The tech industry’s relentless push for data centers is colliding with farmers who see the projects as a threat to their way of life. Despite being offered sums that often…

Rural America: Perspective from USDA Report, and Federal Reserve Ag Credit Survey

On Thursday, the U.S. Department of Agriculture released its annual Rural America at a Glance report, which summarizes the status of conditions and trends in rural areas. In addition, the Federal Reserve Bank of Minneapolis recently provided details of its third quarter Agricultural Credit Conditions Survey, which follows on the heels of recent third quarter agricultural reports from four other federal reserve districts. Together, the USDA report and Minneapolis Fed update, provide some interesting perspective on the state of non-metro America.

Rural America: USDA Report

The USDA’s Economic Research Service (ERS) released its annual Rural America at a Glance report on Thursday, which stated that, “Rural areas are more economically diverse than in the past, with employment reliant not only on agriculture and mining but also manufacturing, services, and trade.”

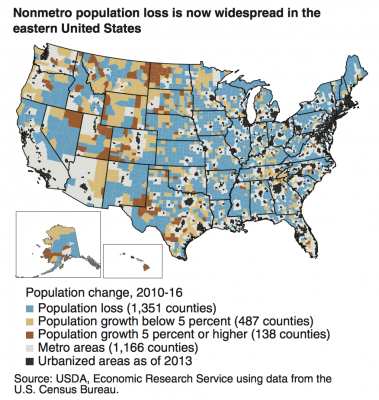

The number of people living in rural (nonmetro) counties declined by nearly 200,000 between 2010 and 2016, the first recorded period of rural population decline.

The report noted that, “Long-term population loss continued in counties dependent on agriculture, in the Great Plains, Midwest, and southern Coastal Plains. New areas of population loss emerged throughout the eastern United States, especially in manufacturing-dependent regions.”

The ERS update explained that, “Increased mortality among working-age adults is a more recent and unanticipated trend contributing to lower population growth. Between 1999-2001 and 2013-15, rural mortality increased more than 20 percent for 25- to 29-year-olds, from 135 to 165 deaths per 100,000 people. Mortality rates also increased for rural adults between the ages of 20-24 and 30-54. In urban areas, increased mortality during the period was limited to adults ages 20 to 29.”

More specifically, the report added that, “Rising rates of prescription medication abuse, especially of opioids, and the related rise in heroin-overdose deaths are contributing to this unprecedented rise in age-specific mortality rates after a century or more of steady declines.

This trend, if it continues, will not only lower rural population but will increase what is known as the dependency ratio: the number of people likely to be not working (children and retirees) relative to the number of people likely to be wage earners (working-age adults).

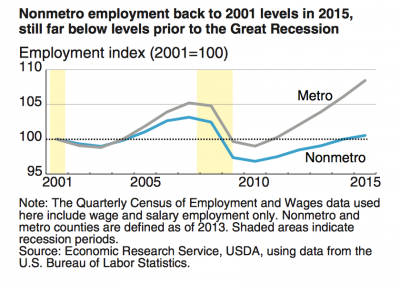

With respect to non-metro employment, ERS indicated that,”After 6 years of economic recovery, increases in rural employment remain limited. While the Great Recession’s impact was equally severe in urban and rural counties (both showed average wage/ salary employment declines of 2 percent per year during 2007-10), subsequent job recovery has been much slower in rural areas (0.8 percent annual employment growth compared with 1.9 percent in urban areas over 2010-15).”

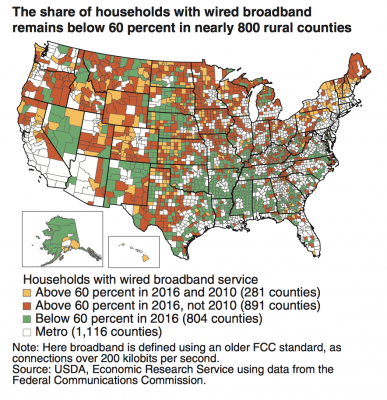

While addressing rural broadband issues, the ERS report stated that, “The urban-rural gap in broadband use has decreased slightly since 2007, but its persistence reflects fewer broadband options in rural areas despite significant investments. Also contributing to the continued rural-urban divide are the older average age of the population, higher poverty rates, and lower education levels in rural areas, all factors associated with diminished broadband use.”

Also this week, Paul Overberg and Janet Adamy reported at The Wall Street Journal Online that, “Eleven House Republicans dubbing themselves the Rural Relief group plan to introduce a package of five bills Tuesday to address worsening economic and social woes in small-town America.

“The bills include measures to bolster training for rural emergency medical service squads and rural students in technical education programs. Others would redirect some existing funding to help small towns manage the complex needs of the homeless and to help families whose children are substance abusers.”

I'm proud to announce the #RuralRelief Initiative - reforms to help Rural America get back on track! pic.twitter.com/2DuvT0nAV8

— Sean Duffy (@RepSeanDuffy) November 15, 2017

The Journal article noted that, “The lawmakers who plan to introduce the legislation cited a Wall Street Journal series detailing the socioeconomic decline of rural America as the impetus for the bills. The series, called ‘One Nation, Divisible,’ has detailed a generation-long decline that has left rural areas with rates of disease and dysfunction that rival or top those of large cities” [More details on the Journal series can be found at these links: “Rural America, “The New ‘Inner City,'” “Rural America “Stranded in the Dial Up Age,” “Rural America’s Child Birth Crisis,” “Brothers in Arms: The Tragedy in Small-Town America,” and “Struggling Americans Once Sought Greener Pastures- Now They are Stuck.”]

“[Rep. Sean Duffy, (R., Wis.)] said that the bill package represents the first stage of an effort by rural lawmakers to support each other’s diverse needs and help small towns. He said the group deliberately chose simple ideas and sought little new funding — $100 million spread across five years.”

Minneapolis Fed: Agricultural Credit Conditions

Following third quarter agricultural credit survey reports from the Federal Reserve Bank of Dallas, as well as the Chicago, St. Louis and Kansas City Federal Reserve Districts, the Minneapolis Fed also released its Agricultural Credit Conditions Survey earlier this month.

The survey, “Drought, prices tough on district farmers,” stated that, “The biggest story of the year for Ninth District agriculture was undoubtedly drought, which caused major crop damage in grain-producing regions of the Dakotas and Montana and forced ranchers to sell off cattle due to lack of feed. But in many areas, harvests have been excellent or at least better than expected.

And for yet another year, farmers around the Ninth District were hoping that crop yields would be sufficiently strong to offset low crop prices.

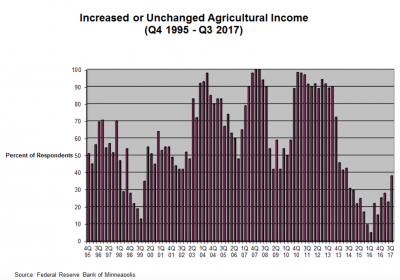

“Farm incomes continued to fall, according to the Minneapolis Fed’s third-quarter (October) agricultural credit conditions survey. Land values retreated further across district states, and interest rates on loans were little changed from the previous quarter. The outlook for the fourth quarter is similar, with lenders in the district expecting farm incomes to decrease further.”

More specifically, the survey stated that, “The majority of district lenders surveyed (62 percent) reported that farm incomes decreased in the third quarter of 2017 from a year earlier, while just over a third said that incomes were unchanged (see chart below). While 11 percent of North Dakota lenders reported increased income, the highest proportion in any district state, half said incomes decreased. Spending on buildings and equipment fell more sharply, as 74 percent of lenders reported decreased capital expenditure, and only 3 percent said it increased. Household spending was down as well, with half of lenders reporting that it fell, and 5 percent saying it increased.”

With respect to loan activity, the Fed update noted that, “The rate of repayment on agricultural loans fell, as expected during leaner times for farm households, while renewals increased slightly…[and]…Falling incomes also drove increases in demand for loans by farm households in the third quarter.”

While addressing farm land values, the Fed survey indicated that, “Land values and cash rents continued to decline from historic highs of recent years, with exceptions in some areas.

The average value for nonirrigated cropland in the district fell by a little more than 1 percent from a year earlier, according to survey respondents.

“The district average cash rent for nonirrigated land actually increased slightly from a year ago, about 1.5 percent.”