A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

U.S., China Trade Issues: Sorghum, Soybeans

In addition to the concern expressed last week by Senate Agriculture Committee members to Agriculture Secretary Sonny Perdue regarding executive branch trade actions, recent news items continue to highlight the implications of ongoing trade disputes between the U.S. and China, particularly as it relates to sorghum and soybeans.

Sorghum

On Thursday, Financial Times writer Emiko Terazono reported that, “US-China trade tensions are expected to hit US sorghum farmers after Beijing slapped a high tariff on imports of the commodity from America.

“The International Grains Council revised down China’s sorghum import projections for the 2018-19 crop year by 13 percent from earlier estimates to 4.8m tonnes while cutting the US export figure by 15 percent to 5.2m tonnes.

“Earlier this month, Beijing imposed a 178 per cent import duty on US sorghum crops as an anti-dumping measure. ‘The trade numbers have been cut as shipments heading for China have been diverted elsewhere,’ said Amy Reynolds, analyst at IGC.”

World 2017/18 #sorghum trade forecast trimmed on slowing Chinese buying amid trade tensions with the US. Market reports suggest some cargoes were redirected to other destinations following China’s imposition of temporary tariff on US imports. pic.twitter.com/5bsGApxxqg

— International Grains Council (@IGCgrains) April 26, 2018

Last week, Reuters news reported that, “Three cargoes of sorghum from the United States bound for China have switched destinations to Saudi Arabia after being sold to a private buyer, a Middle East-based trading source with knowledge of the matter said on Tuesday.”

The article noted that,

Several ships carrying U.S. sorghum to China have changed course since Beijing slapped hefty anti-dumping deposits on U.S. imports of the grain last week, trade sources and a Reuters analysis of export and shipping data showed.

Also last week, Reuters writer Josephine Mason reported that, “A vessel carrying 70,223 tonnes of sorghum from the United States to Asia switched its destination on Thursday, data showed, becoming the latest diverted cargo in a trade flow roiled by China’s move to impose hefty deposits on U.S. shipments of the grain.”

“The vessel is one of almost two dozen stranded at sea as a result of the move, with frantic importers in China offering to sell their grain at steep discount to buyers elsewhere,” the Reuters article explained.

Meanwhile, Reuters writer Hallie Gu and Dominique Patton reported on Tuesday that, “Some Chinese sorghum importers have asked Beijing to waive the hefty anti-dumping deposit imposed last week on U.S. imports already at sea, as companies rushed to sell stranded China-bound cargoes that were on the water at big discounts.”

“One source said his company was asking Beijing to impose the new tariffs only on cargoes loaded at U.S. ports after April 18, in a bid to protect almost a dozen vessels carrying U.S. sorghum that have already started sailing,” the article said.

Soybeans

In a separate Reuters article last week, Naveen Thukral and Dominique Patton reported that, “China’s purchases of U.S. soybeans have come to a grinding halt, trade and industry sources say, as fears of further action by Beijing to curb imports of U.S. crops following last week’s anti-dumping move on sorghum rattles the agriculture industry.

“Buyers from China, which takes 60 percent of soybeans traded worldwide, have not signed any new deals to take U.S. beans in the last two weeks, according to a Reuters review of data published by the United States Department of Agriculture (USDA).

“At stake are 3 million tonnes of soybeans – estimated worth about $1.3 billion – for which deals have been signed but cargoes have yet to leave U.S. ports, traders say. Soybeans, crushed to make cooking oil and protein-rich animal feed ingredient soymeal, were the biggest U.S. agriculture export to China last year at a value of $12.3 billion, according to the USDA.”

The article explained,

China’s imports of U.S. soybeans fell 27 percent in March compared with the same month a year earlier, customs data showed on Tuesday, while purchases from Brazil jumped by a third.

“‘We are now buying Brazilian, Canadian and some Argentina beans,’ said a person familiar with soybean purchasing at a large crusher in China who was not allowed to be identified in media. ‘We are a state-owned company, we wouldn’t dare to buy U.S. beans.'”

Amid current trade tension, 2017/18 cumulative (September-March) #soyabean shipments to China shifted away from the US due larger than average Brazilian availabilities. pic.twitter.com/SUGL4VKqlT

— International Grains Council (@IGCgrains) April 26, 2018

However, the article added, “To be sure, the decline in U.S. bean exports to China is also partly due to seasonal factors. Freshly harvested South American soybeans typically dominate the world trade in the first half of the calendar year, followed by the United States from September onwards.”

Despite a potential 25% import tariff, Chinese processors still likely to require some US #soyabeans in 2018/19 to satisfy domestic demand. pic.twitter.com/1HMQkzJp7w

— International Grains Council (@IGCgrains) April 27, 2018

A report last month from USDA’s Foreign Agricultural Service (FAS) (“Brazil: Oilseeds and Products Annual- Planted Area to Hit Record for Ninth Consecutive Year“) pointed out that, “The record [soybean] crop in 2017/18 increased the amount of exportable supplies. As a result, Brazil is heavily competing with U.S. soybeans and is expected to continue to take away market share from the United States in 2018.”

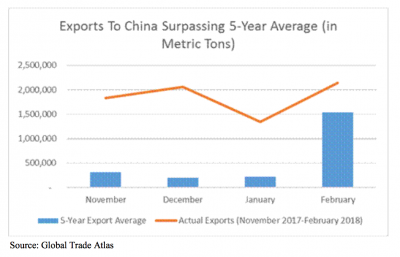

The FAS update also pointed out, “The higher protein levels of Brazilian soybeans, the additional Chinese requirements on foreign matter on U.S. soybeans, and the current trade environment, are expected to help Brazil support higher exports to the Chinese market. Exports to China are on pace to hit its highest levels yet. The 5-year export average for December (2012-2016) to China is 199,000 metric tons (mt). In December 2017 alone, Brazil exported two (2) mmt to China. For January, the 5-year average (2013-2017) is 215,000 mt but Brazil exported about 1.3 mmt to China in January 2018. This pace is expected to continue in 2018 due to the Brazilian bumper crop and Chinese demand.”

Meanwhile, a recent update from Iowa State University (“Key agricultural products in U.S.-China trade disputes: the proportional, the significant, and the substitutable,” by Minghao Li, Wendong Zhang, and Chad Hart“) stated, “That China did not choose soybeans as the target of retaliation for the steel and aluminum tariff is not surprising in light of the ‘proportional response’ principle: while China exports $2.8 billion of steel and aluminum products to the United States, it imports more than $12 billion in soybeans from the United States. But with the additional tariffs from the U.S. targeting $50 billion of Chinese products, a retaliation using soybeans had to be on the table to reach a proportional response. In fact, since the total value of U.S. agricultural exports to China (including related products) is $24.1 billion, most of the U.S. agricultural exports to China would be needed to achieve the $50 billion response.

Currently, China relies on soybeans from Brazil and U.S. to supply about 90 percent of its soybean consumption, predominately for feed. The sheer volume of Chinese soybean imports makes it more difficult to displace than other products. However, if needed to, China could shift some significant share of imports to other countries such as Brazil and Argentina, produce more soybeans domestically, and look to replace soybeans with other products.

And, an update last week from Purdue University (“Chinese Tariffs on Soybeans and Pork: U.S. and Indiana Impacts,” by Chris Hurt, Wallace Tyner, and Farzad Taheripour) included “background information and estimates of effects if the threatened tariffs on soybeans and pork should proceed.”

In part, the update noted, “China would still need to buy some U.S. soybeans because we are such a large supplier. But, the U.S. would become the supplier of last resort, of-ten called the ‘residual supplier.’ China would first buy from our competitors and purchase the minimum they can from the U.S.”

The report also explained, “Purdue Ag Economists Tyner and Taheripour have completed a study of the impacts of a 25% Chinese tariff on soybeans. Given the many assumptions in their models, they find that after approximately 5 years of adjustment the tariff would result in:

- U.S. soybean exports to China dropping 65%

- U.S. global soybean exports dropping 37%

- U.S. soybean production dropping by 15% (mostly from lower soybean acres)

- Soybean prices dropping about 5%

- U.S. and Chinese economic wellbeing falling $3 billion per year.

Trade Talks Continue

Wall Street Journal writer Siobhan Hughes reported on Sunday that, “Some farm-state lawmakers have been concerned about Mr. Trump’s efforts, which they fear will invite retaliation from other countries against American agricultural exports. Mr. Trump acknowledged those worries but said the country had other considerations.

Farmers are ‘great patriots’ but ‘there may be pain for a little while,’ he said. ‘Short term, you may have to take some problems; long term you’re going to be so happy,’ Mr. Trump said.

On Thursday, Bloomberg writer Andrew Mayeda reported that, “Senior Trump administration officials will push China to address a wide range of trade irritants when they visit the Asian nation in coming days, a top economic adviser to the president said.

“‘It’s going to cover a broad area. All of the disputes will be discussed,’ Larry Kudlow, director of the White House’s National Economic Council, said in an interview Thursday with CNBC. Kudlow said he will join a delegation that’s expected to include Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer.

“President Donald Trump said this week his officials would visit China within days, adding that there’s a ‘very good chance‘ the two countries can reach a deal.”