Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

FAPRI Update: U.S. Net Farm Income Projected to Decline

On Tuesday, the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri released its Baseline Update for U.S. Farm Income and the Farm Balance Sheet. Today’s update includes brief highlights from the baseline update.

FAPRI indicated that, “Large crops and trade disputes put downward pressure on U.S. farm commodity prices and farm income. Even considering the initial round of market facilitation program (MFP) payments, U.S. net farm income is projected to decline slightly in 2018 and again in 2019.”

For background, the baseline update explained that, “The farm income projections incorporate the initial round of MFP payments, announced on August 27, 2018, that provide compensation for losses incurred because of trade disputes. We assume $4.0 billion in MFP payments will be made in calendar year 2018 and another $0.7 billion in 2019. No additional MFP payments are assumed, even though it is possible that a second round will be announced later this year.

“Two important caveats: First, these estimates do not reflect any commodity market developments since August 2018, such as changes in the estimated size of the 2018 crop. Second, while MFP payments are included in these farm income estimates, they were not considered in the commodity market projections which were prepared before the payments were announced. In future baseline projections, we will consider possible com- modity supply and price effects of MFP payments.”

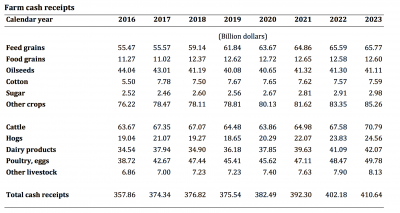

With this in mind, FAPRI indicated that, “Cash receipts are up slightly in 2018, as higher receipts for feed grains and poultry products more than offset lower receipts for oilseeds, hogs and dairy products.”

“Higher costs for fuel, feed and labor contribute to a $10 billion increase in projected farm production expenses in 2018.”

With respect to government payments, the baseline update stated,

The MFP payments help push 2018 direct government payments to the highest levels since 2006. With no additional MFP payments assumed, total payments decline sharply in 2019.

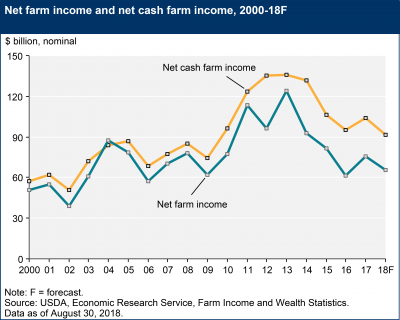

After analyzing these variables, the FAPRI update noted that, “Net farm income declines by $3 billion in 2018, as the effect of higher production costs more than offsets the increases in cash receipts and payments.”

Furthermore, the update pointed out that, “In 2019, net farm income declines by another $3 billion, in part because of lower livestock prices and government payments. Net farm income increases in nominal terms in subsequent years, but after correcting for inflation, real net farm income is about the same in 2023 as in 2017.”

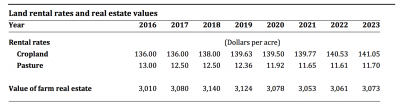

In addition, the FAPRI update explained that, “Farm real estate values are projected to decline slightly between 2018 and 2021 because of relatively flat returns and rising interest rates. This contributes to a similar modest decline in farm asset values.”

Recall that the USDA’s Economic Research Service (ERS) released its latest U.S. farm income projections back in August.

The ERS forecast, which did not include payments under the Market Facilitation Program (MFP), stated that, “Net farm income, a broad measure of profits, is forecast to decrease $9.8 billion (13.0 percent) from 2017 to $65.7 billion in 2018, after increasing $13.9 billion (22.5 percent) in 2017. Net cash farm income is forecast to decrease $12.4 billion (12.0 percent) to $91.5 billion.”

In a recent column, Pat Westhoff, FAPRI’s Director, noted, “Looking ahead, it appears that trade disputes and agreements, a new farm bill, monetary policy, biofuel mandates, environmental regulations and other government policies will continue to be critical to the bottom line for farmers and the rest of U.S. agriculture.”