Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Senate Ag Committee Examines the Farm Economy

Yesterday, the Senate Ag Committee held a hearing titled, “Examining the Farm Economy: Perspectives on Rural America,” where lawmakers heard testimony from four witnesses, including the Chief Economist from USDA, and a Federal Reserve Bank district economist. Today’s update provides an overview of yesterday’s meeting with particular emphasis on crop prices, land values, and trade. Recall that the House Ag Committee held a similar hearing on the farm economy back in February.

Background

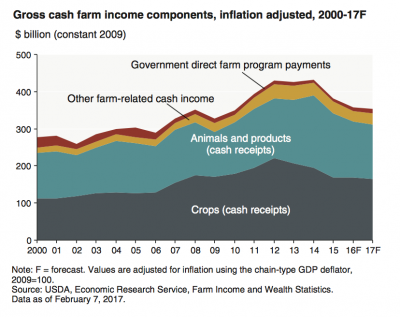

In his opening statement, Committee Chairman Pat Roberts (R., Kans.) indicated that, “Low commodity prices are continuing to weigh on farm sector profits for both row-crop and livestock producers. Crop receipts are expected to decline by over $42 billion and livestock receipts over $23 billion.

“On the credit front, reduced farm income over the past four years has continued to weaken credit conditions in the agricultural sector.

“Demand for farm loans, as well as renewals and extensions, has increased due to ongoing cash flow shortages. And, prolonged tight profit margins are creating additional declines in repayment rates for farm loans.”

WATCH: Chairman @SenPatRoberts' opening statement at today's Senate Ag farm economy hearing: https://t.co/zyen8umelg

— Sen. Ag Republicans (@SenateAgGOP) May 25, 2017

Chairman Roberts added that:

We need to ensure that producers have risk management tools at their disposal – let me emphasize that crop insurance is the most valuable tool in the risk management toolbox.

Committee Ranking Member Debbie Stabenow (D., Mich.), in her opening remarks, noted that the Committee has held two Farm Bill field hearings in Kansas and Michigan, and pointed out that, “We know that farm prices for many crops are down nearly 50 percent from their highs just a few years ago. Challenging market conditions have pinched margins and many producers are struggling to make ends meet.”

Sen. Stabenow also referenced the administration’s agricultural budget proposal, which Secretary of Agriculture Sonny Perdue discussed earlier this week, and stated that, “This proposal cuts $231 billion from Farm Bill programs which would make a 5-year farm bill virtually impossible to pass.

“It cuts crop insurance by $29 billion, which would take away a crucial part of the farm safety net at a time when it’s needed most. The budget also calls for sharp cuts to the family safety net, gutting SNAP by nearly 30%.”

Robert Johansson, USDA’s Chief Economist, indicated in his prepared remarks yesterday that, “Given favorable global harvests and ample stocks, we expect crop prices to remain mostly flat to lower into 2017/18.”

And with respect to agricultural exports, Dr. Johansson explained that, “The United States is projected to remain competitive in global agricultural markets and to grow export values over the next 10 years. U.S. agricultural exports were most recently forecast at $136 billion for FY2017. That is up nearly 5 percent from last year, pushed up by larger volumes even as unit value declines for some bulk commodities. The top three customers of U.S. agricultural products remain China, Canada, and Mexico, which account for 46 percent of U.S. agricultural exports.”

In addition, Kansas City Federal Reserve Economist Nathan S. Kauffman pointed out yesterday that, “Farm real estate values have also declined the past few years, but only at a modest pace, and regional disparity has also been notable.

Federal Reserve surveys show that the average value of high quality cropland has fallen by about 10 to 20 percent since 2013 in states with a high concentration of crop production.

“Since the beginning of 2015, however, farmland values have decreased more significantly in regions where the land is considered to be less productive or where the local farm economy has weakened more dramatically.”

Dr. Kafuffman added that, “The strength in land values has given agricultural lenders some opportunities to work with borrowers by restructuring loans and requesting additional collateral in response to heightened risk in their loan portfolios.”

See our statement for the record for @SenateAgGOP @SenateAgDems hearing on #AgEconomy & rural America https://t.co/9tHoa388lU

— AmericanBankersAssn (@ABABankers) May 25, 2017

And Oregon State University Professor Bruce Weber reminded the Committee that, “Farm household well-being is very dependent on rural community prosperity. Most farm households earn the majority of their income off the farm.” (Note: for more background on this issue, see this FarmPolicyNews update: “The Importance of the Non-Farm Rural Economy to Farm Household Income.”)

Discussion

During the Q and A portion of yesterday’s Ag Committee meeting, Chairman Roberts queried, “As we begin to work on our next farm bill, give me the top three factors, or two factors in the agriculture economy that we should be considering, given this trend that everybody is talking about, and the word ‘prolonged.'”

Dr. Johannson noted that, “As you mentioned, there are ways that we can see prices rebound. Whether we have some supply side shock in some major producing part of the globe or if we do start expanding trade quickly, those will also push prices up. But for right now, relative to 2014, stocks are really relatively high.

“So back then the farm bill pivoted towards countercyclical types of Title I programs. This time, as you consider farm bill programs, certainly the Title I programs would be one that I would look to in terms of the fact that countercyclical programs may have to be reexamined in the price when we have flat prices relative to volatile prices.”

Dr. Kauffman pointed out that, “So we’ve seen persistent cash flow shortages the last several years, demand for financing. As profit margins have remained weak, we’ve seen liquidity decline. That would be the first, is just monitoring the trend in liquidity.

“We haven’t seen it turn into an issue of solvency, partly because of farm real estate values. Farm land values have remained relatively strong in some—in most areas, although I would cite that as a second area where, if we did see more rapid declines, then we could start seeing more balance sheet problems for farm operations, as debt to asset ratios could rise further from there.”

Asked top USDA economist and a Federal Reserve leader if they could defend the admin’s 21 percent cut to USDA. Here’s what they said: pic.twitter.com/6lx5ARhXOv

— Sen. Heidi Heitkamp (@SenatorHeitkamp) May 25, 2017

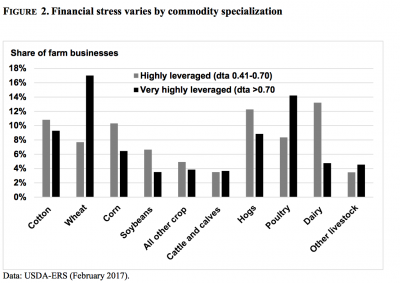

Meanwhile, Iowa GOP Senator Chuck Grassley stated that, “I’m particularly struck by Figure 2 of Dr. Johannson’s testimony that shows the share of farms by crop that are highly leveraged with debt-asset ratios between 41 and 70%, and the more concerning very highly leveraged farms with debt ratio above 70%. With that sort of ratios I would think more pressure would exist for input and land costs to correct for profitability to return.

“So two questions. Why do you think land values and cash rents are declining so much slower than farm income? And are there any specific factors that you can point to? Are outside investors keeping land prices high, as just one example?”

Dr. Johannson replied by noting that, “Obviously we see cash rents and land values being a little bit more sticky on the way down, just due to the nature that oftentimes those contracts, certainly on the cash rent side, are a little bit longer-term, so you have a three year term on your contract. We would expect to see, and we have seen that cash rents to start coming down a little bit more, and I think that’ll help the bottom line for a lot of producers that are renting land.

“So we have about 50% of our cropland that’s rented. As you mentioned, it’s not coming down as quickly. So I think there are some reasons for why that is in addition to the contracting length. There has been institutional investment in land. You often find good farmland still securing fairly high returns when it comes up.

“Oftentimes you don’t see land coming on the market as fluidly as you see other commodities coming on the market, so when something does come up, there are still producers out there that do have cash resources to go out—and of course interest rates are very low—to be able to purchase that land. Looking forward into the future it’s seen as a fairly good investment.”

Dr. Kauffman added that, “I think first is to recognize just the scale of wealth that has been generated during the really good times in agriculture. So you had a lot of farm operators that had the capacity to add additional land, and it has really moved that market forward. A lot of farmers also recognize that there are limited alternative investment options available to them, and so they have a propensity to want to buy land as part of their operation as they look at the long-term.”

And Senator John Thune (R., S.D.) focused a portion of his time on trade, and asked, “Would you agree that one of the quickest and most effective ways to counter low commodity prices for crops and livestock is to increase exports?”

Dr. Johannson agreed with that proposition and Sen. Thune inquired further indicating that, “And assuming, you know, right now we’re talking about potentially with Mexico and Canada having a renegotiation of NAFTA. But if you add Mexico, China and Canada, they’re the most significant trading partners, accounting for about 46% of U.S. agricultural exports. The question, I guess, is, is there room to grow that, do you think, if…you know, with these three countries? Or should the U.S. be looking for export opportunities in other countries? And if so, which countries?”

Dr. Johannson stated that:

I think that there’s still room for improving our access to NAFTA countries in terms of dairy, poultry and eggs.

“Also, obviously a robust—you mentioned biofuels—a robust E10 market in Mexico would be very beneficial to the ethanol sector.

“China is obviously our biggest trading partner, and there’s still plenty of opportunities to improve our sales to China in terms of grains, feed grains, for example. I know that Japan’s a very attractive market for our meat sector, so we’re going to be actively pursuing agreements with Japan.

“And then looking forward, we certainly know that in the medium-term India is going to be a major market for ag commodities going forward. They’re going to have a tripling of the number of households in the medium income class over the next ten years, so I would imagine that we’ll be putting some effort into trying to open up that market as well.”