A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

July Rains: U.S. Corn Harvest Could Be “Second-Largest on Record,” as Black Sea Export Issues Persist

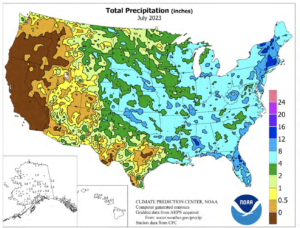

Reuters writer Mark Weinraub reported yesterday that, “The U.S. corn harvest could be the second-largest on record as rains during July shepherded the crop through its critical development phase, offsetting dry conditions early in the season and hot summer temperatures, analysts and farmers said.

“A strong harvest would add to domestic stockpiles that are expected to balloon as demand for U.S. corn exports wilts due to a massive harvest in Brazil, which is expected to overtake the United States as the world’s top corn supplier.”

Weinraub explained that, “Corn prices fell 18% from their late-June peak during July, with improving conditions in the field weighing heavily on the market as the drought damage from the early season was not as bad as feared.

#July contiguous U.S. precipitation total was 2.70 inches — 0.08 of an inch below avg. — ranking in the middle third of the historical record:https://t.co/CJw3jDNo6w@NOAANCEI #StateOfClimate pic.twitter.com/aB0pPDm3b0

— NOAA (@NOAA) August 8, 2023

“Drought-tolerant genes and other improvements in genetically modified corn allowed the crop to weather severe drought across much of the Midwest, farmers said. Genetically modified corn accounts for more than 90% of the U.S. crop.”

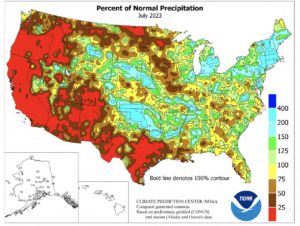

30- Day Percent of Normal Precipitation pic.twitter.com/pImiaaqxHN

— FarmPolicy (@FarmPolicy) August 8, 2023

The Reuters article noted that, “Analysts expect the U.S. government in a monthly report due on Friday to cut its forecast for domestic corn production to 15.135 billion bushels this year, from its July estimate for a record high 15.320 billion.

“The new forecast if achieved would be the second-biggest harvest ever, behind the 2016 harvest of 15.148 billion bushels. Average yields were seen at 175.5 bushels per acre this year, which would be the fourth-biggest ever.”

Weinraub also pointed out that, “The percentage of corn rated good-to-excellent this year by the U.S. Agriculture Department in weekly reports rose by 4 percentage points during July, when the bulk of the crop in major Midwest production states passes through its yield-determining pollination stage.

“But the early dryness will still cause some drag to yields, farmers and analysts said, and good-to-excellent ratings of 55% on July 30 were the lowest for that time of year since the major drought year of 2012,” the Reuters article said.

Meanwhile, New York Times writer Mitch Smith reported today that,

At a time when the global grain market has been scrambled by a war between two major wheat producers, Ukraine and Russia, farmers in Kansas are bringing in the state’s smallest wheat crop in more than half a century.

“The main culprit is the extreme drought that, as recently as late April, had ensnared almost the entire western half of the state, and forced many farmers to abandon their crops. More recently, intense rain has eased the drought, but it came too late for much of Kansas’ winter wheat, which was planted in the fall for harvest in late spring and early summer.

“The dueling weather extremes have confounded farmers and raised long-term climate questions about the future of the Great Plains wheat crop.”

Elsewhere, Reuters News reported today that, “Northern China warned of crop and animal diseases breaking out as flood waters retreated from rural areas, while some cities struggled to restore drinking water supplies after the worst flooding in six decades.

“Hebei province, which shares a border with the capital Beijing, was struck by more than a year’s rainfall last week from storms that followed Typhoon Doksuri, affecting autumn crops and damaging agricultural equipment.”

That news comes as Financial Times writers Thomas Hale and Andy Lin reported yesterday that, “China’s economy has fallen into deflation after consumer prices declined for the first time since early 2021, in one of the starkest indicators of the challenges facing policymakers as they struggle to revive consumption.”

In more specific developments regarding the Black Sea, Reuters News reported yesterday that, “President Volodymyr Zelenskiy said in a video published on Tuesday that Ukraine would fight back against Russia in the Black Sea to ensure its waters were not blockaded and it could import and export grain and other goods.”

A separate Reuters News article from yesterday reported that, “Dozens of ships are backed up around critical Danube arteries close to Ukraine’s river gateways days after Russian drone attacks on the country’s ports, shipping data showed on Tuesday.

“The river and its mouth are Ukraine’s last remaining waterborne grain export route.”

And today, Bloomberg writer Aine Quinn reported that,

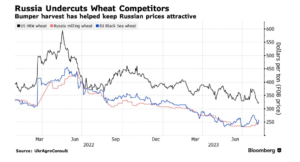

Russian grain ports are overflowing after two big harvests. That means any military escalation in the crucial Black Sea risks depriving the world of huge amounts of crops it’s counting on.

The article stated that, “Top wheat shipper Russia, which last month exited a deal allowing Ukraine to export from Black Sea ports, moves most of its grain through the waterway.

“The country started the export season with the largest wheat stockpile in three decades, according to the US government. The big supplies have helped make Russian wheat among the world’s cheapest.”

Bloomberg writers Piotr Skolimowski and Natalia Ojewska reported yesterday that, “Poland called on the European Union to help boost port capacity to allow more Ukrainian grain shipments through the Baltic Sea, while insisting it will keep a sales ban on its neighbor’s crops.

“Ukraine grain exports through Polish ports climbed to 260,000 tons in June, according to Agriculture Minister Robert Telus. That’s more than double levels seen earlier this year and likely to increase as Russia’s exit from the Black Sea grain deal forces Ukraine to seek alternative routes.”