A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

USDA Announces Details of Coronavirus Food Assistance Program (CFAP) Aid Payments

Bloomberg writers Mike Dorning and Teaganne Finn reported yesterday that, “President Donald Trump announced rules Tuesday for a $19 billioncoronavirus farm aid package covering a broad swath of U.S. agriculture that producers can begin claiming by next week.

“Farmers who suffered a 5% or greater price loss will be eligible for direct payments of as much as $250,000 per person, the U.S. Department of Agriculture said in a statement.

“‘We’re standing strong with our farmers and ranchers once again,’ Trump said at a White House event with representatives of farm groups, citing two prior trade bailouts.”

President @realDonaldTrump is announcing major action to support our Nation's farmers, ranchers, and growers! pic.twitter.com/x6lMwfO26S

— The White House (@WhiteHouse) May 19, 2020

The Bloomberg writers noted that, “The coronavirus pandemic has pummeled farmers, a steadfast Trump constituency already struggling from years of depressed prices amid a global commodity glut and the president’s trade war with China.

“The crisis upended food-supply chains and damaged overseas markets as the global economy slid into recession. Dairy farmers have been dumping milk they cannot sell. Hog farmers have been forced to destroy market-ready animals and leave them in compost heaps as slaughterhouses closed or slowed production because of employee illness.

.@USDA announces $16 billion in direct payments to provide relief to America’s farmers and ranchers impacted by the #coronavirus pandemic. FSA will begin accepting applications on May 26. More info: https://t.co/xPKqHBHdt4 #CFAP pic.twitter.com/dRzzjCTCYb

— Farmers.gov (@FarmersGov) May 19, 2020

“Congress allocated money for farm aid in the last coronavirus relief package. The program includes $16 billion in direct payments to farmers and $3 billion for purchases of commodities including dairy products, meat and fruits and vegetables,” the Bloomberg article said.

https://t.co/03mWszJw8y CFAP Easy

— Todd E. Gleason (@commodityweek) May 19, 2020

Reuters News reported yesterday that, “U.S. farmers that grow crops including corn and soybeans will receive coronavirus assistance payments based on either half of their 2019 production or the supplies they had on hand as of Jan. 15, the government said on Tuesday.”

“The payments were set at 45 cents per bushel for soybeans, 32 cents per bushel for corn and 18 cents per bushel for hard red spring wheat, the U.S. Agriculture Department said. Other crops such as barley, canola, cotton and oats also were eligible for payment under the plan.”

Also yesterday, DTN Ag Policy Editor Chris Clayton reported that, “USDA officials on Tuesday provided more extensive details on the payment plan for producers under the Coronavirus Food and Aid Program (CFAP).

The payment details are complicated, depending on whether livestock or crops are involved and whether producers had sold their commodities within a timespan from Jan. 15 to April 15 of this year.

“Farmers and livestock producers will initially receive 80% of their calculated payment under CFAP. USDA right now has $9.5 billion from the Coronavirus Aid, Relief and Economic Security (CARES) Act and $6.5 billion in funds from the Commodity Credit Corp. USDA officials on Tuesday acknowledged the aid available right now will not meet all of producers’ expected losses.”

Mr. Clayton explained that, “For commodity crop producers, payments are eligible for unpriced crops, or ‘inventory held subject to price risk’ that a farmer held on Jan. 15, 2020.

“‘If you already sold it ahead, you set a price on it, then that’s not being impacted by the reduction of prices,’ said Bill Northey, USDA’s undersecretary for farm production and conservation.

“The inventory will be self-certified, Northey said, though there will be some compliance audits conducted, he said.”

The DTN article stated that, “A producer will be paid on that commodity in storage, but the inventory cannot be higher than 50% of total 2019 production that the producer reported to the Farm Service Agency. Effectively, a farmer who grew 100,000 bushels or more in 2019 and has 50,000 bushels of 2019 corn in storage, unsold, on Jan. 15 would be paid on the 50,000 bushels.

“Yet, it is more complicated the way the rule is spelled out.

“Half of that 50,000 bushels would be paid 32 cents from the CARES Act, and the other 25,000 bushels would be paid 35 cents from the Commodity Credit Corp. Essentially, USDA officials explained, when it is boiled down, the 50,000 bushels would be multiplied by 33.5 cents. That breaks down to 50,000 x 0.335, or $16,750.”

Mr. Clayton pointed out that, “For soybeans, the payment rates are 45 cents a bushel from the CARES Act and 50 cents a bushel from CCC. A farmer with 50,000 bushels unsold in storage from the 2019 harvest on Jan. 15 would be paid on 25,000 bushels at 45 cents a bushel. The other 25,000 bushels would be paid at 50 cents a bushel. That equates to $23,750 (50,000 x 0.475).”

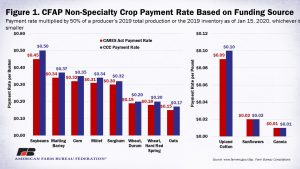

And a Market Intel update yesterday from the American Farm Bureau stated in part that, “For non-specialty crops, e.g., malting barley, canola, corn, upland cotton, millet, oats, soybeans, sorghum, sunflowers, durum wheat and hard red spring wheat, payments will be coupled to actual 2019 production and will be paid based on inventory subject to price risk held as of January 15, 2020. A single payment will be made based on 50 percent of a producer’s 2019 total production or the 2019 inventory as of January 15, 2020, whichever is smaller, multiplied by 50 percent and then multiplied by the commodity’s applicable payment rates.

“The payment formula equals: min[50%×2019 Production, Jan. 15 Inventory]×50%×[CARES Payment Rate + CCC Payment Rate].”

“Producers will be required to provide their total 2019 production for the commodity that suffered a 5%-or-greater price decline, and total 2019 production that was not sold as of Jan. 15, 2020. CFAP payment rates from the CARES Act range from a low of 1 cent per pound of canola to 45 cents per bushel for soybeans. Payment rates from the CCC range from 1 cent per pound of canola to 50 cents per bushel of soybeans. Figure 1 [above] displays the CFAP non-specialty crop payment rates.”

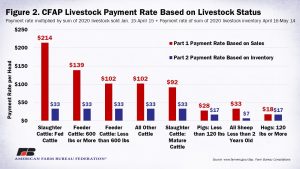

Yesterday’s Market Intel update added that, “Producers of eligible livestock, i.e., cattle, hogs and sheep, will receive a single payment for livestock will be calculated using the sum of the producer’s number of livestock sold between January 15 and April 15, 2020, multiplied by the payment rates per head, and the highest inventory number of livestock between April 16 and May 14, 2020, multiplied by the payment rate per head.

“The payment formula equals: [Number of Livestock Sold Jan. 15 to Apr. 15]×[CARES Act Part 1 Payment Rate] + [Inventory Apr. 16 and May 14]×[CCC Part 2 Payment Rate].

“For example, fed cattle sold between Jan. 15 and Apr. 15 will receive $214 per head, and the maximum number of fed cattle in inventory between Apr. 16 and May 14 will receive $33 per head. The payment rates are not additive and are paid on different sets of cattle. Producers will be required to provide the total sales of eligible livestock, by species and class, between Jan. 15, 2020 and April 15, 2020, of owned inventory as of Jan. 15, 2020, including any offspring from that inventory; and highest inventory of eligible livestock, by species and class, between April 16, 2020, and May 14, 2020. For livestock in inventory, payment rates range from $7 per head for sheep less than two-years-old to $33 per head for all cattle. For livestock sold, payment rates range from $18 per head of hogs 120 pounds or less to $214 per head for fed cattle.

“Figure 2 [above] displays the CFAP livestock payment rates.”