Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S., China Trade Issues: Meeting Phase One Targets a “‘Herculean Task”

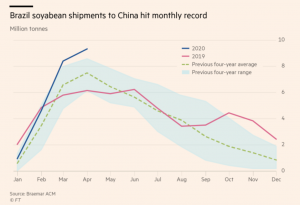

Emiko Terazono and Sun Yu reported today at The Financial Times Online that, “Brazil’s soyabean shipments to China hit a monthly record of more than 9m tonnes in April, casting doubt on whether Beijing can meet the first-year targets of its trade deal with Washington.

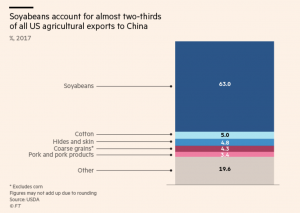

“Soyabeans are at the heart of US-Chinese agricultural trading, accounting for almost two-thirds of American exports to China in 2017, prior to the trade war. In January’s US-China phase one trade agreement Beijing pledged to buy at least $80bn of US agricultural products over two years, including $36.5bn in 2020 — $12.5bn more than it spent in 2017.

“But so far China has bought just over $3bn, said the American Farm Bureau Federation, which represents US farmers.”

“Some 9.3m tonnes of soyabeans were shipped from Brazilian ports to China in April, according to preliminary cargo tracking data from shipbrokers Braemar ACM.”

The FT article stated that,

Meeting the target will be a ‘Herculean task,’ said Seth Meyer, research professor for the Food and Agricultural Policy Research Institute at the University of Missouri and a former senior economist at the US Department of Agriculture.

“The US normally exports low volumes of soyabeans in the spring months. Nevertheless, lower prices will make the target harder for China to meet later this year, he said. ‘Commodity prices are lower and this is a value deal and not a volume deal. They’re going to have to buy a heck of a lot of beans [to meet the target].'”

Terazono and Yu pointed out that, “For Chinese buyers, there are economic incentives to buy from Brazil. A record Brazilian soyabean harvest of about 125m tonnes, the real’s tumble against the dollar and lower freight rates for bulk commodities have combined to make oilseed imports from the Latin American country to China about 23 per cent cheaper than those of the US.”

Earlier this week, Bloomberg News reported that, “China is stepping up purchases of soybeans from the U.S. as Brazilian sales start to wane and the Asian nation seeks to meet its pledges under the trade deal with Washington, according to people familiar with the matter.

“State-run buyers have purchased more than 20 cargoes, or over 1 million metric tons, of American soybeans in the past two weeks, said the people, who asked not to be identified because the information is private. The beans were bought using tariff waivers previously issued, the people said. Purchases of 136,000 tons reported by the U.S. government Tuesday were probably made Monday.

“Top trade negotiators from both nations spoke by phone last week and pledged to create favorable conditions for implementation of the bilateral trade deal and cooperate on the economy and public health, according to a statement from the Chinese Ministry of Commerce. President Donald Trump later said he’s struggling with Beijing in the wake of the global coronavirus pandemic.”

US #soybean #export commitments (outstanding sales + accumulated exports) to #China exceeded 2019 levels slightly, totaling 13.5 million tons compared to 13.3 million a year ago.

— Farm Policy (@FarmPolicy) May 13, 2020

However, export commitments to China continue to trail 2018 and 2017 levels https://t.co/OdioSbV7hp pic.twitter.com/yMVfEZJEps

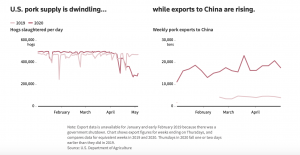

Meanwhile, Associated Press writer Josh Funk reported yesterday that, “U.S. meat exports are surging even as the industry is struggling to meet domestic demand because of coronavirus outbreaks at processing plants that have sickened hundreds of workers and caused companies to scramble to improve conditions.”

Meat exports, particularly pork exports to China, grew significantly throughout the first three months of the year.

The AP article added that, “The Meat Export Federation said pork exports jumped 40% and beef exports grew 9% during the first three months of the year. Chicken exports, meanwhile, grew by 8% in the first quarter. Complete figures weren’t yet available for April, but Agriculture Department figures for the last week of April show that pork exports jumped by 40% as shipments to China and Japan surged and exports to Mexico and Canada remained strong. Beef exports declined by 22% in that last week of April.

“China’s demand for imported pork has risen over the past year because its own pig herds were decimated by an outbreak of African swine fever, and China pledged to buy $40 billion in U.S. agricultural products per year under a trade pact signed in January. China also became the fourth-largest market for American poultry in the first quarter after it lifted a five-year ban on those products.”

Also this week, Bloomberg News reported that, “China is still willing to meet its American farm purchase commitments as long as the U.S. creates a friendly atmosphere for more imports to take place, a Chinese agricultural expert said on Wednesday.

“A slump in U.S. corn prices to a decade low was a good chance for China to buy millions of tons of the grain, but the world’s second-largest consumer held back on purchases because relations between the two nations have soured, said Li Qiang, chief analyst with Shanghai JC Intelligence Co.”

The Bloomberg article pointed out that, “If relations between the two nations do improve, China could buy more U.S. corn to refill its shrinking state reserves, Li said. American corn prices are about 500 yuan per ton cheaper than domestic corn, which has jumped to the highest in years as domestic supplies tighten.

“The shuttering of some U.S. ethanol plants due to the crude oil rout may also contribute to China missing its import targets for ethanol and distillers dried grains (DDGs), Li said. The Asian nation is expected to buy between $3 billion to $5 billion of American ethanol, and $2 billion to $3 billion of DDGs, depending on the resumption of U.S. production, Li said.”

Reuters writers Hallie Gu, Shivani Singh and Emily Chow reported today that, “China is likely to speed up the buying of U.S. farm goods and will implement the phase 1 trade deal with the United States, an executive at state-owned agriculture trading house COFCO said at an online industry conference on Thursday.”

The Reuters article indicated that, “However, rising Chinese soybean inventories in the coming months and falling crush margins could make buying U.S. beans unfavourable, said Zhang Hua, vice general manager of China, COFCO International…China’s soybean imports in 2019/20 are expected at 87.50 million tonnes, Zhang said, of which about 13.70 million tonnes are expected to come from the United States.

“Brazilian exports to China in 2019/20 are expected to be 63.73 million tonnes, he said.

“China will allow imports of barley and blueberries from the United States effective Thursday, according to notices on its customs website.”

The Associated Press reported earlier this week that, “China suspended punitive tariffs on more U.S. goods including radar equipment for aviation Tuesday amid pressure from President Donald Trump to buy more imports as part of a truce in their trade war…Tuesday’s announcement was the third Chinese tariff cut since the January agreement.”

On Wednesday, Reuters writers Hallie Gu and Dominique Patton reported that, “China is allocating more low-tariff import quotas for corn this year and may expand its use of wheat quotas as it seeks to step up farm purchases from the United States and meet a pledge to comply with global trade rules, according to three sources.”

“As part of a Phase 1 trade deal with the United States in January, China pledged to allow for the full use of its TRQs and it has issued more than 6 million tonnes of low-tariff corn quotas in 2020 so far, said two sources familiar with the matter.”

And Reuters writer Karl Plume reported yesterday that, “Global grains trader Archer Daniels Midland Co remains optimistic that China will meet its Phase 1 trade deal farm product purchase commitments despite the slow pace of buying so far and recent criticism of China by U.S. President Donald Trump.

“Lower commodity prices due to the coronavirus pandemic may limit the value of China’s first year U.S. agricultural product purchases, ‘but it’s a two-year agreement,’ ADM CEO Juan Luciano said during the virtual BMO Capital Markets Global Farm to Market Conference on Wednesday.”

Mr. Plume noted that, “Chinese imports of U.S. agricultural products and related goods totaled just $913 million in February and $952 million in March, the lowest totals for those two months since 2007, according to U.S. Census Bureau data.

“China has accelerated purchases of U.S. soybeans since late April after actively buying mostly Brazilian soybeans in recent months.”

Trump: If US cut off relationship with China, we’d save $500B | https://t.co/6lrT09uqbx

— Farm Policy (@FarmPolicy) May 14, 2020

Bloomberg’s Mario Parker reported on Friday that, “President Donald Trump said he doesn’t want to talk to Chinese President Xi Jinping right now and mused about eliminating the largest trading relationship in the world, with tensions high over the coronavirus outbreak.

“Asked in a Fox Business Network interview whether he had spoken to Xi recently, Trump said that they have “a very good relationship” but ‘right now, I don’t want to speak to him. I don’t want to speak to him.'”

The Bloomberg article added that, “He also rejected renegotiating the so-called ‘phase one’ trade deal he signed with Beijing in January.

“‘We’re not going to renegotiate,’ he said. The virus ‘was never even a subject’ when the deal was signed, he said. His re-election opponent, former Vice President Joe Biden, has sought to turn the trade deal — one of Trump’s signature first-term accomplishments — into a liability by alleging the president was focused on the agreement to the exclusion of the growing coronavirus outbreak.”