The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

A Focus on Corn Belt Ag Exports; NAFTA Update

A FarmPolicyNews update last week pointed to recent USDA information pertaining to the aggregate value of U.S. agricultural exports, and how these trade flows have changed over the past two decades. A recent article from Iowa State University looked more narrowly at recent trade trends pertaining to four specific agricultural sectors: beef, pork, corn, and soybeans. Today’s summary looks at these issues in more detail, along with a brief update on the NAFTA renegotiations.

U.S. Beef, Pork, Corn, and Soybean Exports

The Fall edition of the Agricultural Policy Review from the Center for Agricultural and Rural Development (CARD) at Iowa State University (ISU), contained an article by Lee Schulz and Chad Hart (“The Ebbs and Flows of International Trade“) that explored recent trade data for four segments of the agricultural economy important to both Iowa and the Corn Belt: beef, pork, corn, and soybeans.

The CARD update noted that, “The 2017 marketing year is shaping up to be a mix for US agriculture on the export front. In general, there is export growth for most commodities, but a few are suffering a setback.”

More narrowly, the ISU paper indicated that, “The livestock/meat export picture is mainly of growth.

US beef export sales are nearly 10 percent higher than at this time last year.

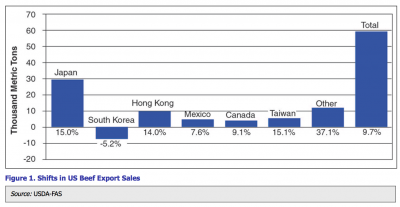

“Figure 1 details the export sales changes for the six largest export markets and the combined impact across all US beef export markets.

“Five of our six top markets are higher, with the Japanese market leading the export charge as they represent roughly half of the total growth this year. South Korea is the only major market that has taken a step back. Our partners in NAFTA have expanded beef purchases 7–9 percent. While there has been a lot of chatter about the opening of China to US beef, the export impacts will take some time to develop. Currently, the entire direct Chinese pull in the beef market is four times less than just the growth in the Canadian market. Growth outside the major markets has been robust, up 37 percent for the year. So the trade situation for US beef is very positive at the moment.”

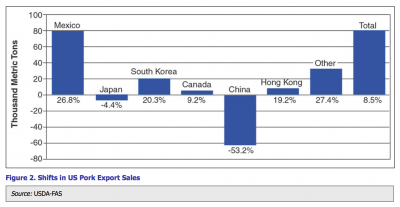

With respect to pork, Schulz and Hart explained that, “The pork sector is experiencing much larger swings in trade flows, but the overall pattern is similar to beef. Total export sales are up 8.5 percent, compared to last year. Most of the major markets are higher, with the majority of that strength coming from countries where the United States has trade agreements (Mexico, Canada, and South Korea). In fact, the growth in the Mexican pork market is basically the growth in US pork exports. The Japanese and Chinese markets have been the areas where US pork has retreated this year. China tends to be a very volatile market for US pork, with substantial gains in one year offset by losses the next, which looks to be the case this year, as Chinese imports are roughly half of what they were last year. Smaller pork markets are growing at a relatively strong rate, above 25 percent.”

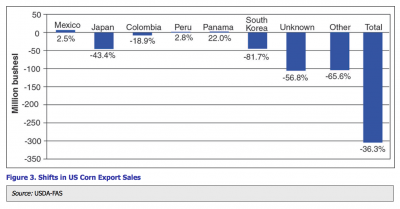

While addressing details related to corn exports, the CARD paper stated that, “USDA has consistently projected lower corn exports for the 2017/18 marketing year. Three of our top six markets have increased purchases, but the growth in bushels is relatively small. Mexico has purchased a bit more corn, but the shrinkage in other markets overwhelms that growth. Japan is down over 40 percent, South Korea is 80 percent lower, and smaller markets are down an average of 66 percent.”

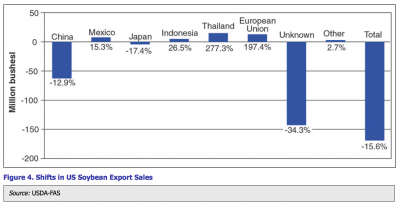

“Soybean export sales so far this marketing year are also off to a disappointing start. Direct sales to China, the largest import market by far, are 13 percent lower,” the paper said.

Schulz and Hart added that,

Furthermore, while trade renegotiations could upset those flows, for most the part, US agricultural trade has been only seen minor disruptions thus far. Farmers and ranchers hope that continues to be the case.

NAFTA Developments

New York Times writers Ana Swanson and Elisabeth Malkin reported last week that, “United States officials have tried in recent weeks to cool tensions over the North American Free Trade Agreement by extending the timetable for renegotiating the pact and asking top officials to sit out the current round of talks in Mexico City.

“But as the fifth round of talks concluded in the Mexican capital on Tuesday, tensions were still simmering, with Canada and Mexico telling the United States that it would make little headway with its current approach and Mexico firing its first warning shot with a tough counterproposal.

“Robert Lighthizer, the United States trade representative, took aim at his Canadian and Mexican counterparts on Tuesday, saying ‘thus far, we have seen no evidence that Canada or Mexico are willing to seriously engage on provisions that will lead to a rebalanced agreement. Absent rebalancing, we will not reach a satisfactory result.'”

The Times article noted that, “In an indication of how far the talks have to go, Mr. Lighthizer will not meet again with his Canadian and Mexican counterparts until late January in Montreal, while lower-level negotiators will continue to hash out details in Washington next month.”

Swanson and Malkin also stated that, “Still, Canada and Mexico are hedging against the potential collapse of Nafta by pushing for trade agreements with new partners, including China. And during the president’s recent trip to Asia, both countries indicated their willingness to move forward with an 11-country trade pact called the Trans-Pacific Partnership, from which Mr. Trump withdrew the United States this year.

“President Trump has often threatened to withdraw from Nafta if the United States does not secure a better deal. He has come to the brink of doing so on numerous occasions, only to have his advisers dissuade him.

“A move by Mr. Trump to withdraw from Nafta would set off a six-month process to terminate America’s membership in the pact. Mr. Trump has described this action as a potential negotiating tool for persuading Canada and Mexico to accede to American demands.”

"@USTradeRep 'Concerned' about Lack of Headway in Latest #NAFTA Negotiations," https://t.co/lk7leNIzut (MP3- 1 minute). @USDA Radio. pic.twitter.com/5IBscBtZgQ

— Farm Policy (@FarmPolicy) November 24, 2017

Reuters writer David Lawder reported last week that, “With NAFTA talks grinding toward stalemate, U.S. President Donald Trump may be tempted to carry out his threat to withdraw from the trade pact, but legal experts say such a decision could be defeated, or delayed significantly by court challenges.

The constitutional and statutory authority for who can terminate the 1994 North American Free Trade Agreement – Trump or the U.S. Congress – is deeply disputed, and it may take the U.S. Supreme Court or a truce between the White House and Capitol Hill to sort it out.

The Reuters article noted that, “Litigation would lay bare the fault lines between Trump’s populist vision and the pro-trade, business friendly lawmakers of his Republican Party, many of whom are increasingly nervous that NAFTA will collapse and cause economic damage.”

Meanwhile, James Q. Lynch reported last week at The Globe Gazette (Mason City, Iowa) Online that, “[Iowa GOP Senate Chuck Grassley] expects the Trump administration will continue its hard line approach to negotiations, ‘but they surely are not going to let this fall through,’ he said while in Cedar Rapids earlier this week.

“Grassley said he, Sen. Joni Ernst and Senate Agriculture Committee Chairman Pat Roberts of Kansas have been making the case for continuing NAFTA with Trump advisers for several months. He’s had three or four meetings with trade adviser Peter Navarro, two or three with Commerce Secretary Wilbur Ross and within the past two weeks U.S. Trade Representative Robert Lighthizer was in his office for 45 minutes.

“‘And that’s all we talked about,’ he said about the future of NAFTA.”

Also, a news release last week from Senate Ag Committee member John Boozman (R., Ark.) stated that, “[Sen. Boozman] led a bipartisan letter to Commerce Secretary Wilbur Ross asking the administration to conduct a robust economic analysis to evaluate how any changes to the North American Free Trade Agreement (NAFTA) would affect changes to the nation’s crop and livestock sectors.”

The news release added that, “As the world’s top exporter of food and agricultural products, U.S. agriculture depends on access to international markets in which to sell their products. With the fifth round of NAFTA renegotiations underway, the senators were clear that any changes to U.S. trade policy must be positive for agriculture, especially in a time when many farmers and ranchers are struggling financially.”