As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve: Observations on the Ag Economy- August 2021

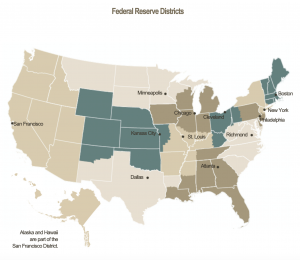

On Wednesday, the Federal Reserve Board released its August 2021 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Sixth District- Atlanta– “Agricultural conditions remained mixed. Widespread rain relieved the District of drought conditions. With planting completed, the District’s corn, cotton, soybean, peanut, and rice crop conditions were mostly on par with this time last year. District crop production forecasts were up on a year-over-year basis for cotton, soybeans, corn, and peanuts but down for rice. On a month-over-month basis, the production forecast for Florida’s orange crop was up in July while the grapefruit production forecast was unchanged; both forecasts remained below last year’s production levels. On a year-over-year basis, the USDA reported cropland values were up across the District states. The USDA reported year-over-year prices paid to farmers in June were up for corn, cotton, soybeans, cattle, broilers, eggs, and milk, but down for rice. On a month-over-month basis, prices were up for corn, cotton, rice, cattle, and broilers but down for soybeans, eggs, and milk.”

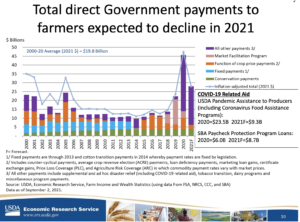

* Seventh District- Chicago– “Although most agriculture prices were higher than a year ago, farm incomes were expected to be down in 2021 with the end of pandemic-related government support payments.

“Cattle and egg prices increased during the reporting period. Milk producers faced lower margins as transportation costs rose and output prices mostly moved sideways. Contacts hoped reopening schools would boost bottled milk demand. Hog, corn, and soybean prices retreated from their recent highs.

Relatively tight supplies of crops helped support corn and soybean prices. District corn and soybean harvests were expected to be near record levels, though parts of the region still faced a drought.

“Concerns grew that strained logistics would lead to shortages of parts for farm equipment during harvest and clog the movement of crops to markets. Farmland values kept climbing.”

* Eighth District- St. Louis– “Agriculture conditions have remained unchanged from our previous report. Relative to early July, the percentage of corn and soybeans rated fair or better has decreased slightly while the percentage of rice increased slightly and cotton experienced no change. Contacts indicated that both nonlabor and labor costs have increased but income is up as well. One contact noted the drought in South America has raised grain prices. They also noted COVID-related shortages of maintenance parts.”

* Ninth District- Minneapolis– “While extreme drought conditions were taking a toll in many areas, District agricultural producers continued to benefit from strong commodity prices.

#Drought Monitor- North Central. pic.twitter.com/vo1qhMPNLT

— Farm Policy (@FarmPolicy) September 9, 2021

“Agricultural bankers indicated broadly increased farm income and spending in the second quarter, with a positive but more moderate outlook for the third quarter. However, livestock and dairy producers were suffering from the drought’s impact on hay availability and pasture conditions, while corn and soybean crop conditions were deteriorating.”

* Tenth District- Kansas City–

In the Tenth District agricultural economy, farm income and credit conditions continued to improve despite weakness in the cattle industry and severe drought in some areas.

“Crop and hog prices remained at multi-year highs, and the condition of corn and soybeans was slightly better than the national average in most District states through early August. However, profit opportunities for cattle producers remained limited. Contacts in the meat packing industry also reported that tight labor markets were slightly constraining production capacity at some facilities. As a result of the widespread drought, over 60% of pasture and range land in Wyoming was in poor or very poor condition as of early August; compared with about 30% in Colorado and New Mexico and 20% or less in all other states.”

Approximately 29% of the #cattle inventory is within an area experiencing #drought, @usda_oce pic.twitter.com/x9q55O3AyT

— Farm Policy (@FarmPolicy) September 9, 2021

* Eleventh District- Dallas– “Texas was nearly drought free by the end of the reporting period, though drought conditions persisted in New Mexico. Sufficient soil moisture boosted crop conditions for wheat and row crops alike, allowing many producers to reap strong yields. Preliminary reports point to higher production this year versus last year for Texas’ major crops—cotton, sorghum, corn and soybeans.

Crop prices remained strong, supporting profitability.

“Rising production costs are a concern going forward, but outlooks were generally optimistic. In the livestock sector, pasture conditions were favorable, and prices rose for cattle and poultry.”

Most individual expense items forecast to increase in 2021, @USDA_ERS pic.twitter.com/8dWhSLZnw8

— Farm Policy (@FarmPolicy) September 7, 2021

* Twelfth District- San Francisco– “Conditions in the agriculture and resource sectors improved modestly on net. Domestic and international demand for meats, fruits, vegetables, nuts, and seafood remained strong. Supply chain disruptions continued to hinder trade with Asia, although shipping delays were noted to have eased somewhat in the past several weeks. At the same time, several growers in the Pacific Northwest noted that extreme heat and drought conditions have caused considerable damage to this year’s wheat and tree fruit yields, which is projected to reduce available inventory even further.”