearing its end, have reached 84 percent of production compared with 74 percent at this time last year and 82 percent of a five-year average.

“The consultancy estimates Brazil produced 119.41 million tonnes of soybeans in 2017/18. Based on that, it projects that farmers have sold so far 99.93 million tonnes.”

The article added,

Chinese soy importers have been seeking cargos in Brazil at a time when normally that trade would shift to the United States due to the different periods of the crops.

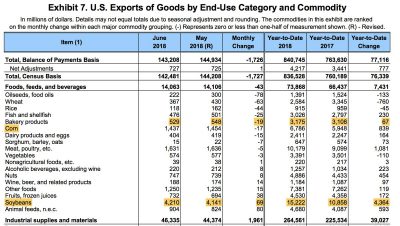

Meanwhile, a news release Friday from the Bureau of Economic Analysis included the following table, which showed that year-to-date U.S. exports of corn and soybeans are ahead of last year.