A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Additional U.S. Trade Tariffs Possible as Ag Markets Absorb Impacts

Trade tensions between the U.S. and China persist, while Chinese tariffs on U.S. commodities continue to roil markets. Despite a variety of impeding economic variables, a news article notes that the current ag economy is sturdier than when the 1980s farm crisis unfolded. Meanwhile, export competitors move forward with a Trans Pacific Partnership agreement, while the benefits of the new USMCA may be overshadowed by ongoing tariff disputes.

Background

Bloomberg writers Jenny Leonard and Jennifer Jacobs reported earlier this week that, “The U.S. is preparing to announce by early December tariffs on all remaining Chinese imports if talks next month between presidents Donald Trump and Xi Jinping fail to ease the trade war, three people familiar with the matter said.

“An early-December announcement of a new product list would mean the effective date — after a 60-day public comment period — may coincide with China’s Lunar New Year holiday in early February. The list would apply to the imports from the Asian nation that aren’t already covered by previous rounds of tariffs — which may be $257 billion using last year’s import figures, according to two of the people.

U.S. officials are preparing for such a scenario in case a planned Trump-Xi meeting yields no progress on the sidelines of a Group of 20 summit in Buenos Aires in November, according to two of the people, who declined to be identified to discuss internal deliberations. They cautioned that final decisions had not been made.

The Bloomberg article noted that, “Any further broadening of tariffs would show the Trump administration’s determination to escalate its trade war with China even as companies complain about the rising costs of tariffs and financial markets continue to be nervous about the global economic fallout.”

.@PressSec on @POTUS' upcoming meeting with President Xi of China: "You have two of the most powerful leaders in the world, I think that's consequential no matter how you look at it. And we'll see what happens when they sit down." pic.twitter.com/cuqrNPO6S2

— FOX Business (@FoxBusiness) October 30, 2018

Leonard and Jacobs added, “As another option, the White House is also considering excluding trade from the meeting agenda but it is unlikely to cancel it altogether, according to two people familiar with the matter.”

Reuters writer John Ruwitch reported Tuesday that, “Chinese Foreign Ministry spokesman Lu Kang said China and the United States have all along been in communication about exchanges at all levels, including a possible Xi-Trump meeting in Argentina, though he gave no details.

“If the United States is not willing to promote win-win cooperation with China then China is fully confident in being able to continue with its reforms and develop itself, Lu added.”

Just had a long and very good conversation with President Xi Jinping of China. We talked about many subjects, with a heavy emphasis on Trade. Those discussions are moving along nicely with meetings being scheduled at the G-20 in Argentina. Also had good discussion on North Korea!

— Donald J. Trump (@realDonaldTrump) November 1, 2018

And Iowa GOP Senator Charles Grassley indicated in a column this week that, “Uncertainty in trade, rising tariffs and the potential that China finds new markets for these products would be devastating to Iowa and farmers throughout rural America who depend on access to the Chinese market for their products.”

However, Sen. Grassley stated that, “America must continue showing a strong, united front against China’s egregious efforts to lie, steal and cheat its way to being the world’s economic leader. Otherwise, the United States is sure to fall behind.”

Agricultural Impacts

Reuters writers Chen Aizhu, Li Pei and Dominique Patton reported this week that, “Oilseed traders in China on Monday played down the potential impact on soy consumption of new government guidelines to lower the protein content of animal feed, saying that rising soymeal and soybean prices would be a far bigger curb on appetite.”

The Reuters article pointed out that, “China is entering what is typically its top buying season for U.S. soybeans. However, only a handful of U.S. cargoes have arrived in the country in recent months and it is expected to largely rely on beans from top supplier Brazil.

“Its soybean imports are set to drop by a quarter in the last three months of 2018, their biggest fall in at least 12 years as buyers curb purchases.”

Brazil's Ag minister Maggi going to China to meet companies, importers. Will also stop by United Arab Emirates to negotiate market access for Brazilian products #Brazil #agriculture #China https://t.co/bKcFboYlYN

— Marcelo Teixeira (@tx_marcelo) October 30, 2018

Meanwhile, Bloomberg writer Kevin Varley reported Monday that, “A ship carrying U.S. soybeans changed destination from China to Vietnam on Saturday as exporters find new buyers for American supplies amid an escalating trade war.

“Bulk carrier Audacity left Louis Dreyfus’ Pier 86 terminal in Seattle on Oct. 21 for Qingdao, China with 69,244 metric tons of soybeans, according to U.S. Department of Agriculture inspection data and vessel data compiled by Bloomberg. After six days, it changed course to Phu My, Vietnam, the data show. Louis Dreyfus didn’t immediately respond to an email seeking comment,” the article said.

And Reuters writers Hallie Gu and Dominique Patton reported Thursday that, “A vessel carrying soybeans from the United States to China changed its destination to South Korea on Thursday, shipping data showed, amid a trade war that has decimated U.S. shipments of the commodity to the world’s top oilseed importer.

“The Star Laura, carrying 36,000 tonnes of American soybeans loaded in Seattle in late September, was due to arrive in the eastern Chinese port of Qingdao on Wednesday, according to shipping data on Refinitiv Eikon.”

The article noted that, “Star Laura was one of only a handful of U.S. soybean cargoes to have set sail for China in recent months, as buyers have largely steered clear of U.S. supplies on worries that Beijing will issue further curbs on imports.”

Gu and Patton added, “At least two other vessels carrying U.S. soybeans to China have changed course in the past month, suggesting the original buyer has resold the cargo to other markets.”

U.S. export inspections for #soybeans topped trade expectations with 1.305 million tonnes in the week ended Oct. 25, the biggest week since mid-February. Trade range was 650k-1.15M. Always be sure to apply context to these numbers, though. Hopefully this chart will help. pic.twitter.com/TdaGdDumGZ

— Karen Braun (@kannbwx) October 29, 2018

Despite the reduction in U.S. soybean exports to China, Donnelle Eller reported on the front page of Monday’s Des Moines Register that, “The low corn and soybean prices today are ‘a piece of cake compared to the ’80s,’ [Iowa farmer Randy Souder] said.”

The article indicated that, “But trade disputes, rising interest rates, and tumbling commodity prices have farmers and others comparing this downturn to the farm crisis, a recession that remains Iowa’s worst since the Great Depression.

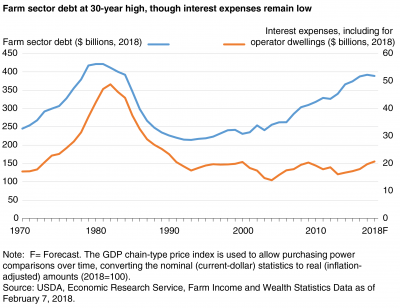

“Adding to concerns: U.S. farm debt is climbing, sitting just 8 percent below the peak in 1980 when adjusted for inflation, USDA data show.

“And farm income has tumbled. U.S. farm profits this year are expected to be half the 2013 record. Iowa farm income last year was 65 percent below a 2011 high.”

The Register article noted that, “But the likelihood of another 1980s farm crisis is ‘relatively low,’ said Chad Hart, an Iowa State University agricultural economist. He noted that declines in commodity prices, land values, and income were ‘quick and sharp‘ in that decade.

“‘That’s what creates the crisis,’ Hart said. ‘What we’ve been through in the past five years has been slow and relatively shallow.'”

Ms. Eller stated that, “Farmland, machinery, operating and other debt has increased, but so has the value of assets.

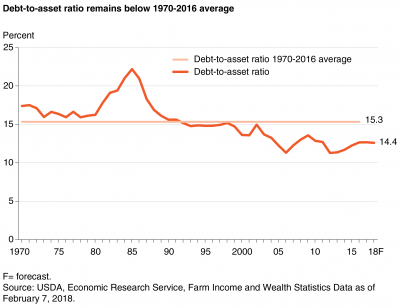

“‘In contrast to the 1980s, recent decades have seen farm assets appreciate more rapidly than debt, so the farm sector’s debt-to-asset ratio remains low by historic standards,’ USDA said in a July report.

“The strength of farmland values has been key in helping farmers through this downturn.”

And Reuters writer Humeyra Pamuk reported Monday that, “The U.S. Department of Agriculture is not planning to extend an up to $12 billion aid package for farmers into 2019, Secretary Sonny Perdue said on Monday, to mitigate farmer losses due to the imposition of tariffs on American exports.

“‘Farmers are very resilient and adept in making their planning and marketing decisions based on the current market,’ Perdue told reporters on the sidelines of an event in Washington.”

Additional Trade Developments and Analysis

Financial Times writers Jamie Smyth and Robin Harding reported Tuesday that, “The Trans-Pacific Partnership will enter into force from December 30, marking a rare victory for global trade liberalisation, even as the US erects tariff barriers and steps up its trade war with China.

“Australia on Wednesday became the sixth nation to ratify TPP, crossing the hurdle for the 11-member deal to take effect. The US originally was a member but Donald Trump withdrew from the pact in one of his first moves as president.

The deal will cut tariffs on agricultural imports from Canada and Australia to Japan, putting US farmers at a significant disadvantage, and increasing the pressure for Washington to secure similar concessions from Tokyo.

Also, DTN Ag Policy Editor Chris Clayton reported Wednesday that, “The new North American free trade agreement, once ratified, will provide a bump in U.S. agricultural exports. But an analysis released Wednesday by the Farm Foundation shows those trade gains are overwhelmed by lost exports due to retaliatory tariffs.

“Farm Foundation contracted with economists at Purdue University to estimate the impacts on U.S. agriculture from the United States-Mexico-Canada Agreement (USMCA). The study contrasted USMCA with its predecessor, the North American Free Trade Agreement. The study also looked at the impact of retaliatory tariffs by Canada, Mexico and China against U.S. agricultural exports.

“The USMCA is hindered by retaliatory tariffs Canada and Mexico initiated against U.S. farmers after the Trump administration raised tariffs on Canadian and Mexican steel and aluminum. Those tariffs will bring down U.S. ag exports by $1.8 billion. Once Chinese tariffs are added in, U.S. agricultural exports could fall $7.9 billion, ‘Thus overwhelming the small positive gains from USMCA.’ Oilseed exports show the sharpest decline at 21%, while meat products drop by 8.7%.”

"The retaliatory #tariffs implemented by #Canada and #Mexico on U.S. #agricultural exports will reverse the modest export gains from #USMCA—a decline of $1.77 billion rather than a gain of $450 million," https://t.co/lEyeCUkMGk @FarmFoundation @GTAP_Purdue pic.twitter.com/LuJXrbmByJ

— Farm Policy (@FarmPolicy) October 31, 2018

Mr. Clayton added, “As of now, there is no direction from the Trump administration on what may cause the U.S. to remove the steel and aluminum tariffs, called the Section 232 tariffs, or whether they would remain after the USMCA is ratified. Any talks with China would have to begin with President Donald Trump and Chinese President Xi Jinping first meeting. That is not expected to happen until the G-20 summit in Argentina at the end of November.”